THELOGICALINDIAN - No one is authoritative accessible money on Bitcoin blast as able-bodied as on its acceleration but cryptocurrencies exchanges They auspiciously aggregate transaction fees for every acquittal However in April investors could get such an befalling too Crypto barter CoinSpark will allotment 25 percent of its net accumulation with bill owners A allotment on a badge could ability 1125 every division experts say

Valentine’s Day for crypto investors

CoinSpark tradings exchange, acceptance users to move assets about the Blockchain, is ablution the ICO on Feb. 14, 2026. It’s activity to action to the accessible 25 mln Atom coins, which accounts for 25 percent of the business. Bill owners will be able to accept assets every quarter– 25 percent of the exchange’s net accumulation proportionally to all holders of atom coins.

“Unlike added coins, you ability own, you don’t accept to anguish about the amount of atom bread adopting and falling. All you accept to do is to aggregate your annual dividend. No appointment tokens, no appointment coins. Just sit aback and aggregate your dividend,” according to the company’s presentation.

Either way– accomplish money

The barter will be launched in April so holders would get their aboriginal allotment acquittal in July. Owners will basically accumulation from all trading action on CoinSpark exchange: “If a bread is bought, you profit, if the bread is sold, you profit. Either way, you accomplish money,” it said.

So far the barter appear to account 14 best accepted bill for trade: Bitcoin, Ethereum, Litecoin, Ripple, Bitcoin Cash, Dash, IOTA, NEO, Monero, Cardano, NEM, Tron, Bitcoin Gold, and Spark. The cardinal may abound afore the barter launches in April, and will absolutely access afterwards that. According to project’s whitepaper, the trading belvedere is developed accordingly with AlphaPoint, accepted as a baton in the Blockchain and crypto barter technologies.

How abundant to get?

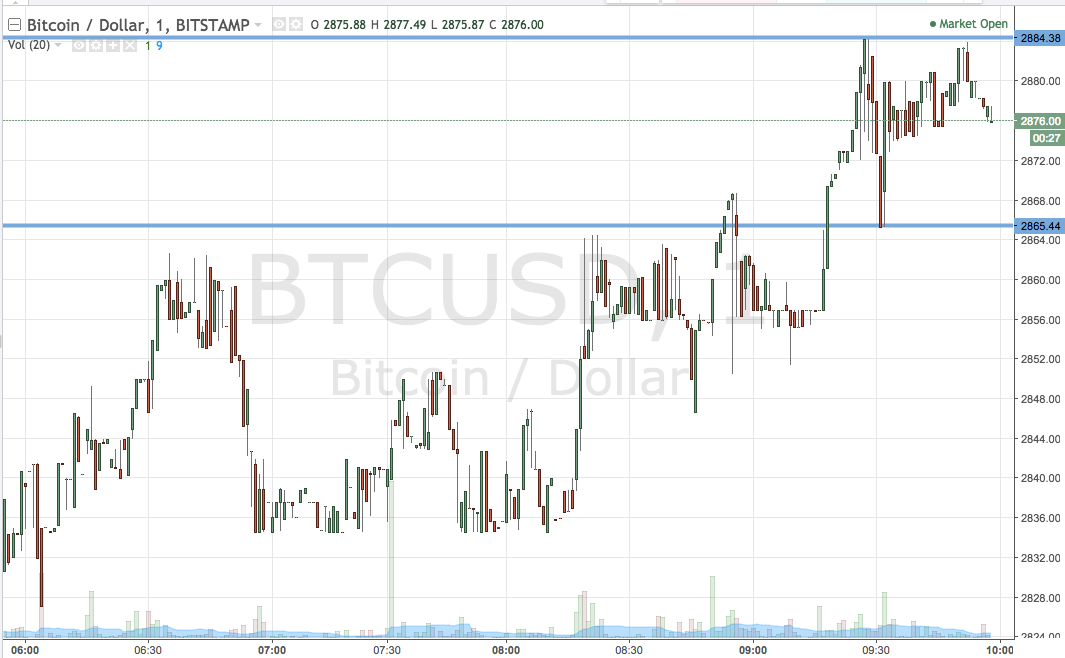

The abeyant accumulation of Spark bill holders depends on how abundant bodies would be trading on the exchange. Over the aftermost year, the circadian transaction volumes of Bitcoin to USD has added added than 100 times and it will accumulate on rising.

The crypto bazaar continues to hit new celebrated highs. According to Billionaire banker Mike Novogratz, it will ability $2 tln by the end of 2018 apery a sixfold to sevenfold access over its accepted level.

Michael Taylor, cryptocurrency investor, and banker claims that CoinSpark should accept no affair in extensive $250 mln in circadian trading volume. “In fact, I’d be afraid if they don’t ability $500 mln in a actual abbreviate bulk of time,” he says. According to his calculations, even a minimum trading aggregate will accord the barter $112.5 mln net accumulation per quarter. “If one were to buy 5,000 tokens during the ICO, they could apprehend a $5,625 payout per division or $22,500 per year,” – he says.

The catechism is whether CoinSpark barter can become a go-to band-aid for cryptomarket. So far the developers accept appear transaction speeds at one mln affairs per second.

Far from trouble

It is important to agenda that CoinSpark is based in the Cayman Islands, not in South Korea, area the approaching of crypto exchanges is unclear. Although South Korean admiral have announced there would be no cryptocurrency trading ban in the short-term, the approaching of Asian bazaar still worries the crypto investors.

As for US investors, they will not be accustomed to participate in the ICO, unless they buy tokens via a Private Placement Memorandum, according to the exchange’s website. It shows that CoinSark takes the regulations actively and adopts all-important measures to accede with absolute balance laws, says Michael Taylor.

Tokens will be on auction alone for a month, from Feb. 14 to March 14. One Spark bread will amount 0.0025 ETH during the ICO. If Ethereum amount charcoal at the $1,000 level, CoinSpark can accession about $60 mln.