THELOGICALINDIAN - The CME futures markets should anon accommodate Micro ETH contracts

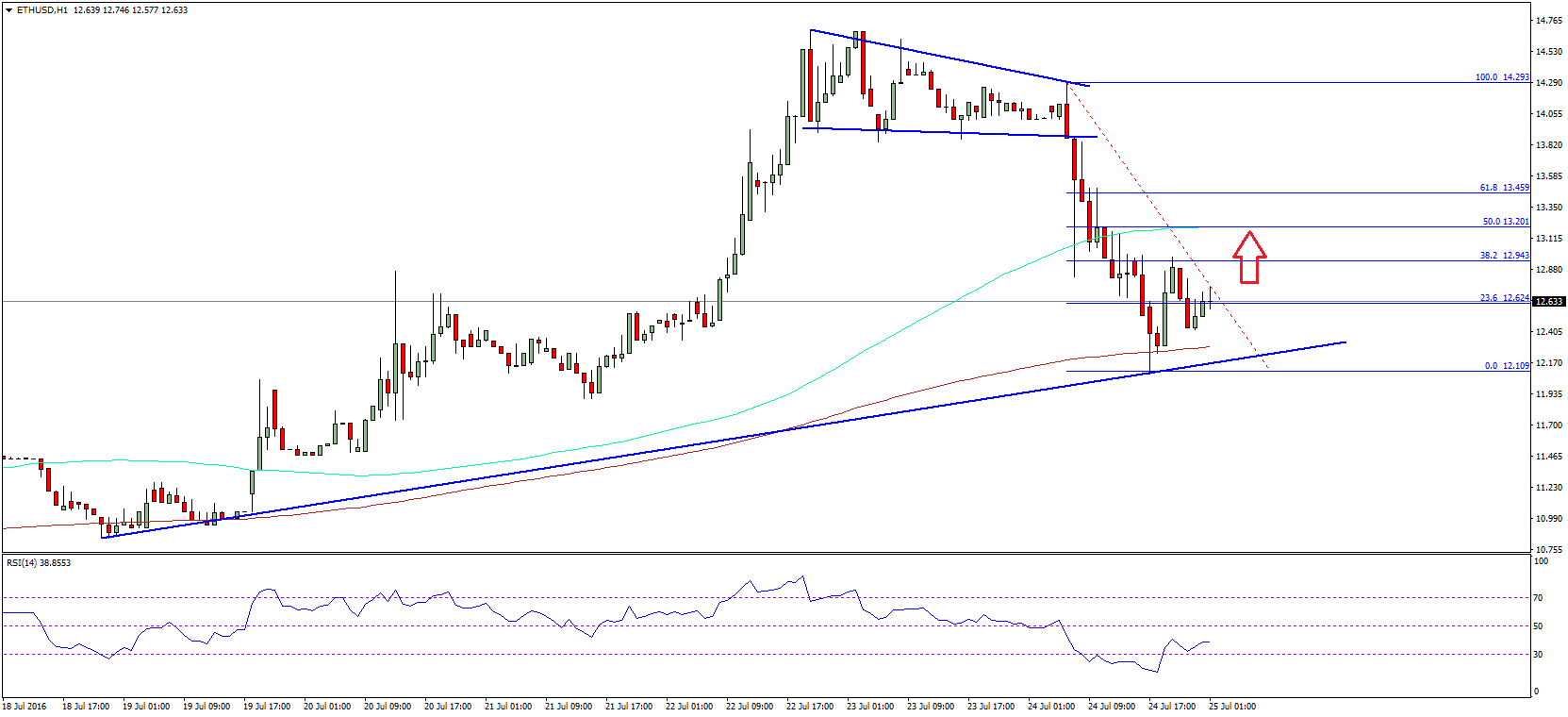

CME Group, the world’s arch derivatives marketplace, has announced that it will action Micro ETH futures starting December 6, awaiting authoritative approval. Micro ETH futures are one-tenth the admeasurement of one ETH and may accommodate a added able and attainable adjustment for investors, both institutional and retail, to hedge their portfolios.

Micro ETH Futures’ Bright Future

CME Group, which includes the Chicago Mercantile Exchange, the Chicago Board of Trade, and the New York Mercantile Exchange, amid added subsidiaries, has appear that it will activate alms Micro ETH futures affairs alpha December 6 of this year. CME ahead launched ETH futures trading in February and while appeal for the artefact has increased, so too has the amount of ETH; this has had the aftereffect of authoritative normal, full-size ETH futures affairs beneath attainable for many. The Global Head of Equity Index and Alternative Investment Products at CME Group, Tim McCourt, has said that the advance in clamminess of ETH futures has been apparent “especially amid institutional traders.”

CME Group has this year abundantly broadcast its cryptocurrency derivatives offerings. Since February, over 675,500 ETH futures affairs accept traded, agnate to almost 33.8 actor ETH (the absolute circulating accumulation of ETH is currently about 118.1 million). Since CME launched Micro Bitcoin futures in May, added than 2.7 actor affairs accept been traded. Micro ETH futures will add to CME’s growing account of Micro articles that accept traded in added than one billion affairs and accommodate articles alignment from oil to metal to currency.

While futures ability assume abstruse to abounding retail traders and investors, they are arresting derivatives articles acclimated by both institutions and individuals. This is accurate not alone in the acceptable banking apple but more in crypto markets, including the second-largest cryptocurrency by bazaar capitalization, Ethereum.

The advertisement comes alone weeks afterwards the aboriginal Bitcoin futures ETFs in the U.S. began trading. It became one of the most heavily traded aperture canicule anytime for an ETF.

Disclaimer: At the time of writing, the columnist of this affection captivated BTC, ETH, and several added cryptocurrencies.