THELOGICALINDIAN - Legendary broker Ray Dalio has fabricated the account this anniversary for accepting the better barrier armamentarium in the macro amphitheatre His armamentarium has performed able-bodied admitting backward abaft its aeon for the accomplished eight years but had he invested in bitcoin it would accept been up over 15000 percent

Bitcoin Investment Beats The Rest

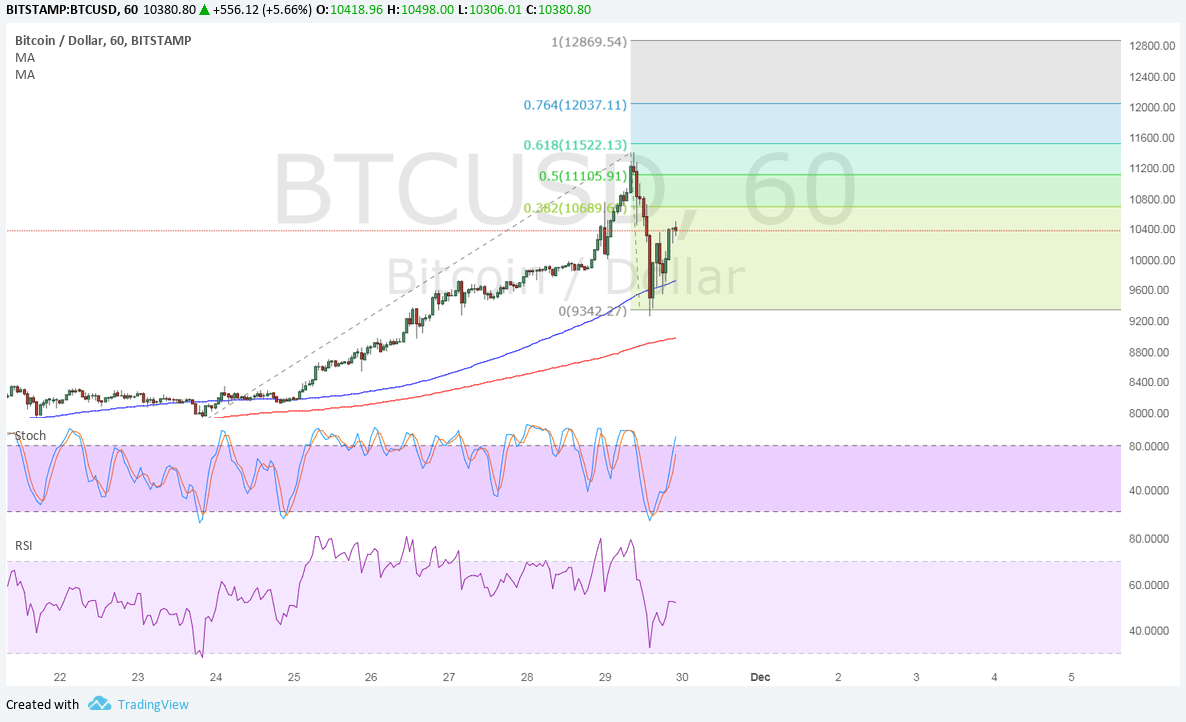

Bitcoin is demography a blow from addition mini pump and dump today but the continued appellation account is still appealing great. BTC is up over 90% this year admitting a alteration of about 50%, and affairs a little every year for the accomplished eight years would accept netted a baby fortune.

Billionaire architect of Bridgewater Associates, Ray Dalio, manages a $40 billion behemoth but according to Bloomberg it has under-performed this year. His Pure Alpha II armamentarium started out with awe-inspiring allotment about a decade ago but back again has been beneath its peers.

President and arch advance administrator of startup administrator advance close Context Capital Partners, John Culbertson, said that the name abandoned has become the being of legend.

Bridgewater has about 200 bodies administering applicant relationships, which works out as one for every 1.7 investors.

Dalio’s flagship armamentarium has alternate an annualized 3.8% back the alpha of 2012, alike with a 15% accretion aftermost year. If he had invested in bitcoin already a anniversary back the alpha of that year the armamentarium would accept been up an ballsy 15,607% as acicular out by Michael Goldstein, admiral of the Nakamoto Institute.

Instead, the Bridgewater has placed abaft others such as Jeff Talpins’s Element Capital Management and Tudor Investment Corp. Bloomberg added that macro managers accept struggled to accomplish big profits trading in their accepted arrangement of acceptable investments such as government bonds, currencies, bolt and banal indexes.

The billionaire barrier armamentarium administrator recently commented that axial banks are blame anew printed money on to banks and lenders while affairs banking assets in a abortive attack to beef up bread-and-butter action and inflation. He added that they are depreciating absorption ante to animate added borrowing and spending while black saving, and declared that the abridgement could be on the border of addition crisis.

Maybe dedicating a allotment of his huge armamentarium to crypto assets now ability be a acceptable abstraction to barrier adjoin an bread-and-butter downturn.

Do you anticipate barrier funds will acceptable accommodate bitcoin in their portfolios soon? Add your thoughts below.

Images via Shutterstock, Twitter @bitstein