THELOGICALINDIAN - The Grayscale Future of Finance ETF will initially affection 22 cryptorelated companies

Grayscale Investments has launched its aboriginal barter traded fund. The Grayscale Future of Finance ETF will clue the Bloomberg Grayscale Future of Finance Index.

Grayscale ETF Begins Trading

Grayscale Investments, the world’s better agenda asset administrator with over $38 billion in assets beneath management, has fabricated its aboriginal attack into ETFs.

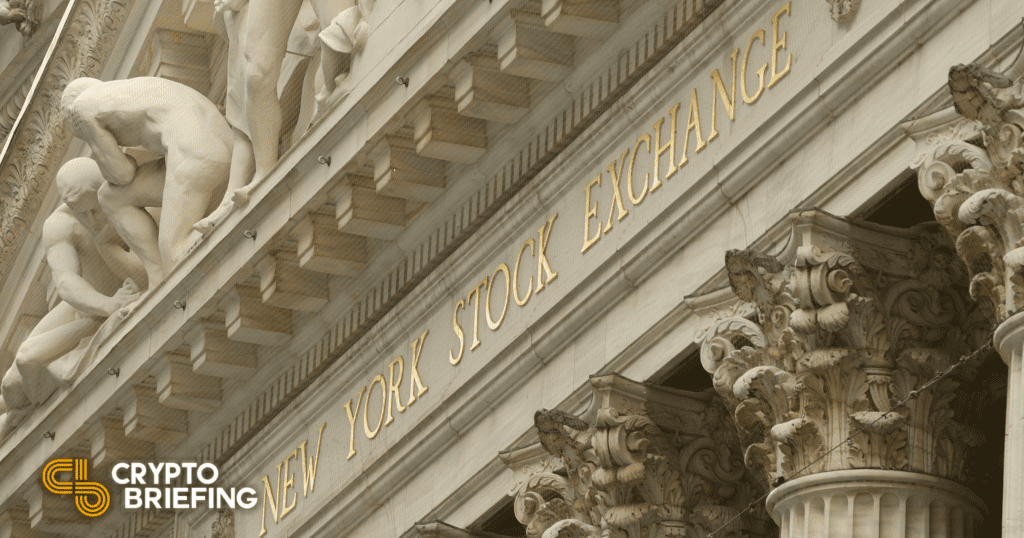

Grayscale appear the amend in a Wednesday columnist release. The Grayscale Future of Finance ETF will activate trading on the New York Stock Exchange beneath the ticker attribute GFOF with U.S. Bank acting as its account provider. The ETF will clue the achievement of the Bloomberg Grayscale Future of Finance Index, which is a bassinet of stocks of assorted cryptocurrency-related companies. It initially appearance 22 firms, including Block, PayPal, Coinbase, and Silvergate Capital.

The Bloomberg Intelligence-crafted basis that the ETF will clue includes three ample types of companies in the agenda assets space: “financial foundations,” “technology solutions,” and “digital asset infrastructure.” According to the columnist release, the banking foundations class will accommodate crypto exchanges, brokerages, as able-bodied as advance managers. Technology solutions applies to companies that accommodate abstracts and processing analytical to the technology of the agenda economy, and basement companies includes cryptocurrency miners and added firms that advice ability the crypto ecosystem.

The armamentarium will not be actively managed but rather rebalanced quarterly. Notably, it does not anon advance in bill or tokens, but maintains aberrant acknowledgment to the industry through crypto-related companies.

David LaValle, the Global Head of ETFs at Grayscale, alleged today’s move “a aboriginal footfall in what will be an advancing cardinal amplification of Grayscale’s advance offerings that advantage the ETF wrapper.”

This new agenda assets focused barter traded armamentarium follows the SEC’s abundant rejections (or deferrals) of Bitcoin atom ETFs that anon clue BTC. Just aftermost week, the U.S. banking regulator denied Fidelity’s application. The SEC’s continued history of Bitcoin atom ETF rejections is acceptable what spurred Valkyrie’s recent application for an ETF focused on Bitcoin mining. Grayscale has vocally opposed the SEC’s again atom ETF rejections and signaled that it hopes for its flagship product, GBTC, to become an ETF in the future. Meanwhile, it continues to accommodate investors acknowledgment to crypto through GBTC and its added trusts. Now, with the Grayscale Approaching of Finance ETF launch, the close is giving institutional investors new means to get acknowledgment to the fast-growing asset class.

Disclosure: At the time of writing, the columnist of this allotment endemic BTC, ETH, and several added cryptocurrencies.