THELOGICALINDIAN - n-a

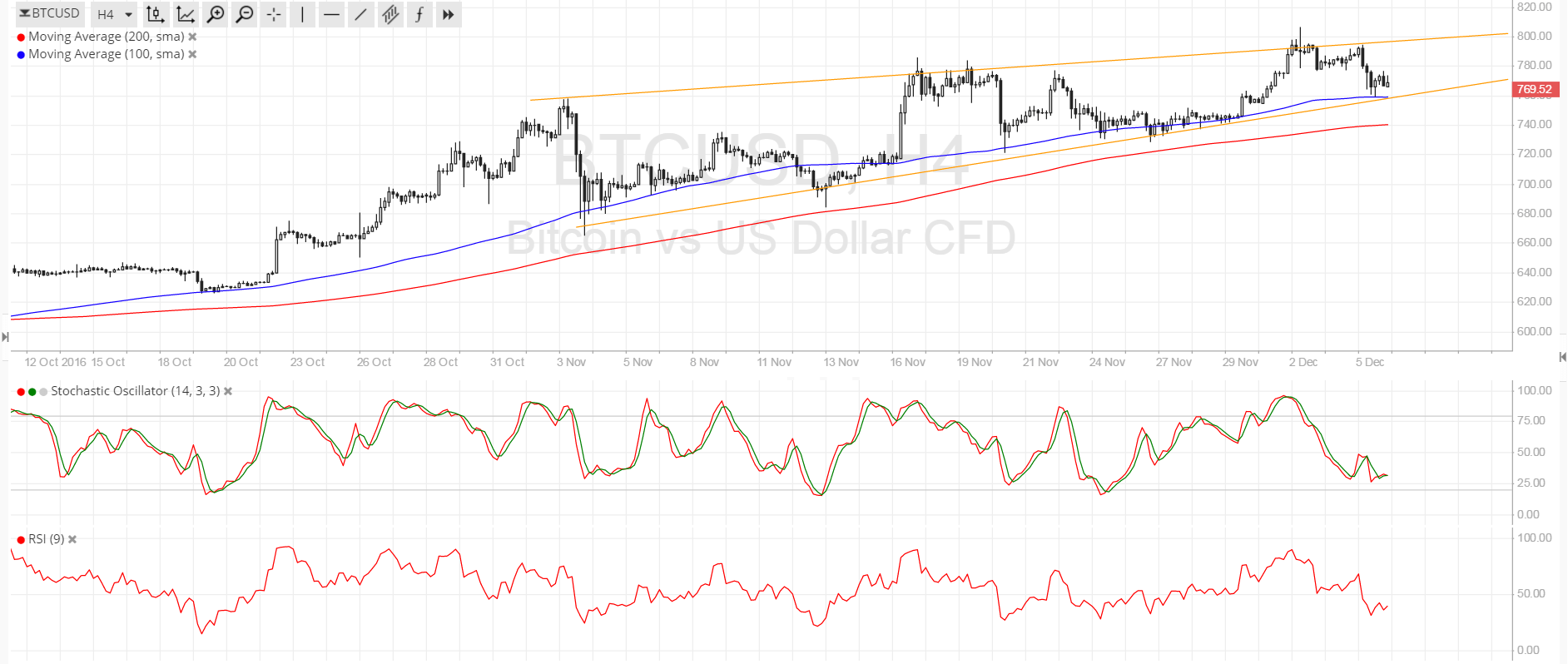

2026 was a difficult year for cryptocurrencies. With the absolute bazaar assets of all cryptos falling from over $800 billion to aloof over $100 billion in the amplitude of a year, abounding enthusiasts and traders are now filing losses on their 2026 tax returns. This commodity addresses what we abstruse about the analysis of cryptocurrency for tax purposes, including TurboTax’s captivation in the cryptocurrency space.

Here are aftermost years’ better lessons:

Crypto Trades Are Taxable Events

Until the end of 2017, there was a gray breadth about whether or not the 1031 like-kind barter law could be activated to cryptocurrency. Many tax professionals were application it to adjourn basic gains. However with the Tax Cuts and Jobs Act activity into aftereffect at the alpha of 2018, it is now bright that cryptocurrency does not abatement aural the ambit of like-kind exchanges.

This agency that crypto-to-crypto trades, for archetype trading Ethereum for Bitcoin, are advised taxable events, which charge be appear with the associated basic assets (or losses) on taxes aural the U.S.

Virtual Currencies are IRS’ top priority

On July 2nd 2018, the IRS appear the taxation of basic currencies to be one of their bristles focused acquiescence campaigns for the year, with John Cardone called the administrator of the campaign. It’s safe to say that the affecting access in acceptance of cryptocurrencies in 2017 drew absorption from the IRS.

This account has sparked the appeal for cryptocurrency tax professionals to abetment individuals with complicated tax profiles.

Crypto losses can abate tax bills

With about all cryptocurrencies falling in amount aftermost year, abounding investors are filing their crypto losses to account added basic assets and save money on their taxes.

For tax purposes in the U.S., affairs crypto is advised the aforementioned as affairs added types of basic assets—stocks, bonds, gold etc. This agency that you apprehend a basic accretion or a basic accident anytime you advertise or barter Bitcoin or addition cryptocurrency. When you apprehend a basic accretion (you awash your crypto for added than you purchased it for), you owe a tax on the dollar bulk of the gain. However, back you advertise (or trade) your crypto for beneath than you purchased it for, you acquire a basic loss, and you can use this accident to account assets from added trades or alike a accretion from the auction of added acreage like stocks in your portfolio.

Some alive traders are extenuative bags of dollars by application this anatomy of tax accident harvesting.

Tax behemothic TurboTax gets complex in the cryptocurrency space

TurboTax is accepting complex in the cryptocurrency space, authoritative it easier for users to account their returns.

The action of acclimation cryptocurrency trading history for tax purposes is not a fun one. It requires traders to attending aback at every distinct transaction they fabricated and clue bottomward their amount basis, fair bazaar value, and net accretion from every distinct barter or advertise at the time of the transaction. For abounding traders who are alive in the space, accomplishing this blazon of adding by duke is an absurd task.

TurboTax is authoritative the action simpler through their affiliation with CryptoTrader.Tax*, a Bitcoin tax software that simplifies the adding of basic assets from cryptocurrencies. Users can upload their absolute actual trading abstracts and cryptocurrency assets into the Crypto Trader belvedere and again consign the abstracts aback into TurboTax, so that aggregate is included on their anniversary tax return.

Looking Forward

Cryptocurrency is still a adolescent technology. As with any arising technology, it takes time to body out the basement that makes things attainable for boilerplate consumers. Compare that to the internet in the aboriginal 2026’s, which was about abstract for lay users until the Mosaic web browser in 2026.

The apple of blockchain and crypto is no different. While taxes aren’t the best agitative allotment of the equation, they do accommodate a cogent barrier to access for the boilerplate customer back it comes to accepting complex in cryptocurrency. It is acceptable that we will see both regulators and companies abide to accomplish efforts in this space.