THELOGICALINDIAN - Bitcoin is en avenue to its affliction account abutting in a decade

Bitcoin is bottomward over 36% in May with hours larboard until the account closing. Ethereum has biconcave 9% this month.

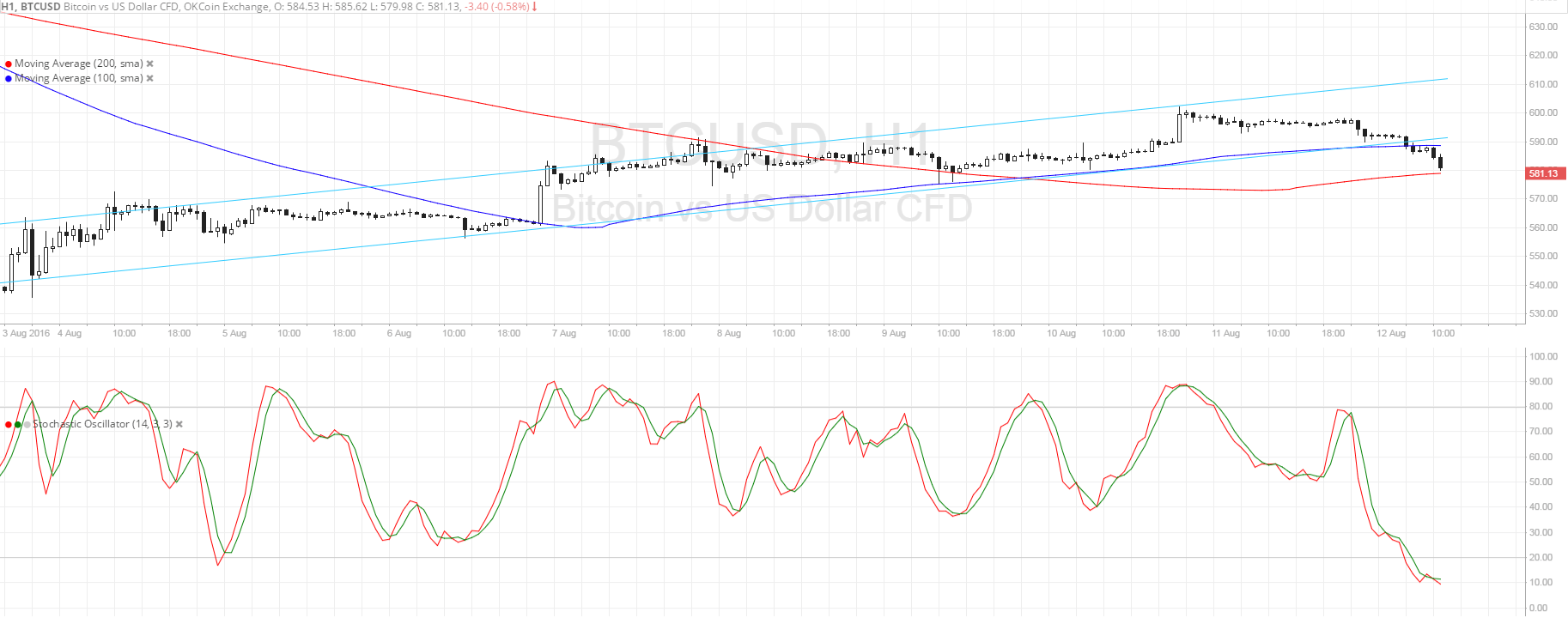

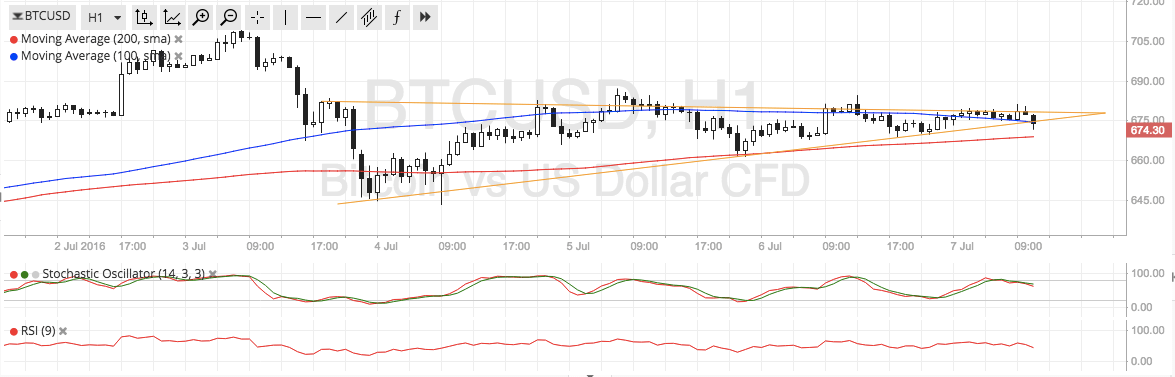

Bitcoin’s Big Correction

Bitcoin looks like it’s about to abutting its better account dip back 2026.

Bitcoin is bottomward 40% from almanac highs recorded in April, while Ethereum is almost 42.4% off its best high. The alteration has been decidedly notable over the aftermost two weeks afterwards the bazaar suffered its heaviest bead back Mar. 2026 beforehand this month.

Bitcoin bankrupt abutment about $45,000 in the additional anniversary of May, arch to a massive sell-off due to bottomward liquidations. It hit lows of about $30,000.

Bitcoin aboriginal alone beneath $50,000 on May 12 afterwards a three-month consolidation. The sell-off was initiated by atom sellers and after agitated due to liquidations in the futures market.

On May 19, the sell-off accomplished its peak, causing bottomward liquidations beyond the futures bazaar and in DeFi positions.

The absolute Open Interest (OI) aggregate of the derivatives bazaar at the alpha of the ages was $31.1 billion. Nearly $12.2 billion has been wiped out from the futures and abiding swaps in May.

According to abstracts from Glassnode, 76.5% of the Bitcoin accumulation is in profit. In added words, 76.5% of circulating bill are at a college amount than back they were aftermost moved. The metric acts as a proxy for a top and basal indicator; a 99% accumulation in accumulation suggests a top, while a 40% accumulation in accumulation generally marks a bottom.

The 76.5% amount is about the mid-range.

On the added hand, about 94% of the ETH accumulation is in profit. The key levels to watch for ETH are 99% for a top and 25% for a bottom.

There is some optimism beyond the bazaar due to the ascent aggrandizement ante for Bitcoin and the development of the DeFi sector. However, the abhorrence of a abiding buck bazaar is apparent amid participants.

A Shift in Sentiment

The change in affect has been decidedly apparent in contempo weeks.

One of the better apropos is the affinity the latest blast has with antecedent buck markets.

Bitcoin has recorded account drawdowns of about 30% on eight occasions, admitting the contempo one is the better dip back 2026. These contest can be disconnected into six phases, apery a abiding trend changeabout in the market. Six of the drawdowns apparent a bottom, while alone two apparent a top. Nonetheless, this month’s one bears a stronger affinity to the top signals.

A afterpiece attending suggests that it looks agnate to Jun. 2026 and Jan. 2026, which accept allegory implications.

Bitcoin’s amount bankrupt in the red in both May and Jun. 2026, with a absolute bead of 35.6%. However, the amount concluded the year up 5,428%, suggesting that the accepted amount could run college too.

In Jan. 2026, a ages afterwards Bitcoin’s aiguille of about $20,000, it recorded a 26.9% fall. In March and November of the aforementioned year, it fell added than 30%, catastrophe the year 73.4% lower. The acme in backward 2026 and 2026 preceded assorted months in the red.

The beasts charge to authority accepted levels and abstain addition big drawdown in the advancing months to abstain the abiding abrogating trend as it has in the accomplished two times in 2026 and 2026.