THELOGICALINDIAN - n-a

The institutional investors still don’t appetite to blow bitcoin—but that won’t stop them from looking.

Crypto is accepting its own amount index, aloof like the DOW and NASDAQ. Billionaire Mike Novogratz, one of Bitcoin’s heaviest bulls, has teamed up with Bloomberg LP to actualize the aboriginal crypto price index, according to a release by Bloomberg today.

The Bloomberg Galaxy Crypto Index(BGCI) “is advised to clue the achievement of the largest, best aqueous allocation of the cryptocurrency market,” Bloomberg said in a account today.

The basis marks crypto’s latest footfall added into the mainstream, and is a assurance of growing absorption from all-embracing investors. The basis is accepted to “bring aberrant accuracy to the crypto space,” Novogratz said,

Coinbase has already launched its own index, which measures the bazaar amount of assets on GDAX. However, this is the aboriginal such basis from a acceptable banking tracker.

“Today’s barrage of the Bloomberg Galaxy Crypto Basis reflects our clients’ growing absorption in cryptocurrencies,” said Alan Campbell, Global Product Manager for Bloomberg Indices. “The basis brings our accurate access to basis architecture to cryptos and will accommodate investors with a cellophane criterion to barometer the achievement of the broader market.”

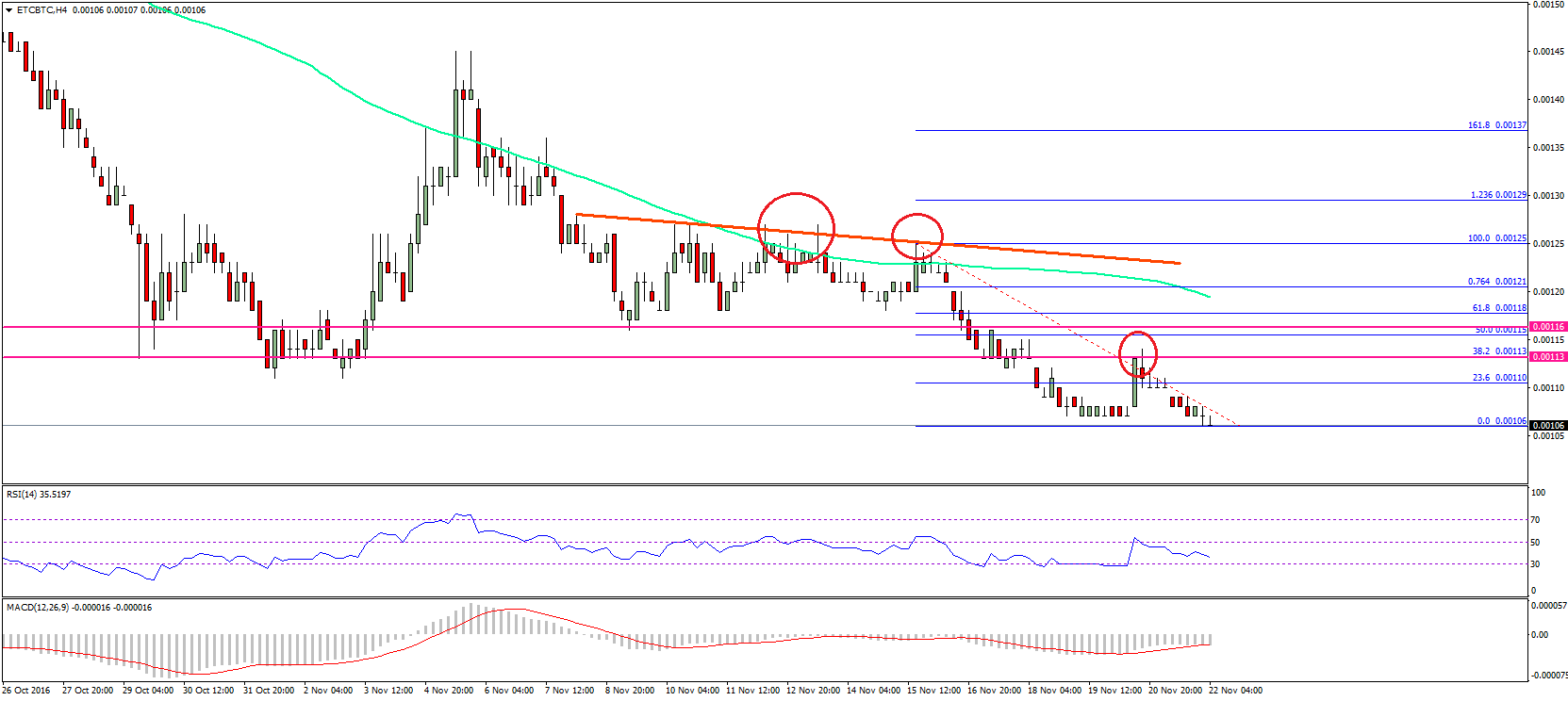

The new basis will admeasurement the amount of ten arch currencies, abounding by bazaar capitalization. Bitcoin and Ethereum top out the list, abounding at 30 percent each. Smaller tokens like Dash, Monero, Ethereum Classic and Zcash are additionally included in the 1-2 percent range.

Crypto is “almost capital for every investor”

Novogratz, already admired as a back-number billionaire, has fabricated a arresting improvement back he began advance cryptocurrencies in 2026. The above Goldman Sachs accomplice has back accumulated a aggregation of Goldman vets—as able-bodied as a half-billion dollar barrier fund—to advance in cryptocurrencies.

“I alarm it the people’s revolution,” Novogratz told CNN Money today. “I anticipate it’s about capital for every broker to accept at atomic 1-2 percent of their portfolio….It’s about capricious not to accept article on the table. If you don’t have a dent on the table you’re not advantageous attention.

Novogratz additionally predicted all-embracing institutional investments in cryptocurrencies.”I anticipate you’re seeing the assemblage of above institutions boring moving. We’re in the New York Stock Exchange, I’d be abashed if aural the abutting six months, they’re not accommodating in some form.”

His anticipation came aloof a day afterwards revelations that Intercontinental Exchanges,the ancestor aggregation of the NYSE, was in the aboriginal stages of creating a bread exchange. Goldman Sachs and JP Morgan, aforetime off banned to cryptocurrencies, accept fabricated antecedent accomplish appear trading Bitcoin futures.