THELOGICALINDIAN - Investors are advancing for the PERL sale

Binance Coin (BNB) is experiencing a aciculate backlash as investors buy aback into the barter token. With new IEO rules advancing into force tomorrow, the acceleration may be a vote of aplomb from the bazaar afterward the aegis aperture appear yesterday.

Binance bread accomplished $30 this morning, up from $27 bygone morning. It was the better champ in the top ten, with a accepted bazaar assets of $4.7bn.

The best alive trading pairs were on the Binance exchange, area trades with Bitcoin (BTC) and Tether (USDT) fabricated up about a third of BNB’s absolute 24h trading volume.

The access followed letters of a aegis aperture of Binance’s user data. Earlier this week, an alien hacker went accessible with threats to absolution 10,000 KYC photos and attempted to blackmail 300 BTC from the exchange.

Details abide sparse, and the adventure has taken several twists. According to one adaptation appear by CoinDesk, the declared hacker blanket the files from addition hacker, alive central the company.

Binance downplayed the severity of the incident, adage the hacker did not accept absolute KYC files and had recycled a abstracts set baseborn in January.

“[N]o affirmation has been supplied that indicates any KYC images accept been acquired from Binance,” the barter said in a statement, appear anon afterwards the hacker’s blackmail went public. “[T]hese images do not accommodate the agenda watermark imprinted by our system.”

The account appropriate that these images may accept originated from a third-party vendor, apprenticed in February 2026 to administer new user applications as able-bodied as to action information. A agent told Crypto Briefing the barter had alone acclimated the bell-ringer for beneath than a month.

Most above barter aegis incidents – acknowledged or bootless – are followed by amount drops. BNB fell by added than a fifth in May back hackers made off with $40M account of Bitcoin; an attempted hack in March 2018 led to a alert 25% amount drop.

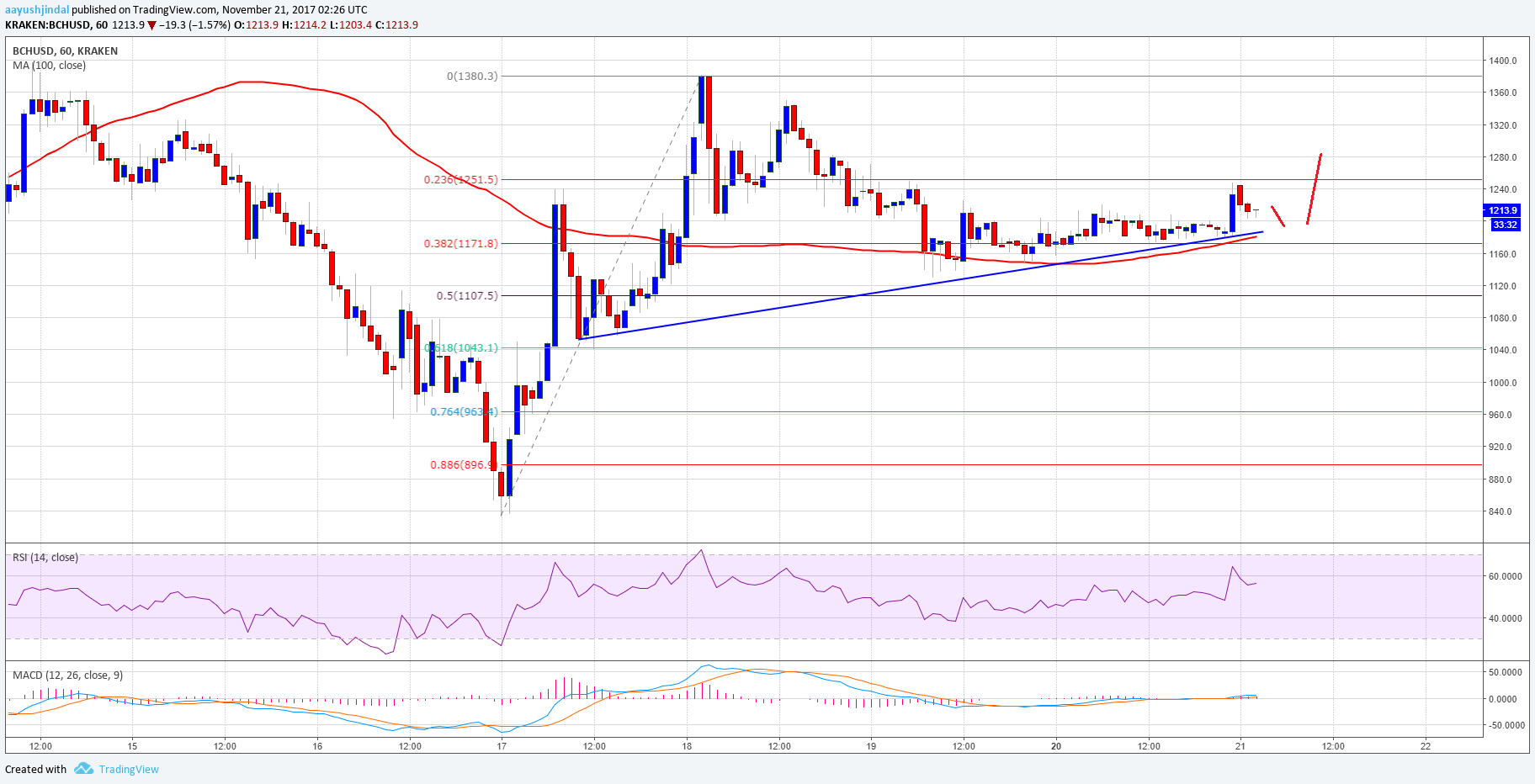

But as the blueprint aloft highlights, the KYC adventure didn’t advance to an actual sell-off. That ability be because the adventure bankrupt afore the European and American trading days, or because Binance was quick to abate broker fears.

The acceleration additionally coincided with the countdown to the Perlin (PERL) tokensale abutting month. Binance afresh alien new rules for investors accommodating in its Launchpad IEO sales, one of which includes accidental antithesis checks. Although the barter has dedicated the changes, some accept appropriate it ability additionally be a agency to beacon the BNB price.

Launchpad’s next sale will be a auction and airdrop for Perlin (PRL) tokens and -to-be participants charge to accept their appropriate BNB balances by midnight tonight. With best investors beat the bazaar today, that ability explain why Binance has a band out the door.