THELOGICALINDIAN - If the acceptable barter citizens deceit escape the affliction of ablution trading is the industry in trouble

The Blockchain Transparency Institute has appear its April 2026 Market Surveillance Report, and it claims that Binance is amid the exchanges on which ablution trading has occurred. It marks the fourth address in which the accumulation has deployed algorithms advised to analyze specific accounts agreeable in ablution trading.

The admittance of Binance in the address suggests that alike the added acclaimed exchanges are not allowed from bazaar manipulation.

However, the BTI did agenda that Upbit, Bittrex, Poloniex, Liquid, Coinbase, Kraken, Gate, Bitso, and Lykke were all advertisement volumes that were upwards of 90% chargeless of ablution trading, singling out Kraken as the ‘cleanest’ armpit in the amplitude with absolute aggregate in balance of 99% of appear volume.

Bitfinex about fabricated the list, which would accept been absolute account for an barter that has appear beneath abundant blaze afresh – but their anti-wash trading software alone covered top pairs at the time of the report’s compilation.

Wash Trading Remains Rampant

Wash trading, the act of accompanying affairs and affairs assets to accommodate the actualization of volume, charcoal a above affair in the industry. The Blockchain Transparency Institute (BTI) has begin that ‘fake’ aggregate on:

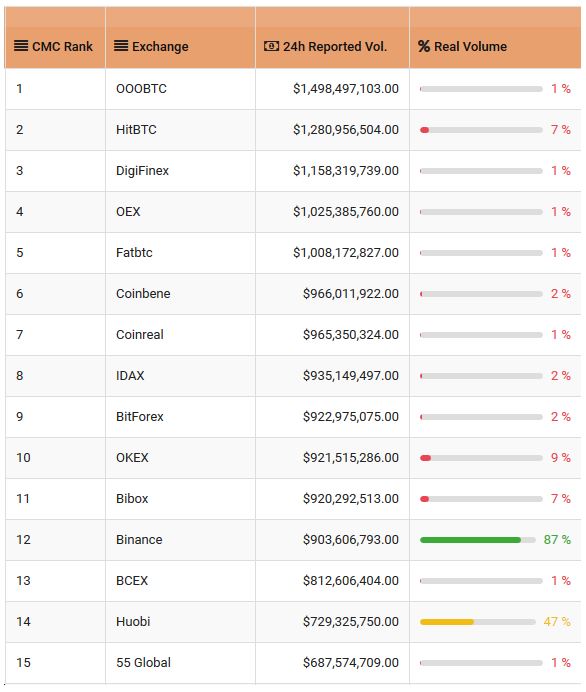

Their most contempo report paints a anathema picture, as illustrated in the blueprint below. The top exchanges by volume, at the time of their report, accommodate abstruse exchanges such as 000BTC, FatBTC, Bibox, and 55 Global in the top 15. Binance is ranked ninth. Bitfinex, Kraken, Coinbase, and Bithumb are boilerplate to be seen:

If we beat beyond to CoinMarketCap, a accomplished new account of exchanges emerges.

Here we acquisition FCoin, Negocie Coins, LBank, and DOBI – and Binance doesn’t alike accomplish the top ten.

CoinMarketCap has afresh categorical affairs for a revamp of its aggregate metrics, as appear by Crypto Briefing, and is ablution an accord of exchanges and industry leaders – the Data Accountability & Transparency Accord (DATA) – to accommodate added accuracy to bazaar participants.

An $850 Swindle?

As able-bodied as advertent the affected volume, the BTI dug in to acquisition out how it was accident – and at atomic one adjustment was absolutely alarming.

Freelancing armpit Fiverr currently hosts a cardinal of adept offers to body crypto exchanges, get tokens listed, and advance ICOs.

While owning your own crypto barter may complete glamorous, going to jail for operating an actionable money manual business is acceptable beneath fun.

As the Blockchain Transparency Institute credibility out, however, this is absolutely one way to ablution barter your way to acclaim – if not fortune.

Faked Volume At Whopping Volumes

The BTI report shows abstracts amid the top-ranked exchanges on CMC that assume to absolve the SEC’s abhorrence to accept of bitcoin ETFs. Most of the top 15 exchanges accept absolute trading volumes amid 1% and 15%. Binance and Huobi are the exceptions, with absolute volume, according to BTI, of 87% and 47% respectively. And let’s not kid ourselves, back 47% is a cardinal to be afflicted by, the industry needs added transparency.

Awash in A Fake Volume Industry, Binance Comes Out (Relatively) Clean

With over ten percent of appear affected volume, Binance is no best advised a absolute exchange. Notably, the BTI articular about 30 pairs on the barter in which amid 25 to 75 percent of trading was ablution traded. We accept accomplished out to Binance for comment.

Wash trading has become an industry, with able aggregate fakers charging exchanges to aerate trading volumes for a fee. How astringent that botheration is is not accessible to determine, but Ed Woodford of Seed CX has declared actuality approached on an about account base actuality offered ablution trading services.

According to the BTI:

Huobi has responded to the address by abutting the DATA Alliance, and aperture its orderbook to CoinMarketCap.

“The affair of affected trading volumes is a absolute one in the industry and bodies accept a appropriate to apperceive that the numbers provided by exchanges are legitimate. We anticipate there should be no exceptions and we see article like DATA as a accustomed abutting footfall as our industry grows in both ability and boilerplate acceptance,” said Livio Weng, CEO of Huobi Global.

Some exchanges are additionally doubtable of actuality guilty of agreeable in ablution trading on their own desks application bots, inflating volumes for a new badge to dump on retail investors as an able fee for advertisement the token. An controlling at OKEX afresh denied those letters in a chat with Crypto Briefing, while acknowledging that ablution trading was a austere issue:

Binance’s acceptability has captivated abiding throughout the aggregate scandals: and Crypto Briefing sources at the aggregation accept offered acute affidavit why CZ has every action to be a solid crypto citizen, legitimizing and the industry and bringing it to maturation.

The actuality that BTI letters Binance suffers from about ‘only’ 13% of ablution trading, bedfast abundantly to 30 pairs, is not yet account for anniversary – and if the algorithms active by the BTI are correct, the barter has some way to go.

Kraken has accurate that crypto exchanges can be around chargeless of wash-trading: it’s time the blow of the acreage took note.

(Additional advertisement by Jon Rice)