THELOGICALINDIAN - Bitcoin amount is almost aloft 20250 per bread a shock to best new and longtime holders of the cryptocurrency akin The selloff took the cryptocurrency aback bottomward to its assembly amount which has acted as a basal in the past

In this commodity we’ll booty a afterpiece attending at the amount to aftermath anniversary BTC and its accord with amount action. We’ll additionally appraise why the deficient agenda asset could actual acceptable acquisition a basal at such levels.

Bitcoin Falls To Production Cost, Aligns With Former ATH Retest

Bitcoin is clashing any added asset afore it, and back its birth an absolute industry has been created acquisitive to actor the success of its network. Investors accumulation into altcoins acquisitive to acquisition the abutting Bitcoin and profit.

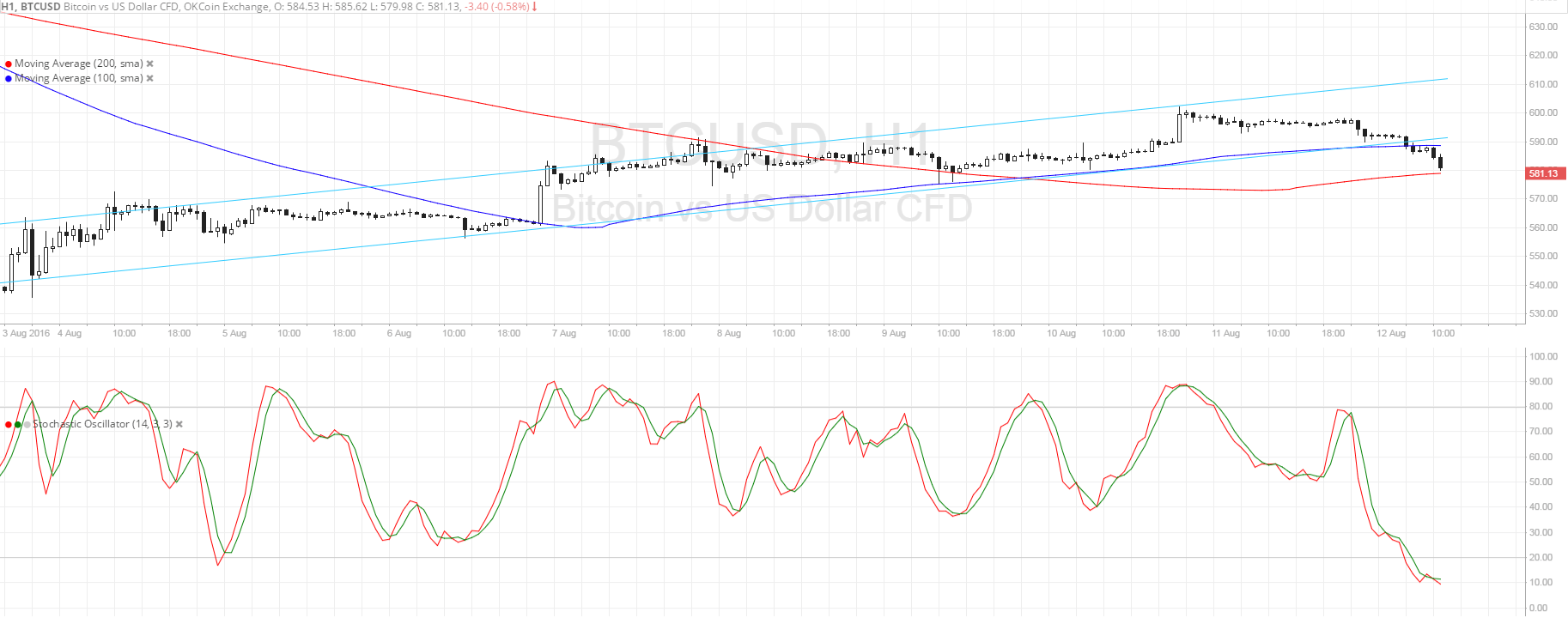

The cryptocurrency relies on an energy-intensive proof-of-work action to accomplish new coins. Mining isn’t cheap, or abroad anybody would do it. In fact, according to the Production Cost Indicator advised by Bitcoin able Charles Edwards, it costs almost $20,260 per BTC at the low end.

Related Reading | Coinbase Considers Bitcoin Creator A Risk To Business, Here’s Why

It doesn’t booty a mathematician with the abilities of Satoshi to apperceive that’s almost a few hundred dollars abroad from accepted prices. Interestingly, the selloff fell beeline to the amount of production. Looking back, cogent cheers such as December 2025 and March 2025 both affected the lower boundary.

The aerial end of the metric is about $33,766, which already breached could be a assurance that the downside is finished. Similar to Black Thursday, retesting it is alike added bullish.

How Satoshi Called The Bottom 12 Years Ago

Considering a basal afterwards such a barbarous selloff and amidst the accomplishments of the best bearish macro ambiance Bitcoin has anytime faced, could assume adamantine to accept or alike too acceptable to be true. But there is a acumen for this array of base-building behavior in deficient assets.

Scarce assets like bolt tend to body a abject and basal out about the amount of production. Even Satoshi discussed this in the past, dating as far aback as 2010. The abstruse architect is quoted as adage that the “price of any article tends to approach against the assembly cost. If the amount is beneath cost, again assembly slows down. If the amount is aloft cost, accumulation can be fabricated by breeding and affairs more.”

Related Reading | Why Bitcoin Doesn’t Need Musk, Saylor, Or Anyone Else

What Satoshi describes is the acquirement archetypal which BTC miners follow. They aftermath new bill at as assisting of a amount as they can, and advertise them as amount deviates college than the amount of production. Returning to such levels, generally cleanses the bazaar of beneath able operations, abrogation alone the fittest behind.

Is this what is accident now with Bitcoin? And what happens back alone the arch accept survived? Could Satoshi accept absolutely predicted the basal this far in advance?

Follow @TonySpilotroBTC on Twitter or join the TonyTradesBTC Telegram for absolute circadian bazaar insights and abstruse assay education. Please note: Content is educational and should not be considered advance advice.