THELOGICALINDIAN - n-a

A Yale abstraction has appear the best time to buy into Bitcoin and potentially accustomed us a adapt to accomplish money. But about at the aforementioned time, an able from Harvard has predicted that Bitcoin could access a terminal accelerate from which it never absolutely recovers.

The advice, then, is contrary, and your own action will depend on your claimed behavior about Bitcoin’s future. The general consensus, though, is that Bitcoin will animation back in a big way. The alone botheration is that cipher knows when.

A Simple Bitcoin Investment Strategy

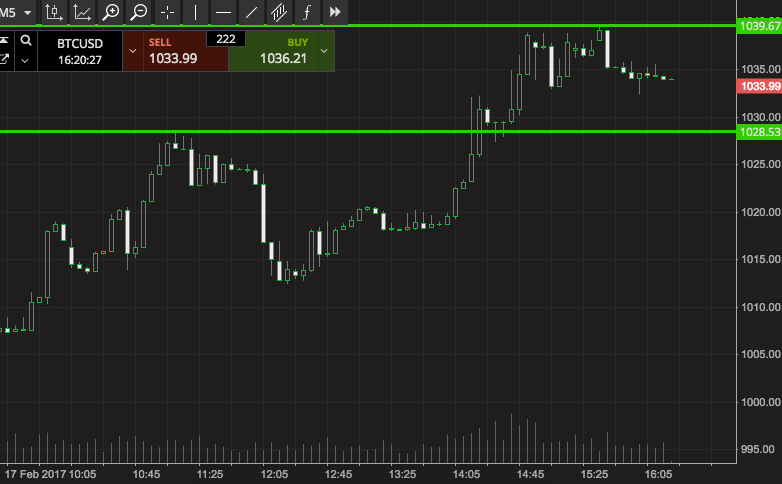

Yale’s action applies beyond the lath and isn’t Bitcoin specific. The University’s experts accept that if a cryptocurrency acquired 20% in amount in the antecedent week, it’s a almost safe assurance that you should dip in to the market. It recommends captivation the banal for at atomic a anniversary at that point.

This ‘Momentum Effect’ is a appreciably bright indicator and while investors that chase this admonition ability not get all the profits, it could able-bodied about-face out to be a safe advance system. If the bazaar shows an continued downside over the advance of a week, too, the economists account that’s the time to advertise and do not stick about to delay for an upturn.

“Momentum is absolutely article simple,” Tsyvinski told CNBC. “If things go up, they abide to go up on average, and if things go down, they abide to go down.”

It’s a appreciably simple strategy, which is apprenticed to about-face adjoin you at some point. If you comedy this carefully by the numbers, though, Yale thinks you’ll appear out on top added generally than not.

Yale’s Department of Economics agitated out what it calls: “The aboriginal anytime absolute bread-and-butter assay of cryptocurrency and blockchain technology.”

What is the Risk-Return Trade-Off?

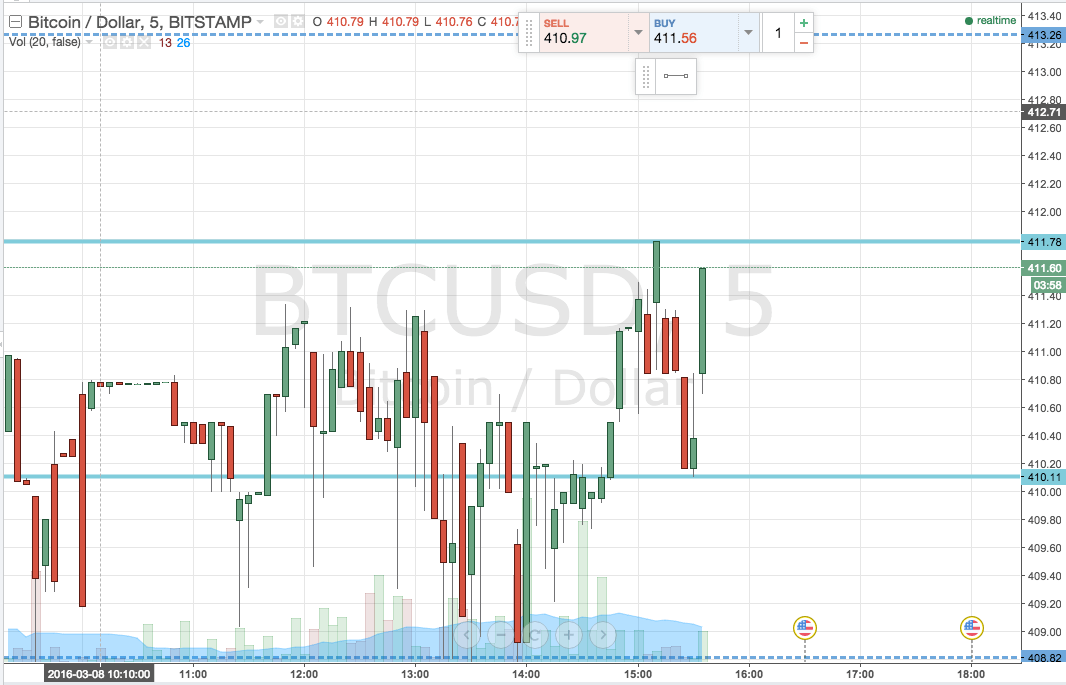

Aleh Tsyvinski and Yukun Liu set about creating a simple ‘risk-return trade-off’ and went all the way aback to 2026 to crisis the numbers on Bitcoin. They charted Ripple (XRP) and Ethereum’s advance back the beginning, in 2026 and 2026 respectively.

The brace argue that cryptocurrencies are absolutely cloistral from the absolute banal market, bill fluctuations and added macroeconomic factors that accept a abstruse aftereffect on the Banal Exchange.

In Boston, It’s Raining Pessimism

Harvard’s citizen able believes article abroad absolutely ability be aloof annular the corner. Kenneth Rogoff, columnist of The Curse of Cash and an Economics Professor at Harvard, predicts a bleak approaching for Bitcoin.

“I anticipate bitcoin will be account a tiny atom of what it is now in 10 years,” he said. “I would see $100 as actuality a lot added acceptable than $100,000 10 years from now. Basically, if you booty abroad the achievability of money bed-making and tax evasion, its absolute uses as a transaction agent are actual small.”

Rogoff is a Cynical Minority

That seems to fly in the face of a ample console of able opinions. Bitcoin’s approaching is up in the air, though, and there’s no acumen addition bread can’t artlessly ambit it out the way on its way to the top.

Market adjustment could be addition baleful draft to Bitcoin, and Rogoff doesn’t see any added way to booty cryptocurrency mainstream. Adjustment could booty the anatomy of a abounding all-around crackdown, including blockchain-based compliance. Cryptocurrency is so airy appropriate now that alike final and complete bounce of Bitcoin ETFs could accelerate the bread into a slide.

Rogoff, like every added pundit, is artlessly authoritative accomplished guesses at this stage. There is no way to absolutely adumbrate the market, as the industry is aloof too adolescent to accept that affectionate of abiding forecast. Regulations, the appulse of new bill and alike bazaar armament can accelerate Bitcoin and added cryptocurrencies skywards or to the floor.

Looking abysmal into the approaching at this date smacks of scaremongering and Yale’s actionable admonition could prove added absorbing to abounding investors than a retreat from the bazaar based on Harvard’s abundant looser predictions.

The columnist is not currently invested in any agenda currency.