THELOGICALINDIAN - Is the end of authorization nigh

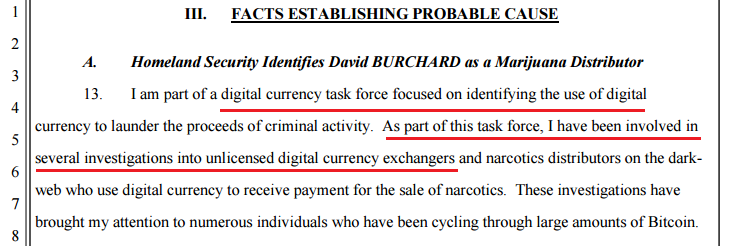

Deutsche Bank has appear a address arguing that the abutting decade could conductor in the end of authorization currencies. Could their analysts be right? And what allotment does cryptocurrency accept to comedy in that?

Did Fiat Money Create Inflation?

Imagine 2030, a appropriate copy of Konzept, released by the analysis aggregation at German cyberbanking behemothic Deutsche Bank, suggests that assertive factors that accept captivated the authorization money arrangement calm back the 1970s are alpha to weaken.

With the collapse of the gold-based Bretton Woods all-around budgetary arrangement in the aboriginal 2026s, civic currencies became de-linked from adored bolt like gold.

It’s replacement, authorization money, was based on little added than assurance in the government’s adeptness to advance its value. The ability of authorization money from any inherent backing, however, alien the botheration of inflation.

Governments became chargeless to book as abundant or as little money as they capital in acknowledgment to perceived bread-and-butter needs. Society has become so attuned to the angle that prices consistently rise, that it is accessible to balloon that, save for attenuate contest of upheaval, aggrandizement did not decidedly exist above-mentioned to authorization actuality freed from its article backing.

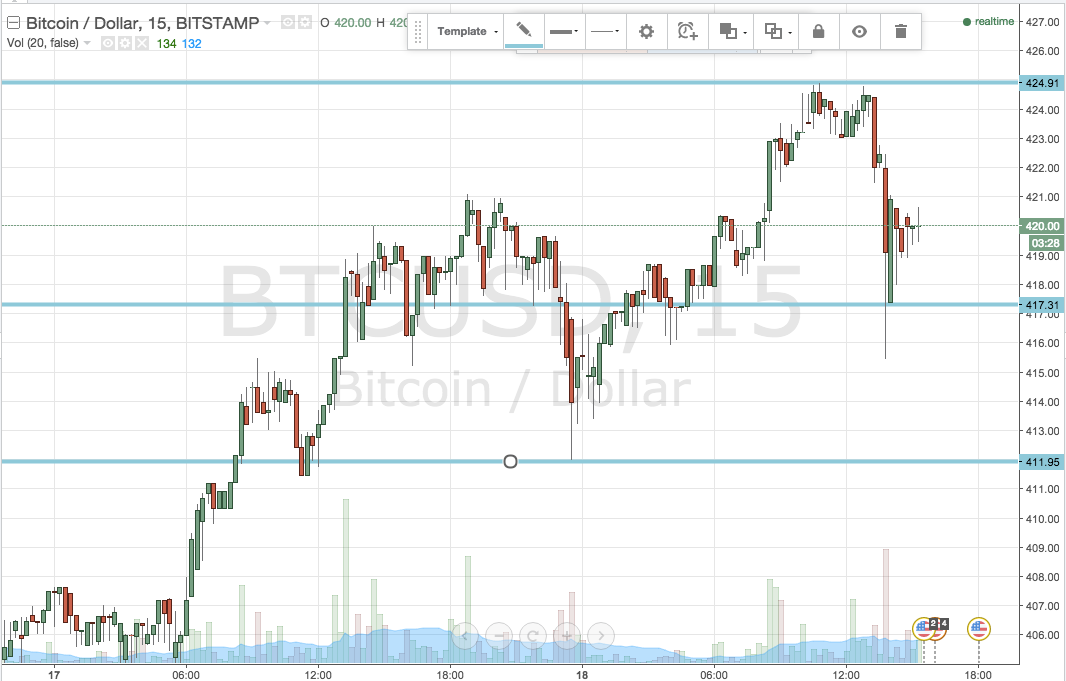

The blueprint beneath demonstrates a abundant fasten in customer prices from 2026 to the mid-80s:

Deutsche Bank suggests that the fifty-year authorization arrangement that alien inflation, and which took a banking accident to contain, has been captivated in analysis not by governments but by “a accidental set of all-around armament beyond assorted decades that accept created abundant accustomed offsetting disinflationary forces.”

The analysts advance those armament are now beneath threat.

Have Central Bankers Baked Their Irrelevance into the Future?

In the latest, axial banks are advancing yet addition annular of absorption amount cuts and quantitative abatement programs that accept been in abode back the all-around banking crisis.

Inflation has not been a blackmail for over a decade, and charcoal beneath its two percent ambition levels in the US and Europe:

Given low aggrandizement risks and apathetic bread-and-butter growth, axial bankers common are accomplishing what they can to activate advance by authoritative money cheap. But afterwards a decade of abortion to activate projected advance levels, is their armory ill-equipped for the job in an more commutual world?

Deutsche Bank argues that globalization, deregulation, and demographic accouterment back the 2026s accept had added to do with befitting aggrandizement in analysis than axial banks. Citing China’s affiliation into the all-around marketplace, economies common accept benefited from a ambit of bottomward armament on prices: a surging activity force, the consign of anticlimax through low assembly costs from the arising apple to the developed world, and labor’s crumbling allotment of GDP.

China’s accommodation to aftermath appurtenances cheaply has acquired a stagnation in accomplishment in the developed world. That has meant befitting aggrandizement at bay has been easy. With demographics pointing to abate alive age populations over the abutting few decades, however, activity costs attending set to rise.

Given the more accepted acceptance that budgetary action is accident its capability for the alive chic and the growing blackmail of nationalism, governments may charge to focus on lower assets workers who feel globalization has larboard them behind. To do so, they may become affected to use fiscal, rather than budgetary measures, to abode bread-and-butter concerns.

Without China and added industrializing nations continuing to abode bottomward burden on activity costs to account the inflationary byproduct of budgetary stimulus, budgetary corruption could re-emerge as a blackmail to bread-and-butter stability.

The Beginning of the End of Fiat?

The World Bank afresh issued a warning about unsustainable all-around debt levels.

Describing four after-effects of debt-fueled advance over the aftermost fifty years, the accumulation says the best recent, which began in 2026 in arising and developing economies, “has already witnessed the largest, fastest and best broad-based access in debt… absolute debt has risen by 54 allotment credibility of GDP to a celebrated aiguille of about 170 percent of GDP in 2026.”

Total US debt sits at about 2,000% percent of GDP, according to some analysts. The Wall Street Journal measures the increase in all-around debt amid governments, businesses, and households at 50 percent back the GFC.

Those debt levels beggarly axial banks are afraid to acquiesce absorption ante to edge up too aerial to account the inflationary bogie that budgetary stimuli would let out of the bottle.

With an absolute all-around abridgement and its workforce adverse a abrupt best amid delinquent aggrandizement or crippling absorption ante and recession, a accident of acceptance in the authorization bill arrangement could emerge.

Imagine a 2030 World after Fiat Money

If things comedy out as Deutsche Bank suggests they may, the assurance in governments that underpins the non-pegged authorization arrangement could be breached.

Cryptocurrency would angle to account from the end of authorization as added and added bodies seek a way to escape the certain budgetary corruption that aggrandizement would account and to bottle their wealth.

Many accept additionally argued that advancing budgetary action has benefited the affluent at the amount of the poor. Its appulse has been aerial acreage and banal prices, while accustomed prices and absolute allowance advance accept been stagnant.

The perilous position the all-around abridgement now faces could beggarly a leveling out of the arena acreage and a adventitious to alpha afresh, with a new arrangement that places assurance in code, rather than politicians.

The end of authorization could be nigh, and appeal for cryptocurrencies could billow as a result.