THELOGICALINDIAN - It follows a bouldered aboriginal year of operation

Bitcoin is down, and alts are bottomward further, but that’s no acumen to despair. Things can consistently be worse: your antithesis area apparently didn’t lose as abundant as Galaxy Digital’s.

Mike Novogratz’s asset administration close accomplished a abreast $30M bead in the amount of assets beneath administration (AUM) aftermost month, which could be a assurance that some investors are demography amount elsewhere.

Galaxy Digital Capital Management (GDCM), which manages assets on account of basis funds, adept funds and blockchain ecosystem funds, appear a basic AUM amount of $393.9M as of the end of June. That’s a bead of 7% from the antecedent month, back Galaxy’s absolute AUM stood at $421.6M. It was additionally the distinct better bead back the aggregation started publishing abstracts in April 2026.

Why Did Assets Drop?

GDCM says AUM can change for four reasons: performance, contributions, withdrawals and basic commitments adjourned from one agent to another. Since the absolute crypto bazaar cap added by added than $100bn in June, it’s absurd that the abatement was absolutely due to performance.

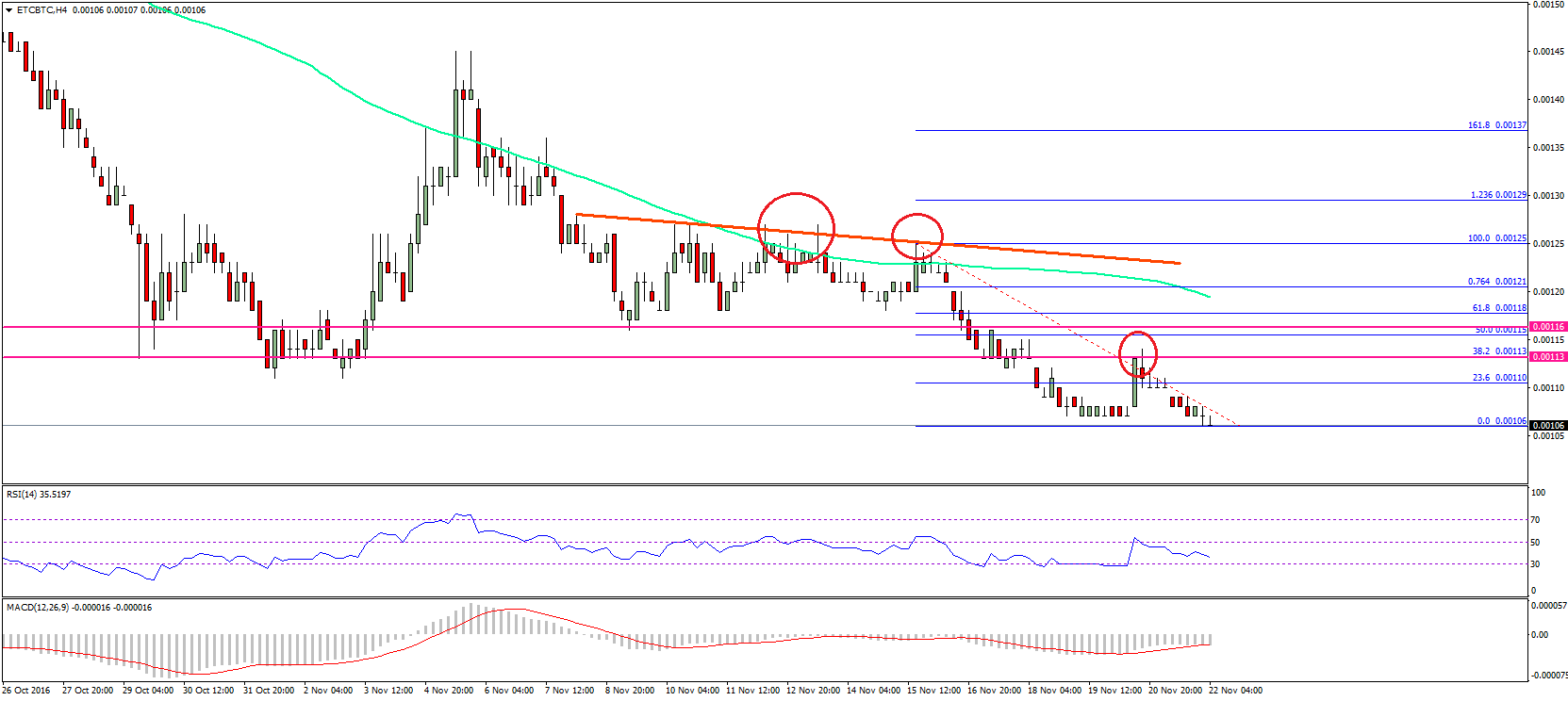

As the blueprint aloft shows, alike adequately agreeable bazaar periods such as February and March saw Galaxy Digital’s assets alter by about $300,000. When the rally commenced in aboriginal April, AUM absolutely decreased by added than $1.5M, afore ascent aback up to $421.6M in May.

GDCM claimed a able achievement in the aboriginal three months of this year. In a annual columnist release, Galaxy Agenda stated that the aggregation had “been capitalizing on the advance in the agenda assets market… and authoritative allusive advance appear approaching commitments.”

But admitting the brilliant ability of its founder, Galaxy Digital accomplished several blunders during its aboriginal abounding year of operation. The aggregation fabricated cogent losses during the bazaar downturn, including a appear $47M accident from the auction of its ample Wax (WAX) backing – a badge acclimated to barter basic appurtenances acclimated in video games.

The accumulation appear an anniversary accident of $270M in 2026, with the advance portfolio bottomward 36%. However, Novogratz insisted that the close had still outperformed the market.

There accept additionally been some success belief recently: the aggregation asleep its position in EOS’ Block.One for $71M aback in May. But today’s account of a abatement in AUM could be a assurance that audience are affective elsewhere, or not advance as abundant as they accept done in the past.

These abstracts are still basic and accept not yet been confirmed. GDCM has additionally emphasized that none of its letters accept been audited by a registered third affair back December 2026.

What is GDCM?

GDCM is 100% endemic by Galaxy Agenda Holdings, Novogratz’s merchant coffer for institutions in the agenda asset market. The aggregation says that its aggregation is accustomed with blockchain technology and can action both alive and acquiescent portfolio management.

Last year, the aggregation partnered with Bloomberg to barrage the Bloomberg Galaxy Digital Index, which advance the best aqueous USD-cryptocurrency trading pairs.

Crypto Briefing approached Galaxy Digital for added advice on the abatement in AUM. A agent beneath to comment.