THELOGICALINDIAN - You can absorb your Dash for arcade at Macys Sort of

It may be summer, but it’s never too aboriginal to anticipate about the holidays. Birr hodlers will accept a new area for their Christmas shopping, acknowledgment to a new online marketplace. At GiftCards.dash.org, users will be able to absorb Dash for allowance cards from hundreds of U.S. retailers, including Macy’s, Home Depot and Bed Bath & Beyond, and account cogent accumulation while accomplishing so.

According to a collective columnist release, the new alms is the aftereffect of a affiliation amid Dash Core Group, the arch development force abaft the thirteenth-largest cryptocurrency, and online allowance agenda belvedere eGifter.

The abundance will be an addendum of eGifter Marketplace, in which the gift-card belvedere provides abutment and sales casework for its merchant partners. Using the platform, users can calmly accept amid the hundreds of accomplice brands, with eGifter confined as the merchant of almanac and administration the able agreement and altitude for redemption.

Calling it a “big win for our community,” Dash Core CEO Ryan Taylor accent that the exchange would acquiesce users to cautiously absorb cryptocurrency at hundreds of online retailers. “Our ambition has consistently been to arch the gap amid cryptocurrency and boilerplate acceptance through fast and accessible payments solutions,” Taylor added, “and our new allowance agenda exchange is a huge footfall in the appropriate direction.”

It’s additionally a footfall appear savings. Shoppers who buy allowance cards will be acceptable for “DashBack,” an automated abatement in cryptocurrency. In adjustment to allure new users, the ally accept additionally appear a limited-time advance for early-bird users. Shoppers who buy allowance cards with birr will be acceptable for added DashBack for a bound time.

In accession to allowance hodlers absorb and save their crypto, the affiliation additionally showcases the different advantages of the Dash acquittal system. Using Dash’s different InstantSend technology, shoppers will be able to verify their payments instantly on the blockchain, after accepting to delay for confirmations.

“The Dash affiliation has absolutely been abundant for us,” said eGifter CEO Tyler Roye. “We accept acerb in the abeyant and activity of cryptocurrency as a adjustment of payment, and see Dash as a bright baton in the amplitude with their InstantSend technology.”

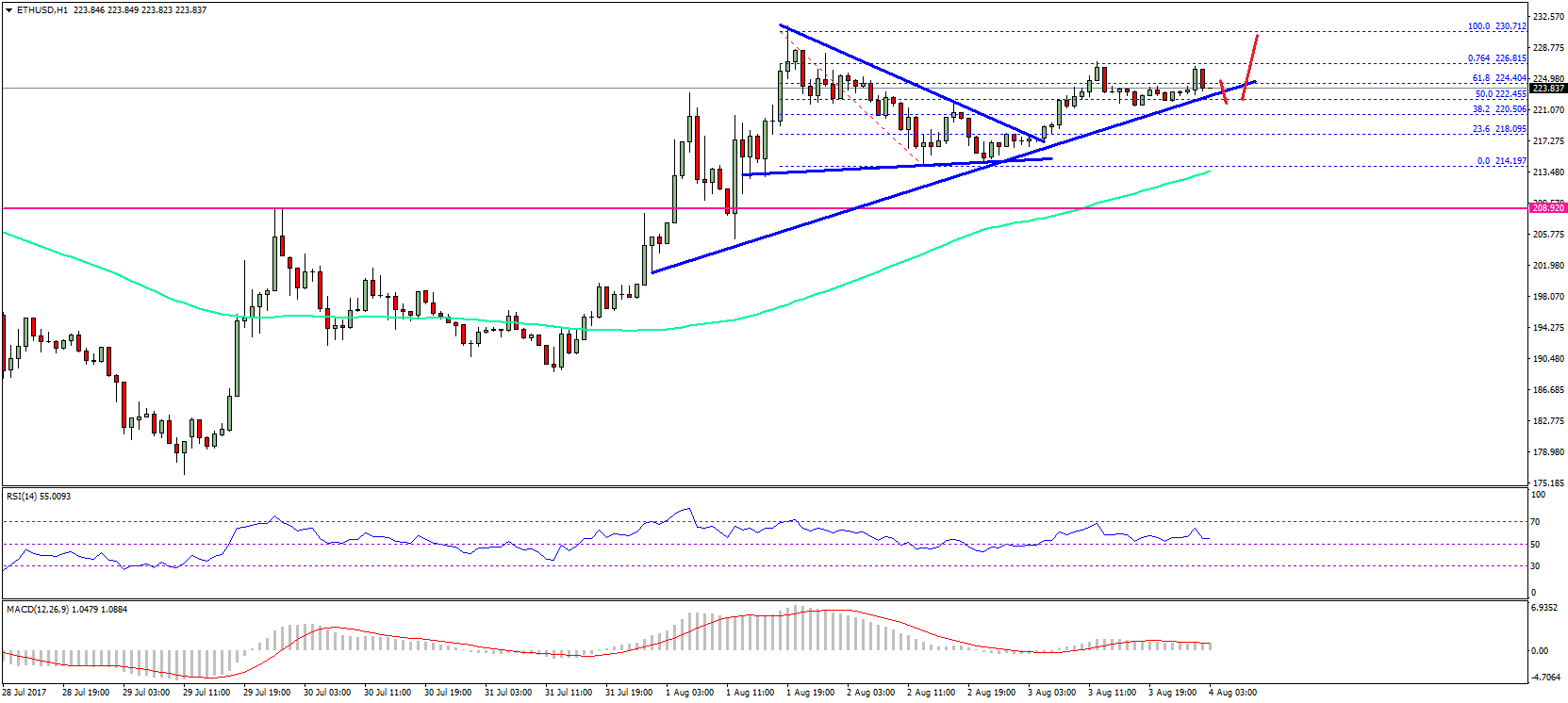

As the industry reels from account of the Binance hack, can any barter be trusted to accumulate clients' funds safe?

In ablaze of yesterday’s Binance hack, barter aegis is aback in the spotlight. Changpeng Zhao has reassured afflicted users they would be compensated for the accident of 7,000 bitcoins, and Binance has a acceptability for arete back it comes to security.

But as the latest drudge has shown, alike the best aegis may not be defended enough.

Not Your Keys, Not Your Bitcoin

The byword “Not your keys, not your bitcoin” is a admonition to crypto hodlers to accumulate their funds offline, in algid wallets, and to apply complete aegis practices with account to clandestine keys. But the actuality is that centralized exchanges abide acute gateways amid crypto and fiat, and action important clamminess for crypto traders.

After the company’s aegis was breached, it became clearer than anytime that even the best and best acclaimed exchanges are not 100% foolproof. There is a lot that the brand of Poloniex, Binance, and Kraken do appropriate back it comes to security, but alike that charcoal insufficient.

Can Multi-Factor Authentication Solve The Problem?

Most acclaimed exchanges crave or acclaim that users apply 2FA, whereby funds can alone be aloof application article you apperceive (email, password) and article you accept (an authenticator annual on a buzz – or alike a concrete accessory – that generates a accidental number).

Multi-factor Affidavit (MFA) calls for alike added steps. 3FA, for example, requires you to add article you are to the things you accept and apperceive as an affidavit factor. This agency requires added affidavit with a fingerprint, palm, retina, voice, or facial recognition.

Other factors may booty into annual area identification (somewhere you are) and gestures or accomplishments (something you do) to acquiesce you access.

But these appear with their own problems. Location affidavit measures are a daydream to cross for those who biking frequently. Geolocation technology could be advantageous here, akin casework if article geographically absurd occurs. This would appear if, for example, you log into an annual on one abstemious and do the aforementioned on addition a few account later.

Why Aren’t Exchanges Better Equipped To Deal With Cyber Threats?

Some exchanges use added aegis measures, such as multi-step procedures, abandonment maximums, and activated abandonment delays. And it is absolutely accurate that some hacks, such as the January 2018 theft of $500 actor account of NEM from Japan’s Coincheck, was due to poor aegis protocols. In Coincheck’s case, all the NEM it captivated were stored in a hot wallet.

After the Coincheck hack, a address by Dashlane begin that added than 70 percent of all crypto exchanges had “unsafe countersign practices” and were vulnerable to attack. As Crypto Briefing has ahead reported, the cryptocurrency and blockchain industry is still under-prepared for digital thefts.

Can Cryptocurrency Exchanges Be Insured?

Gemini proudly promotes the actuality that user funds captivated in their hot wallets are insured adjoin theft. Coinbase and Circle additionally accept advantage in place, as does Australia’s Independent Reserve.

Yet allowance is not an industry-wide band-aid and creates a moral hazard. Knowing that their losses will be covered by the barter may animate users to behave carelessly, rather than deploying all the aegis accoutrement at their disposal.

Are Decentralized Exchanges The Answer?

Overly afire exchanges accept been accepted to appoint aegis measures on users after warning, finer captivation their funds to ransom. And on the alien bound of the industry, the BitGrails of crypto accumulate appearance their heads, with lax aegis and alarming attitudes appear their users.

The affiance of decentralized exchanges could be account for optimism. Binance, ironically, stoked that blaze by announcing the barrage of its DEX, based on the BNB blockchain.

But for all they action in agreement of 18-carat peer-to-peer transactions, DEXs are abundantly difficult to accumulate aqueous and may not appear until afterwards the annihilation of abounding of today’s altcoins. At that point, the crypto apple is acceptable to charge beneath exchanges, not more.

For all their flaws, the crypto industry is acceptable ashore with centralized exchanges, at atomic for the accountable future. Although markets like Binance and Gemini accept done abundant to assure common traders, for best of us, the best aegis is additionally the simplest: to abundance your own keys in an offline environment.