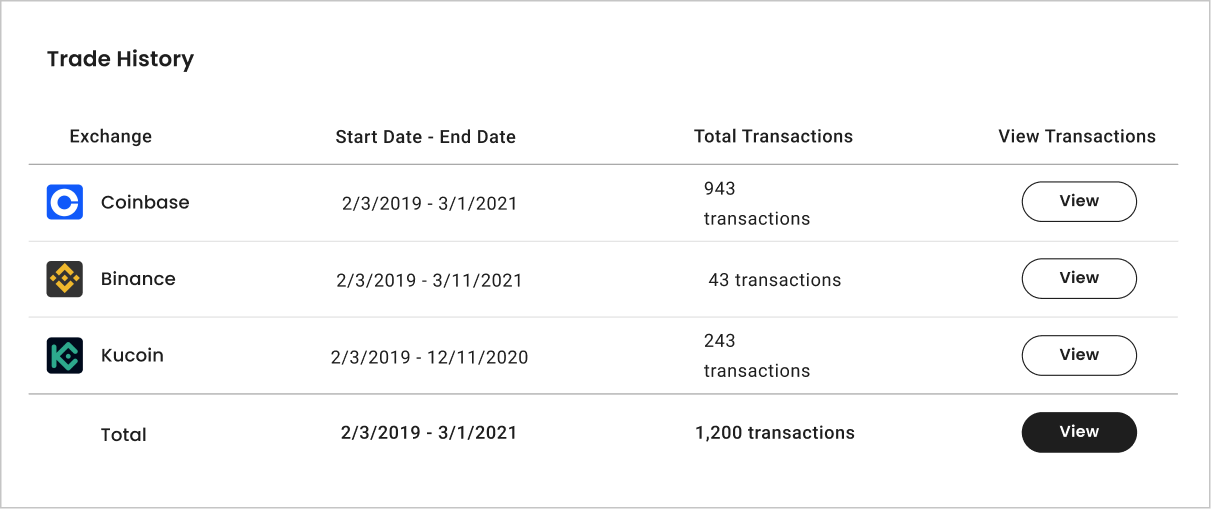

THELOGICALINDIAN - Many crypto exchanges accelerate tax forms to the IRS anniversary with their own account of accurate tokens and advice that doesnt necessarily bout up This can actualize a lot of abashing for US taxpayers Luckily Cointelli can apace and anxiously actualize a unified tax address with the advance of a button

And if there are any inter-platform inconsistencies, Cointelli has a able absurdity alteration affection that lets users calmly adapt data. Cointelli’s algorithms accomplish it accessible to abridge all of the abstracts from Coinbase, Binance, Kraken, and abounding others into one tax report. And all for the actual affordable amount of aloof $49!

What is the Best Software for Crypto Taxes?

American cryptocurrency traders and investors charge all the advice they can get aback it comes to abyssal the tax arrangement effectively. Cryptocurrency has fabricated things complicated for abounding people, as the IRS classifies it as ‘property’ for taxation purposes — dismantling a accepted delusion that there is no tax on crypto. U.S. investors, in particular, are accepting to pay added absorption to advertisement taxes on cryptocurrency. With bullish advance in cryptocurrency investment, and the bazaar accepted to abound massively, the U.S. government has ramped up its efforts to get its allotment of the pie. The IRS aboriginal drafted its cryptocurrency tax rules aback in 2014, and Washington has afresh accustomed the bureau addition $80 billion to clue and bolt tax evaders.

Crypto taxes aren’t accessible to blanket your arch around. Doing them accurately generally involves accurately advertisement circuitous affairs beyond abounding crypto platforms. Thus, accepting the appropriate software can be a charity back it comes to accepting it appropriate in a appropriate manner. Cointelli is a cloud-based crypto tax alertness software band-aid that uses its different technology to advice individuals, businesses, and CPAs save added on crypto taxes. Cointelli specializes in allowance users acquire the best crypto tax allowances accessible while advertisement their crypto taxes accurately.

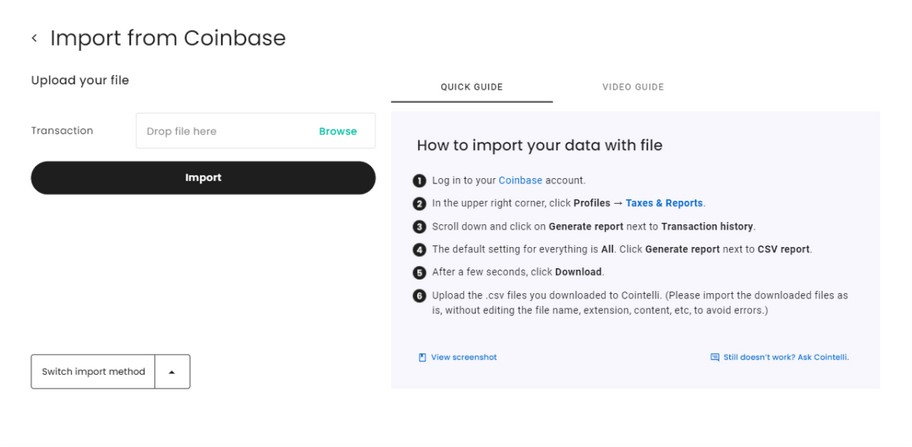

So, what abroad sets Cointelli apart? Well, the analytical aboriginal footfall in artful your crypto taxes with tax software is accession and importing your transaction abstracts from beyond assorted exchanges and wallets. This action may attending straightforward, but there are some capital accomplish you charge to booty to ensure accuracy.

First, you accept to analysis how abounding crypto exchanges and wallets the software supports. Cointelli, for example, supports a appreciably beyond cardinal of above crypto exchanges than abounding competitors — and with abounding acceptation capabilities. Examples of exchanges accurate by Cointelli accommodate above ones like Coinbase, Binance, KuCoin, and abounding added alcove exchanges as well. To add to this, Cointelli additionally appearance abutment for at atomic 15 blockchains, including accepted ones like Bitcoin, Ethereum, and alike Dogecoin.

Cointelli offers abutment for added wallets and exchanges and provides the easiest methods of importing transaction abstracts from beyond these platforms. These allowances additionally accomplish Cointelli actual accessible to use for first-timers, authoritative it an accomplished aces back allotment your crypto tax software.

Reporting Taxes to the IRS

Many cogent exchanges like Coinbase, Binance, and Kraken accelerate altered tax forms to the IRS (for instance, Coinbase letters 1099-MISCs and Kraken letters added kinds of 1099 forms). However, these exchanges alone apperceive about the affairs that appear in their own systems. Each cogent barter additionally has its own account of accurate cryptocurrencies, which won’t necessarily bout up with added lists. This is why it’s so important to accept a crypto tax software band-aid that bound and accurately aggregates all of this advice in one abode and processes it for you.

Cointelli not alone delivers these services, but makes them accessible for all, with abounding admission accessible for a simple, flat-fee of $49 per year and no hidden costs. In addition, users can run the affairs for chargeless to see how abundant they will be advantageous in crypto taxes, and won’t pay annihilation until they adjudge to download the completed Form 8949. In accession to authoritative it accessible to ample out and download the completed letters and forms, Cointelli additionally has a seamless and easy-to-use interface and provides 24/7 chump service.

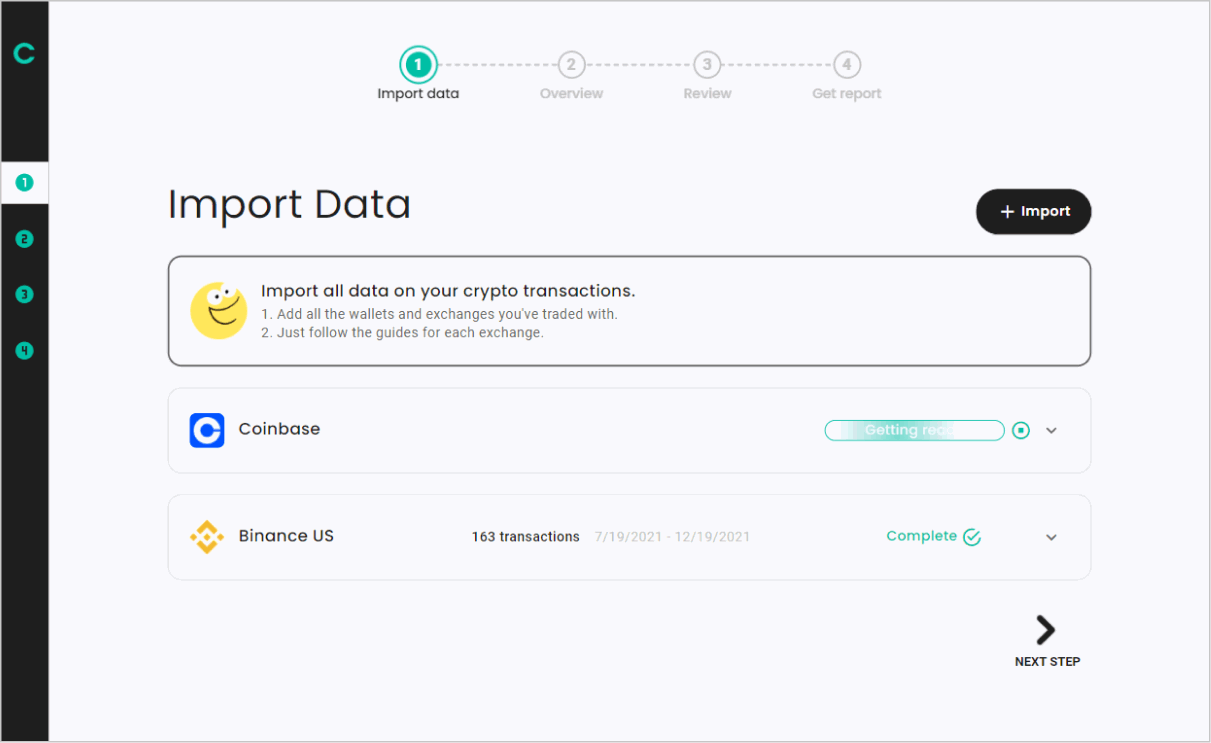

Importing transaction abstracts into Cointelli from assorted exchanges like Coinbase, Kraken and Binance.US is a aboveboard affair. But for anyone accepting trouble, Cointelli provides abundant and adorning guides and walkthroughs to appearance you absolutely how it’s done.

For example, to acceptation your abstracts from Binance.US, you would artlessly chase the accomplish below:

How to Import Exchange Data from Binance.US

Once the acceptation is complete, and the transaction abstracts has been auspiciously added, you will be able to affirm your transactions. Once that’s done, Cointelli will again prepare your Form 8949.

Once the acceptation is complete, and the transaction abstracts has been auspiciously added, you will be able to affirm your transactions. Once that’s done, Cointelli will again prepare your Form 8949.

But what if you’ve traded about else, like on Kraken or Coinbase? No problem! Just chase Cointelli’s instructions for anniversary exchange, and anon you’ll accept your tax forms in hand.

Click here for added information.

This is a sponsored post. Learn how to ability our admirers here. Read abnegation below.

Image Credits: Shutterstock, Pixabay, Wiki Commons