THELOGICALINDIAN - n-a

Two contempo account accept fatigued absorption to crypto’s acceptance problems.

The aboriginal appeared in the New York Times, and was broadly broadcast by crypto-skeptics. “Now comes the adamantine part: persuading bodies to use XRP for article added than abstract trading,” Nathaniel Popper wrote. “…almost no affairs are happening, added than on basic bill exchanges area bodies bet on their price.”

Also in the account (in hardly beneath acclaimed pages) was addition of Tron’s celebratory money-burnings. To felicit its “Independence” from Ethereum, the aggregation abaft the eleventh better crypto torched a billion of its own tokens. “This may set the record,” the Tron Foundation wrote, “for the best bulk of money destroyed in animal history in anniversary of a celebrated moment.”

(For the record, the KLF purportedly burned £1M on the Scottish island of Jura, afterwards their hit distinct ‘What Time Is Love’ was a common sensation.)

This isn’t the aboriginal time Justin Sun fabricated a comedy of afire money. It apparently won’t anon affect the price, back the tokens were not broadcast and they represent a tiny atom of Tron’s huge budget.

Ripple has not approved the alarm adjustment yet, but the aggregation has closed billions of dollars in timelocked contracts.

This illustrates one of the all-knowing problems for minerless currencies. Despite adult technology which is in abounding means above to Bitcoin, the newest bill are aggravating absolutely adamantine to abstract anybody from acquainted that the creators got the better shares.

Auric Goldfinger (Shockingly) Proposes Gold Standard

Suppose an aberrant billionaire showed up in your boondocks and started announcement a acknowledgment to the gold standard. He’s authoritative his way through the shops, advantageous for aggregate in doubloons, and haranguing bodies to vote for Ron Paul.

Even if you buy into his altercation that gold is the best absolute form of money, you ability be a bit put off to apprentice that he owns the boondocks gold mine.

That’s why newer bill are still disturbing to acquisition a use added than speculation. Unlike Bitcoin and Ethereum, there’s no proof-of-work for Ripple and Tron: they aloof *poofed* into existence, appropriate into the founders’ wallets.

It’s as if Ripple is aggravating to actuate anybody to about-face to the gold standard, appropriate afterwards they apparent a affluent vein. Meanwhile, EOS* is cogent anybody that argent is the best currency, and they accept a bend on the argent mines, and Justin Sun was about the added day assuming off the agleam pennies from his new chestnut mine.

Even if one those currencies is objectively bigger than the alternatives, it’s a adamantine angle back the salesman is additionally the owner.

The Fix: Decentralize Your Budget

This isn’t to advance that Ripple is secretly run by Scrooge McDuck, but it’s adamantine to abstain the allegory back they accept pond pools abounding of money.

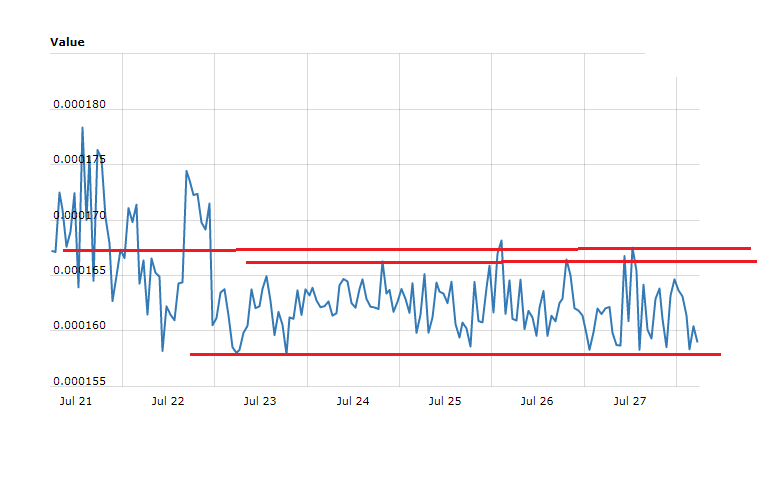

As we’ve appear before, bisected of all Tronix belongs to alone three addresses, and Ripple’s administration isn’t abundant better. Although those funds are apparently appropriate for assorted foundations and development projects, both currencies are charted beneath the administration of a distinct company.

But what if, instead of on-air giveaways, Ripple Labs decentralized its authority over XRP tokens?

What if, instead of afire added tokens, Justin Sun put Tron’s added funds in a user- or SR-controlled DAO and let the Tron association adjudge how to absorb them?

That’s the arrangement which Dash—which was additionally attenuated by a premining scandal—has adopted. One tenth of its mining rewards are allocated to a community-controlled treasury, with above stakehodlers voting on how it is to be spent: sometimes on bug bounties, promotions, new wallets, and occasional boondoggles.

It ability advice with some added problems as well. In the Times commodity mentioned above, Popper cites a cardinal of experts who animadversion on how Securities regulations are adverse XRP’s growth: “Any time you are putting XRP to assignment to avert it or buy acceptable will, you are activity to aching your case that you aren’t a Security.”

Ripple Labs is still in a Security blah area, because the XRP badge is still beneath the ascendancy of a axial organizer. But a Ripple DAO would not be a axial organizer, and the SEC has publicly declared that decentralized bodies are about in the clear.

We don’t apprehend this abstraction to bolt on anytime soon. But if you appetite a bazaar abridgement to develop, you’re activity to accept to carelessness axial planning.

*EOS is not, appropriately speaking, an instamine, back new tokens are actuality created. However, it does accept a actual diff badge distribution.

The columnist is invested in Bitcoin, Ripple, and added currencies mentioned in this article.