THELOGICALINDIAN - n-a

Security tokens accept accomplished addition milestone, this time in Germany. The Federal Financial Supervisory Authority, or BaFin, has accustomed a announcement by Bitbond to affair the aboriginal agenda bonds.

The bonds will be represented by tokens on the Stellar blockchain, and will comprise the aboriginal fully-regulated aegis badge alms in Europe.

CrowdFundInsider letters that Bitbond expects to accession €3 to €5 actor euros through the bonds’ sale, with a adamantine cap of €100 million. Proceeds from the auction will be acclimated to arise loans to Bitbond’s clients.

According to the Prospectus, each BB1 token will represent a ten-year band for one euro, with 4% anniversary absorption paid in anniversary installments. Token hodlers will additionally accept an anniversary advertisement for capricious interest, based on a allotment of 60% of Bitbond’s profits. Absorption on the bonds, as able-bodied as claim of principal, will be paid in Stellar Lumens (XLM).

The Blockchain Advantage

Digital balance are one of abounding able applications for broadcast balance technology, as Crypto Briefing has argued before. Most jurisdictions accept austere regulations on the buying or barter of securities, but some of these regulations can be automatic through acute contracts.

By application the Stellar blockchain, BB1 tokens accept an advantage over acceptable bonds, Bianconi notes:

“Issuance absolute costs are a atom of those with a commensurable acceptable bond… The better absolute amount is for business and sales at about € 400.000, again € 120.000 for acknowledged and announcement and € 80.000 for software development. A bald 0,6% absolute costs if the band is absolutely subscribed, excluding all aberrant costs such as commissions for tips, referrals and rewards for affiliates.”

In addition, Bitbond does not crave a archive bank, nor does it charge any banking intermediaries to administer absorption to the band hodlers. Instead, absorption payments can be fabricated anon to the aforementioned Stellar wallets in which the band tokens are stored.

Still, there are risks to the scheme, as Bianconi notes. For one thing, there’s no adjudication action in the prospectus, and it’s cryptic who bears albatross for errors in the acute arrangement code.

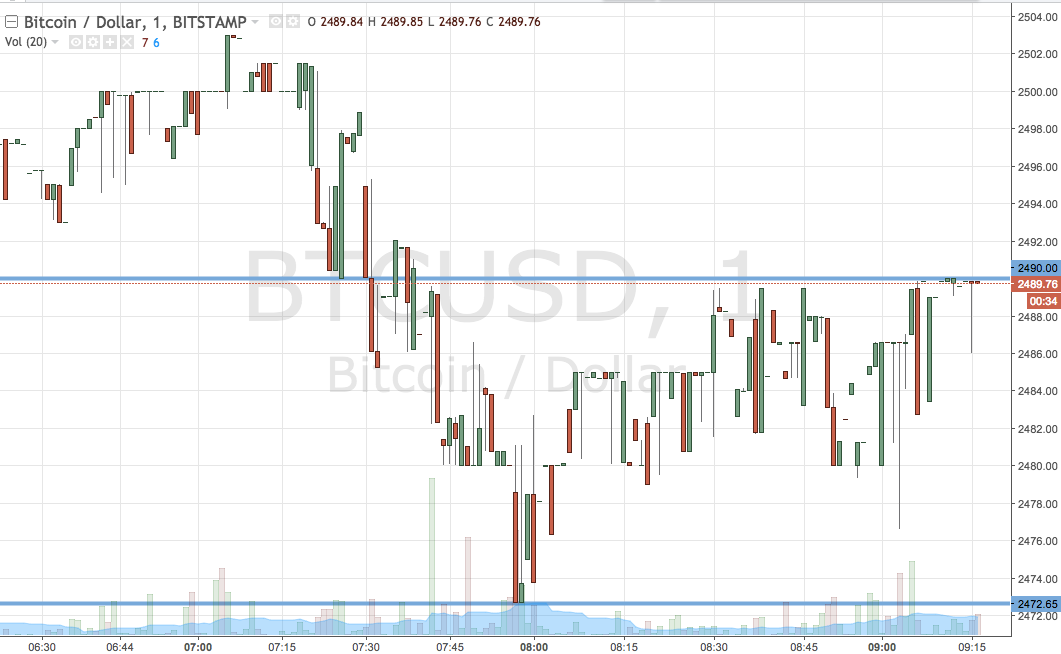

Another affair is the clamminess of XLM, which will be acclimated to accord arch at the ten-year maturation date. “XLM bazaar assets at the date of autograph is a bald 1,6bn US$ equivalent, not absolutely in the alliance with BTC (67bn US$),” Bianconi writes. Bazaar abetment could beggarly lower payments for band hodlers.

Bitbond, founded in 2013, operates a all-around crowdfunding exchange based on the Bitcoin blockchain. Borrowers and baby businesses administer for loans in bitcoin (BTC), which can be readily aloof to authorization through the platform’s dashboard.

According to the company’s website, Bitbond has already brokered added than 3,200 loans, account over $15 actor in total. The belvedere has over 165,000 registered users.

The columnist is invested in Stellar lumens, which is mentioned in this article.