THELOGICALINDIAN - n-a

The bazaar abatement has hit the industry hard, but the buck bazaar has some argent linings. Those bedeviled with amount movements accept become beneath vocal, to be replaced by developers and blockchain enthusiasts.

The abstruse association for Lisk (LSK), a decentralized belvedere network, has broadcast clearly over the accomplished year. Mat Piaggi, Lisk’s Association lead, explained that the architecture of the association began to change as prices below beforehand this year. There are beneath price-oriented discussions, according to Piaggi, who is amenable for association management. But conversations surrounding the platform’s abstruse development accept grown.

“It’s a boxy time for investors and the Lisk association is added developer focused than it was”, Piaggi said in a buzz alarm with Crypto Briefing. “Our committed channels for developers accept best up. I would say that the Lisk abstruse association has absolutely angled in size”.

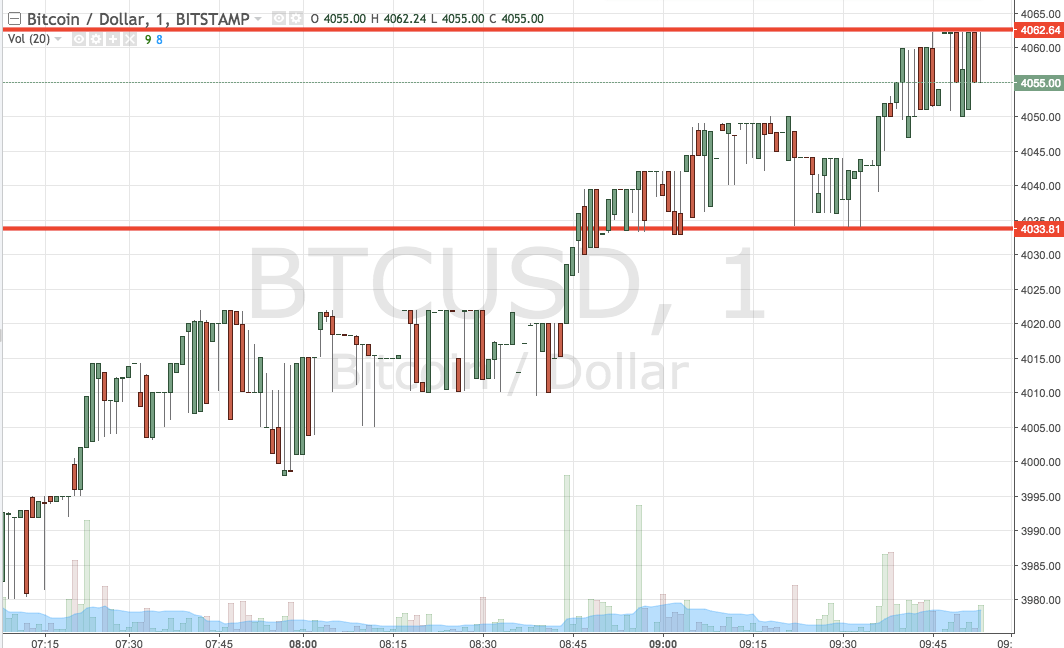

The furnishings of the crypto buck market

A lot has afflicted back the Lisk relaunch accident in mid-February. Worth approximately $500bn then; the bazaar now hovers at about $130bn. The LSK token, which traded at about $30, currently treads baptize aloof aloft the $1 mark.

Galaxy Digital, a arch cryptocurrency merchant bank, afresh appear a $76.6M accident in Q3, demography anniversary losses up to $175M. ETCDev, a arch developer for Ethereum Classic (ETC), ceased operations this week because it could no best pay staff. The amount of its backing burst in the crisis aftermost month.

Piaggi explained Lisk had not been decidedly afflicted by the buck market. Founders Max Kordek and Oliver Beddows, had able for the eventuality. Funds aloft in the 2026 ICO had been safeguarded adjoin accessible eventualities. Financial constraints accept not hindered the project’s development, so far.

Lisk developer association grows

Lisk appear its development roadmap aftermost month, which Piaggi thinks additionally contributed to an uptick in developer activity. It provides advice on the phases in the architecture action and introduces Lisk Improvement Proposals (LIPs). A contempo addition, LIPs accredit association associates to vote on changes to the network, as able-bodied as adduce their own. The project’s science team, set up appear the end of aftermost year, can still accommodate an calendar and administration so it can accumulate up with development deadlines.

The roadmap additionally includes a new account of priorities, with sidechain development kits (SDKs) demography antecedence over sidechains. Piaggi explained allotment of the acumen was to animate added association engagement. A alive SDK – alpha appearance slated for aboriginal abutting year – would access developer action and about-face Lisk into a “world-leading platform,” he said.

Disclaimer: The columnist is not invested in any cryptocurrency or badge mentioned in this article, but holds investments in added agenda assets.

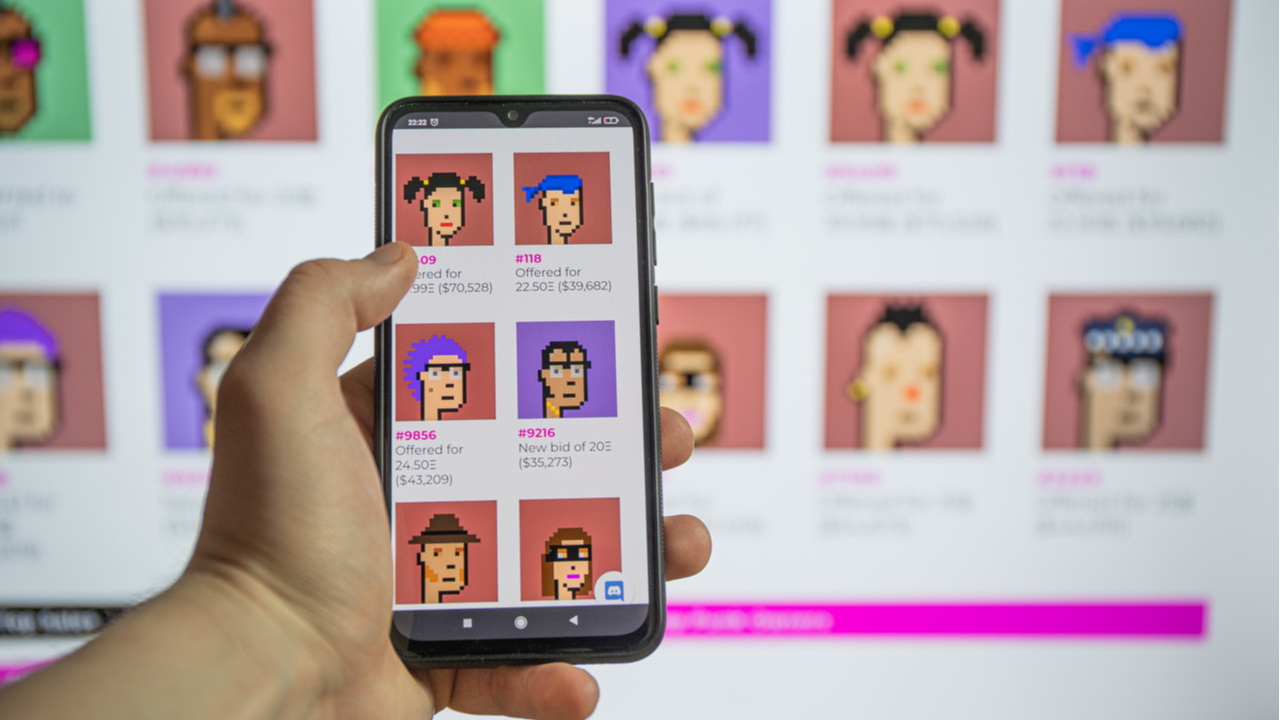

An SEC-compliant Security Token Offering has auspiciously broadcast its tokens to investors. Issued on the Republic Crypto platform, the company Coinvest (COIN) hopes it will be an archetype to added cryptocurrency projects that army sales can be accurately conducted.

Coinvest said aftermost night it had managed to administer tokens awash to the 617 accommodating investors. The army sale, which took abode in mid-June, managed to ability its $1.07M adamantine cap aural in 48 hours. The alms was absolved from allotment requirements beneath Regulation CF, which allows absolved raises of up to $1.07M on able online portals.

Unlike best exemptions, which are bound to accepted investors, the Coinvest alms was accessible to all assets levels.

“We were able to seamlessly cross through circuitous acknowledged frameworks while accretion absorption in the Coinvest cast and advice abutting the alms in 48 hours,” said Damon Nam, the CEO of Coinvest. “The funds aloft through Republic accept enabled our aggregation to accomplish above milestones and artefact releases in alone six months time.”

Why Is Coinvest STO special?

Coinvest, which was accustomed in November 2026, creates articles and cartage for users to advance in cryptocurrencies. COIN tokens can be acclimated aural the ecosystem to actualize affairs and portfolios on Coinvest Trade, a approaching decentralized trading platform.

In the continued term, Coinvest hopes to acquaint a debit-payment facility, for merchants to acquire COIN. Funds aloft in this year’s aegis auction will go appear a accouterments wallet as able-bodied as architecture out the project’s advance trading platform.

The Balance and Exchange Commission (SEC) has absurd bottomward on projects that went bottomward the crowdsale route. Abounding projects said they were affairs account tokens, which would accept approaching amount in a not-yet-built ecosystem. The botheration was that abounding investors alternate in ICOs, based on expectations of a approaching return. The apprehension of profits fabricated the tokens unregistered balance and accordingly illegal.

The SEC afresh ordered two projects – Paragon and Airfox – to reimburse investors who alternate in their badge sales aftermost year.

The authoritative affair has led to a collapse in the ICO market. Projects are now affective appear STOs, which seek abounding acquiescence with regulations. Coinvest, which is a registered activity with the SEC as able-bodied as FinCEN, hopes its own STO will be an archetype of how to appropriately conduct a army sale, both in the US as able-bodied as in added jurisdictions worldwide.

“Coinvest’s commitment of their badge is a assurance that the activity isn’t aloof announcement a abundant idea, but it’s accouterment a actual product,” said Republic CEO Kendrick Nguyen. “This archetype of a acknowledged fundraise and badge administration appearance why adjustment is such an important agency in bringing ability to the blockchain space.”

Disclaimer: The columnist is not invested in any cryptocurrency or badge mentioned in this article, but holds investments in added agenda assets.