THELOGICALINDIAN - Inverse Finance was afraid on Saturday The hacker has already confused over 146 actor through Tornado Cash

Another day, addition DeFi hack. Inverse Finance is the latest Ethereum agreement to ache a multi-million dollar exploit.

Inverse Finance Suffers Multi-Million Dollar Hack

Ethereum’s DeFi ecosystem has suffered addition above hack.

Inverse Finance, a stablecoin agreement that focuses on basic able crop generation, was drained in an accomplishment aboriginal Saturday. PeckShield, one of the crypto industry’s top aegis analytics companies, alerted the Inverse aggregation to the drudge on Twitter account afterwards the accomplishment occurred.

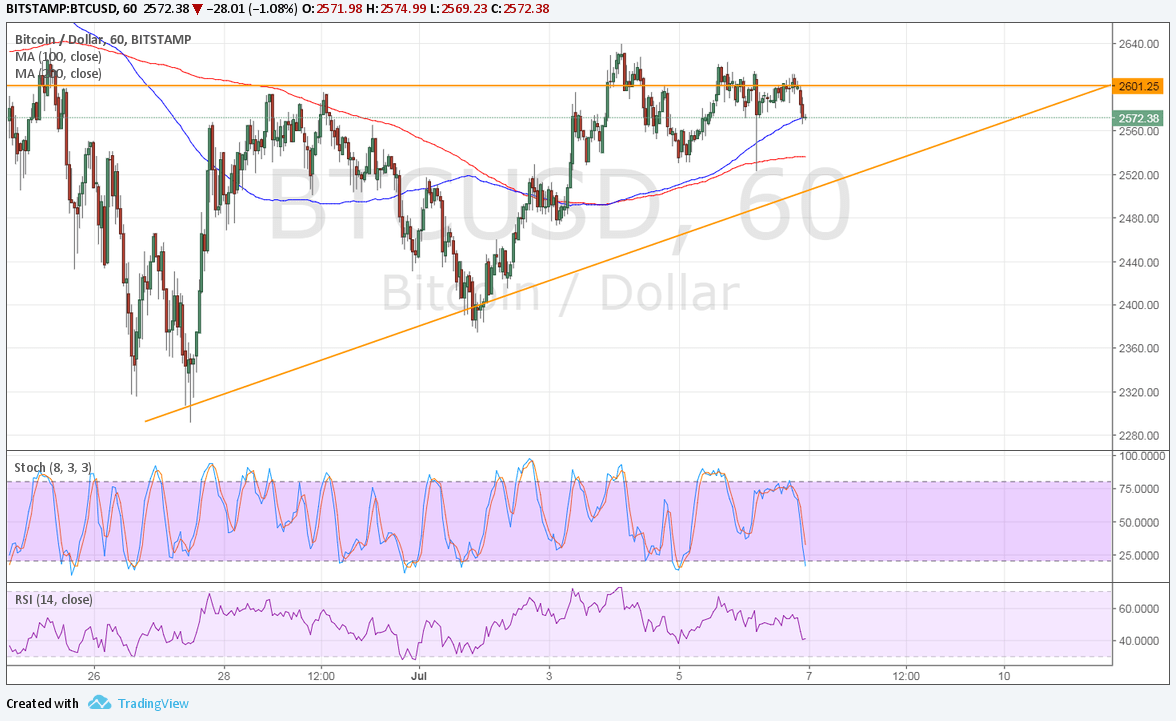

PeckShield explained in a alternation of tweets that the hacker deposited 901 Ethereum to the agreement and acclimated an answer abetment bug to dispense the amount of Inverse’s INV token. They again acclimated INV as accessory to borrow assets and cesspool the protocol. Etherscan data shows that the hacker drained millions of dollars in YFI, WBTC, and Inverse’s own DOLA badge from the agreement and again acclimated decentralized exchanges such as Uniswap to barter the assets for Ethereum. This Ethereum wallet affiliated to the hacker has already siphoned 4,200 Ethereum account about $14.6 actor through the transaction mixer Tornado Cash in a bid to awning their traces. The wallet contains aloof over $250,000 at columnist time.

The Inverse aggregation accustomed the drudge in a tweet, but has not yet aggregate a abounding statement. “We are currently acclamation the bearings amuse delay for an official announcement,” the column read.

Update: The Inverse aggregation has paused approaching borrows on its Anchor belvedere and said that it will be appointment a babyminding angle to ensure that afflicted users are absolutely reimbursed. “The plan to be proposed to babyminding is to ensure all wallets impacted by the amount abetment are repaid 100%,” a cheep read. It’s additionally alms the hacker “a acceptable bounty” for the safe acknowledgment of the funds.

INV has plummeted in the hours back the hack. It’s bottomward 17.1% on the day, trading at about $314 at columnist time.

This adventure is developing and will be adapted as added capacity emerge.

Disclosure: At the time of writing, the columnist of this allotment endemic ETH, INV, and several added cryptocurrencies. They additionally had acknowledgment to UNI and YFI in a cryptocurrency index.