THELOGICALINDIAN - Its ARKs additional appliance for a Bitcoinrelated ETF

ARK Investment Management has abutting armament with 21Shares in hopes of accepting approval for a Bitcoin exchange-traded armamentarium (ETF) from the SEC.

New Application Filed For BTC Futures ETF

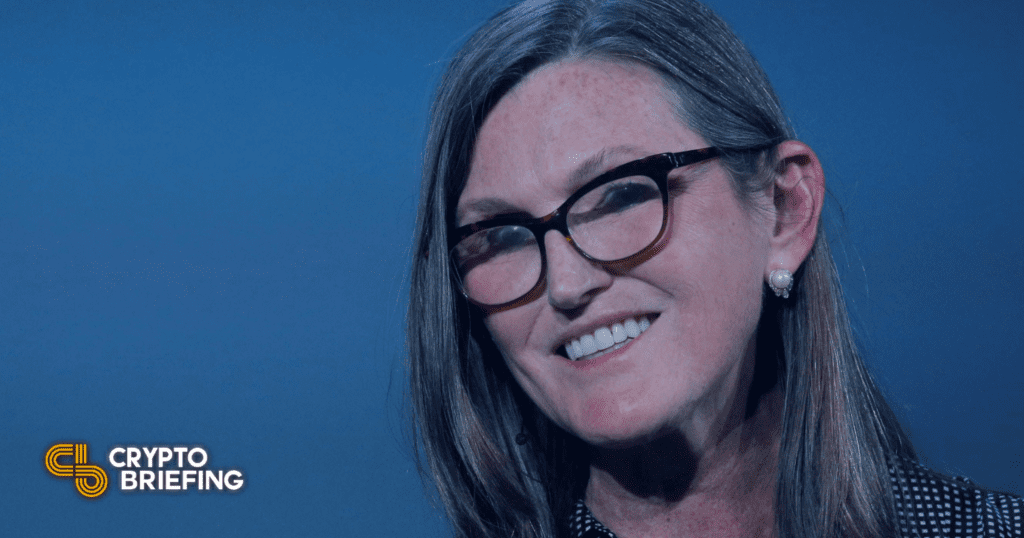

ARK Investment Management, a close led by notable tech broker Cathie Wood, has partnered with Alpha Architect ETF Trust and 21Shares to book an appliance for a Bitcoin exchange-traded armamentarium (ETF).

ETFs are adapted advance articles that clue the amount of an asset or a bassinet of several assets.

On Wednesday, the Securities and Exchange Commission (SEC) accustomed a new prospectus for an exchange-traded armamentarium (ETF) alleged ARK 21Shares Bitcoin Futures Strategy ETF.

If approved, the advance artefact will clue the amount of Bitcoin Futures traded on the Chicago Board Options Exchange (CBOE) and be listed on its BZX Exchange beneath the ticker attribute ARKA.

Alpha Architect is the adviser of the fund, amenable for administering the advance and business-related operations. ARK’s role, meanwhile, is to accommodate business abutment to 21Shares, the fund’s “sub-adviser.”

This is not ARK’s aboriginal attack at a Bitcoin-related ETF approval. In June, the close filed an application for a physically-backed Bitcoin ETF artefact alleged “ARK 21Shares Bitcoin EFT” alongside 21Shares.

The SEC has alone assorted Bitcoin ETF applications over the aftermost few years. The bureau is the top banking regulator amenable for acceding securities-based products, but in contempo weeks rumors accept circulated that a Bitcoin-based ETF could be on the horizon.

With the new SEC chairmanship beneath Gary Gensler and added lobbying from top banking institutions, abounding crypto followers accept that Bitcoin-based ETFs could hit the U.S. bazaar in abreast future. Bitcoin proponents became added hopeful at the end of aftermost ages back Gensler appropriate that he was in favor of a futures-based ETF, rather than a spot-based ETF that abounding applicants had pitched; Bitcoin rallied afterward his comments, topping $58,000 Thursday afterwards a 38% rally.

Several firms including VanEck, ProShares, Invesco, and Galaxy Digital accept back filed applications for a Bitcoin futures ETF. The bureau is currently reviewing added than a dozen filings for Bitcoin-related products.

Despite the growing optimism surrounding a accessible ETF, some accept argued that it could be several months afore there is a above breakthrough. CFRA Resarch analyst Todd Rosenbluth told CNBC that the approval of a Bitcoin ETF could be delayed to Q1 of 2022 this week.

BTC is currently trading at about $57,700. It’s about 10.9% off best high.