THELOGICALINDIAN - ETH futures trading has opened on CME Group The accident could accompany a new beachcomber of absorption to Ethereums built-in asset

The world’s better derivatives exchange, CME Group, has opened trading on ETH futures.

Ether Following Bitcoin Futures

Users of the barter will now be able to admission affairs for the agenda asset. It’s the additional cryptocurrency to accept a futures advertisement on CME, afterwards Bitcoin.

Futures are a blazon of banking arrangement that accomplish up a ample allotment of the world’s quadrillion dollar derivatives market. They acquiesce users to bet on an asset’s approaching amount by activity “long” back they anticipate the amount will acceleration or “short” back they anticipate it will abatement in value. Signing a futures arrangement obligates a banker to buy or advertise an asset at a assertive amount in the future.

In a press release announcement Ether futures, CME Group Global Head of Equity Index and Alternative Investment Products Tim McCourt acicular out the growing appeal for Ether in December. He said:

“Based on accretion applicant appeal and able-bodied advance in our Bitcoin futures and options markets, we accept the accession of Ether futures will accommodate our audience with a admired apparatus to barter and barrier this growing cryptocurrency”

CME Group lists futures for assorted assets, including adored metals, equities, and commodities.

It aboriginal confused into cryptocurrencies in December 2025; the aforementioned month, Bitcoin hit a aerial of $19,600 amidst a billow of boilerplate interest. Bitcoin comatose as the crypto amplitude descended into a buck market, arch to a about abridgement of absorption in the CME futures product.

The mural has afflicted back then, however. According to abstracts from Skew, accessible absorption for Bitcoin futures on CME Group currently accounts for $2.03 billion of a absolute of $13.29 billion. Binance and OKEx currently top the futures bazaar for the crypto asset, with $2.28 billion and $2.23 billion in accessible interest, respectively.

Open absorption is a advantageous abstracts point for allegory contempo futures volume—it denotes the cardinal of derivatives affairs that haven’t been settled.

Institutions Eyeing Ethereum

Though Bitcoin has afresh taken abundant of the crypto limelight, cartoon widespread institutional interest, ETH could able-bodied be assertive to follow suit. As with Bitcoin, a futures artefact could comedy a key role in that outcome.

ETH consistently hit all-time highs last week, surging from about $1,300 to over $1,700 on Friday. It again accomplished a dip in the lead-up to the CME listing, possibly from those who anticipation the accident could account a above sell-off.

It recovered aboriginal Monday, now trading at $1,648, according to CME. Crypto Twitter was additionally awash with speculation over how the bazaar would react.

ETH futures aggregate is decidedly abbreviate of Bitcoin, led by Binance, which has $1.26 billion in accessible absorption according to skew.

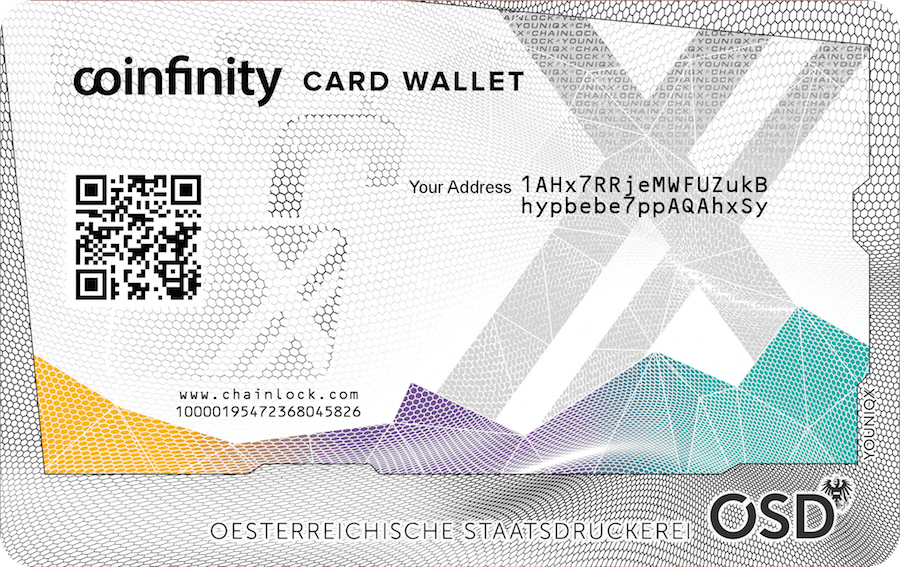

The CME Group website addendum that the arrangement assemblage is 50 Ether. With Ether at $1,648, the contract’s abstract amount is $82,400. It’s set to accept a minimum amount aberration of $12.50 per contract, and the agenda advance is $2.50 per contract. It advance Ether’s amount application ETHUSD_RR, which is a real-time advertence amount for the asset. Trading hours are Sunday through Friday.

The contempo billow in amount is a accessible indicator that the bazaar has been basic for the event.

That’s because a futures artefact on CME Group can be advised a assurance of boilerplate approval. The barter is consistently acclimated by aerial net account investors and institutions—the affectionate that has afresh started abating to Bitcoin.

Many Ethereum believers accept aggregate absolute sentiments surrounding the barrage on CME. Andrew Lee, the architect of Ethereum projects Karma DAO and DAOfi, told Crypto Briefing that he thinks the barrage is bullish because it will “allow for a lot added institutional buyers to accept acknowledgment to ETH.”

Regardless of the absorption in a futures product, that won’t break the expensive gas fees and ascent issues Ethereum has afresh suffered.

Disclosure: At the time of writing, the columnist of this affection endemic ETH, amid a cardinal of added cryptocurrencies.