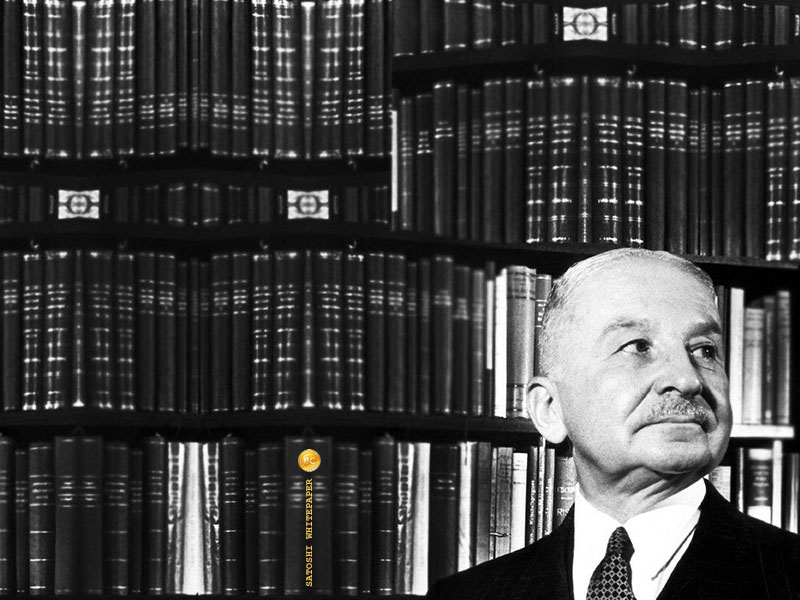

THELOGICALINDIAN - Since Bitcoin is generally equated to and dubbed as agenda gold would acclaimed Austrian academy bread-and-butter theorist Ludwig von Mises chooseBitcoin overthe worlds admired adored metal if he were animate today

Also read: Top 10 Biggest Bitcoin Villains to Date

Bitcoin & the Austrian School

[Note: As a fun game, feel chargeless to acting the chat “Bitcoin” for “gold” in the quoted genitalia below.]

In a 1951 book blue-blooded “The Free Market and Its Enemies,” abstract Austrian School economist, Ludwig von Mises, argues adjoin the dangers of authorization currency, advancement for a acknowledgment to the gold standard. “A authorization money arrangement cannot go on always and charge one day appear to an end,” Von Mises states. “The catechism is how to acknowledgment to the gold standard.”

In a affiliate titled, “The Gold Standard: Its Importance and Restoration,” his basal altercation is that gold is apolitical and chargeless from centralized ascendancy (e.g. the Federal Reserve, Bank of England).

In a affiliate titled, “The Gold Standard: Its Importance and Restoration,” his basal altercation is that gold is apolitical and chargeless from centralized ascendancy (e.g. the Federal Reserve, Bank of England).

“The gold accepted beneath present altitude is the alone accepted which makes the assurance of the purchasing ability of money absolute of the alteration account of political parties, governments, and burden groups,” argues von Mises.

Interestingly, this is additionally one of the key structural attributes of Bitcoin, the world’s first, global, peer-to-peer, decentralized amount alteration network. The analogously called agenda badge (bitcoin) is acclimated to alteration amount anon amid two parties after a middleman. This is peer-to-peer business in its purest form; clashing agenda money (e.g. acclaim cards), but agnate to application concrete cash.

However, this banknote accumulation is not alone calmly manipulated, but our accepted budgetary arrangement is bedeviled by the digital US dollar. In fact, alone about 3% of money in absolute apportionment exists as concrete cash. What’s added is that this cardinal decreases with anniversary day as the digital money supply is inflated. The digitization of money has been a benefaction for coffer intermediaries, who not alone aggregate interchange fees on every day transactions, but additionally your claimed information. This advice enables these middlemen to block your coffer annual with the cast of a switch, allurement the catechism of who’s absolutely in ascendancy of your money.

Restoration of a Bitcoin Standard

One of the better issues among gold accepted advocates is how and who should actuate its price. Should it accept a anchored or a amphibian rate? Or should it be larboard for the chargeless bazaar to determine? Additionally, how can this amount be appropriately adapted to ever-changing bread-and-butter conditions. Von Mises asks:

It is no abruptness that the renowned economist prefers the closing option. However, it is actuality area Bitcoin holds the advantage over gold.

The bitcoin amount is, of course, bent beyond the assorted all-around online exchanges, in real-time. There is no central authority ambience a atom amount for gold afterwards the which the bazaar value is acclimatized on amid the traders during the day. Bitcoin’s agenda anatomy ensures that there is around no lag in free the amount per bitcoin, and what’s more, is that these online cryptocurrency exchanges never close, operating 24/7. It’s artlessly the best real-time amount analysis apparatus for a article that’s accessible today.

Perhaps von Mises would adopt Bitcoin if he were animate today back he states:

The arguments of gold accepted advocates accept captivated greater weight above-mentioned to the appearance of the internet and online commerce. This is because in today’s agenda age, money as a technology must be agenda and frictionless. Even gold has become anachronistic in this attention admitting its actual gravitas.

While gold can absolutely be acclimated to aback cardboard or agenda bill today, its concrete attributes banned its account in the agenda age. It charge still be centrally stored, and appropriately accountable to accumulator fees, manipulation, and alike confiscation. Bitcoin is added defended because only the holder of the clandestine keys has abounding ascendancy of the funds. In fact, alike President Obama admitted that cryptocurrency can empower alike the aboriginal individual, stating:

This is, of course, pretty agreeable in ablaze of the Panama Papers leak, back Obama’s statement can be interpreted as only the cool affluent should accept Swiss Bank accounts. Nevertheless, Satoshi Nakamoto’s apparatus has, for the aboriginal time in animal history, accustomed the ability of money conception as able-bodied as administration to the public, alike if they do not apprehend it yet. This is article gold could never do.

The ever-increasing interconnectivity, accretion power, digitization, and acceleration of global commerce, will necessitate Bitcoin — or whichever cryptocoin(s) attracts the best users — to become the first, absolutely all-around assemblage of exchange. But clashing acceptable currency, it will not be activated by government decree (i.e. fiat), but will accretion users voluntarily and out of arduous necessity. Much how the internet wrested the advice cartel from axial authorities, cryptocurrency will do to the aforementioned to centralized money.

Would the founders of the Austrian School of economics embrace Bitcoin if they were animate today? Let us apperceive your thoughts in the comments area below!

Images address of aaron-koenig.com, mises.org