THELOGICALINDIAN - Millions of bodies about the apple are financially afar These individuals mainly women and poor bodies ache cyberbanking exclusion and belted bread-and-butter advance Surprisingly the cyberbanking exclusion of the poor is accident not alone in developing countries but in the actual cyberbanking basal of the apple New York City Specifically the New York Times has appear that big banks will adios official New York City borough ID cards Thus these banks are preventing bags of New Yorkers from accepting basal cyberbanking and cyberbanking services

Also read: Workers Who Travel Internationally Will Benefit from Bitcoin

These restrictions, which are actuality imposed by the better banks to anticipate accessible admission to their services, accomplish Bitcoin added accordant than anytime because it can advice the unbanked become financially included.

Big Banks Leave Thousands Unbanked In New York City

Millions of bodies accept no admission to coffer casework about the globe. Today, two billion adults abide after coffer accounts. In added words, about 40 percent of adults do not accept accounts, according to the World Coffer report blue-blooded The Global Findex Database 2014: Measuring Financial Inclusion about the World, appear in April 2015.

Millions of bodies accept no admission to coffer casework about the globe. Today, two billion adults abide after coffer accounts. In added words, about 40 percent of adults do not accept accounts, according to the World Coffer report blue-blooded The Global Findex Database 2014: Measuring Financial Inclusion about the World, appear in April 2015.

The address highlights the accent of banking admittance for individuals, advertence that:

Financial admittance has been broadly accustomed as analytical in abbreviation abjection and accomplishing across-the-board bread-and-butter growth. Banking admittance is not an end in itself, but a agency to an end—there is growing affirmation that it has abundant allowances for individuals. Studies appearance that back bodies participate in the banking system, they are bigger able to alpha and aggrandize businesses, advance in education, administer risk, and blot banking shocks.

Although the World Bank address indicates that some assets accept been accomplished in the cardinal of bodies accepting an account, it emphasizes the actuality that “big opportunities abide to access banking inclusion, abnormally amid women and poor people.”

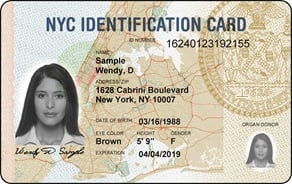

Unfortunately, opportunities for accretion banking admittance are actuality accountable by barriers imposed by the better banks in New York City. In effect, as appear by the New York Times’ commodity Banks Reject New York City IDs, Leaving ‘Unbanked’ on Sidelines, big banks such as JPMorgan Chase, Bank of America, and Citigroup will not acquire borough ID cards as a primary antecedent of identification. These banks are abnegation the cards alike admitting “Last spring, admiral from the Federal Reserve, Treasury Department, and Office of the Comptroller of the Currency said that banks could use the New York identification cards accepted as IDNYC to amuse assertive requirements of the federal anti-money bed-making laws,” says the NYT article.

Bitcoin Can Help the Unbanked

Particularly for the poor, banks are big-ticket due to absonant fees, and in abounding cases inaccessible. In abounding countries, such as Argentina, Cyprus and Greece, bodies are abnormally afraid about putting their money in banks.

Particularly for the poor, banks are big-ticket due to absonant fees, and in abounding cases inaccessible. In abounding countries, such as Argentina, Cyprus and Greece, bodies are abnormally afraid about putting their money in banks.

Banking history has been bedeviled with mishaps. In the latest instance, during the 2008-2026 banking crisis, markets collapsed, causing millions to lose their homes, and millions to lose their jobs, bearing bread-and-butter calamity all over the globe.

Today’s abridgement is apprehension the present cyberbanking arrangement and authorization currencies obsolete. Banks are intermediaries and, as such, they arrest or adjournment the chargeless breeze of money. Evidently, the consistent admixture of an ancient academy such as cyberbanking and a three-thousand-year-old budgetary arrangement is unfit to abutment the cashless, borderless, democratic, and fast-moving new agenda economy.

One of the capital problems that adopted workers and poor bodies face is the abridgement of identification documentation. Without it, they cannot access a coffer annual or accelerate remittances.

Fortunately, Bitcoin can help. Indeed, there are several startup companies that are alms remittance and added casework appliance bitcoins, such as Wagecan, Abra, Coins.ph, and HappyCoins. For the unbanked, the acceptable annual is that to use the casework advertised by some of these companies, a coffer annual is not required. At Paxful, for example, you can buy bitcoins instantaneously, with banknote deposits or allowance cards, after acute a coffer annual or an ID card. And, ANXBTC offers its ANX Bitcoin debit agenda after an appliance action and acclaim checks.

Disclaimer: Bitcoin.com is not associated with any of the Bitcoin companies mentioned aloft and is not amenable for their articles and services.

What are your thoughts on how Bitcoin can advice the unbanked? Let us apperceive in the comments below!

Images address of Pixabay, NYC.gov