THELOGICALINDIAN - The SEC takes bottomward eight Atlantabased artists for profiting in the millions from two counterfeit cryptocurrency schemes

Rapper T.I. (Joseph Harris Jr.) and blur ambassador Ryan Felton and six others were answerable by the SEC for misappropriating funds from two antecedent bread offerings.

Shilling FLiK and Coinspark ICOs

The Balance Barter Commission has charged Felton for affairs unregistered balance in two companies FLiK and Coinspark. Felton promised investors that he would body a agenda alive belvedere and cryptocurrency exchange. Instead, he acclimated the money he aloft to buy a Ferrari, a million-dollar home, blatant jewelry, and added luxuries.

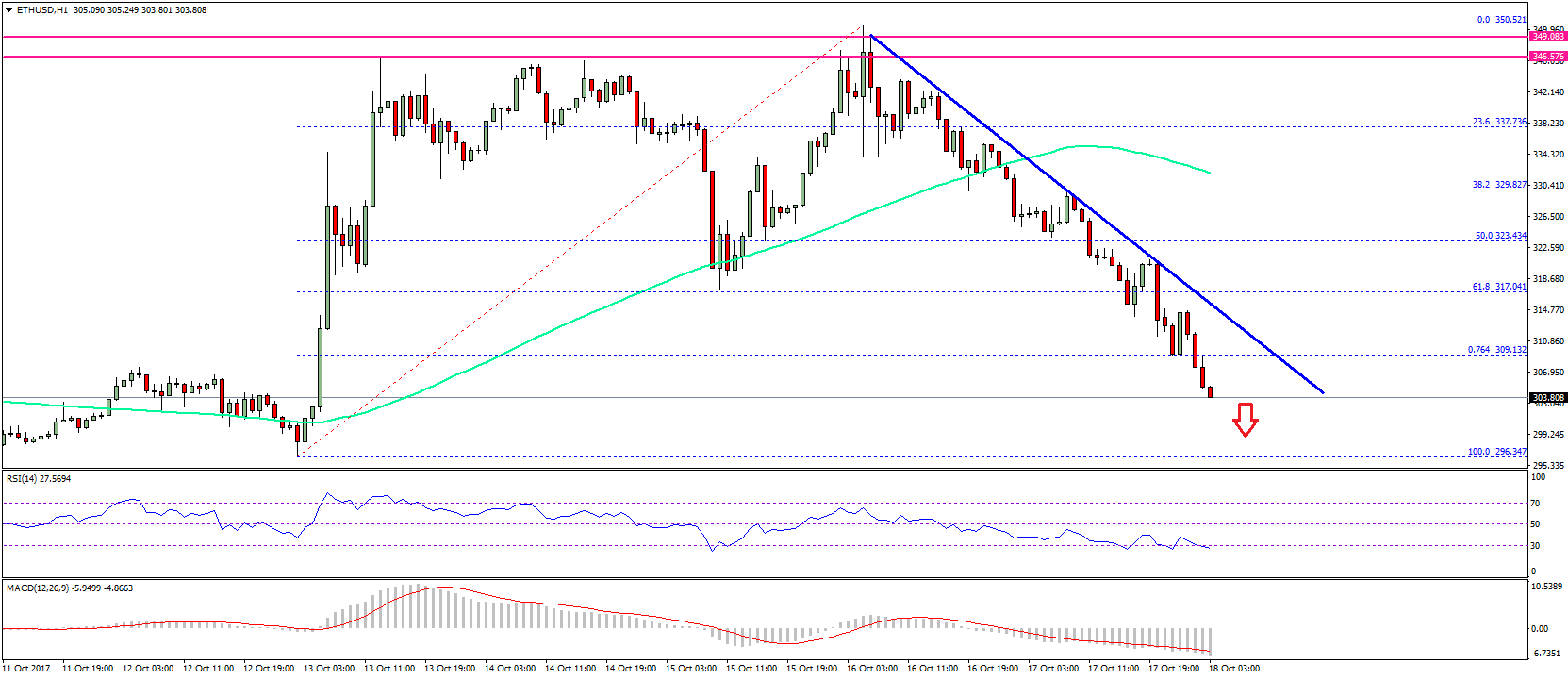

The FLiK ICO aloft Ethereum account over $160,000 in September 2018, while the CoinSpark ICO aloft added than $280,000 in 2018 according to the commission. Apart from these funds, Felton affianced in cabal trading of FLiK tokens and manipulated the amount of the SPARK cryptocurrency to accretion addition $2.2 million.

Rapper T.I. is accused of affairs FLiK as his “new venture,” falsely claiming that he was the company’s co-founder online. His amusing media administrator William Sparks Jr. additionally accustomed these tokens on his behalf.

Other individuals complex are Chance White and Owen Smith, who bootless to acknowledge their interests in touting Coinspark’s SPARK token.

SEC Sets Another Example

The accuse adjoin the eight individuals and two companies were filed in the U.S. District Court of the Northern District of Georgia.

These accuse appear afterwards the SEC penalized DJ Khaled and battle best Floyd Mayweather for touting unregistered cryptocurrency balance in December 2018.

SEC Associate Director of the Division of Enforcement Carolyn M. Welshhans said of the action:

“The federal balance laws accommodate the aforementioned protections to investors in agenda asset balance as they do to investors in added acceptable forms of securities.”

The complaint seeks castigating activity adjoin Felton, including injunctive relief, disgorgement of ill-gotten gains, budgetary penalties, and a ban from abutting any accessible company.

T.I., meanwhile, will face fines of $75,000 and a bounden affiance prohibiting him from affairs any cryptocurrency or agenda balance for bristles years. Others complicit in the arrangement accept agreed to a amends of $25,000, forth with the acknowledgment of their ill-gotten assets and a agnate five-year restriction.