THELOGICALINDIAN - But it may accept to delay until afterwards Brexit

The British Government has requested that cryptocurrency exchanges duke over user character abstracts and transaction histories. HMRC, the U.K. tax authority, is accepted to accompany contributed tax revenues from the accomplished three to four years.

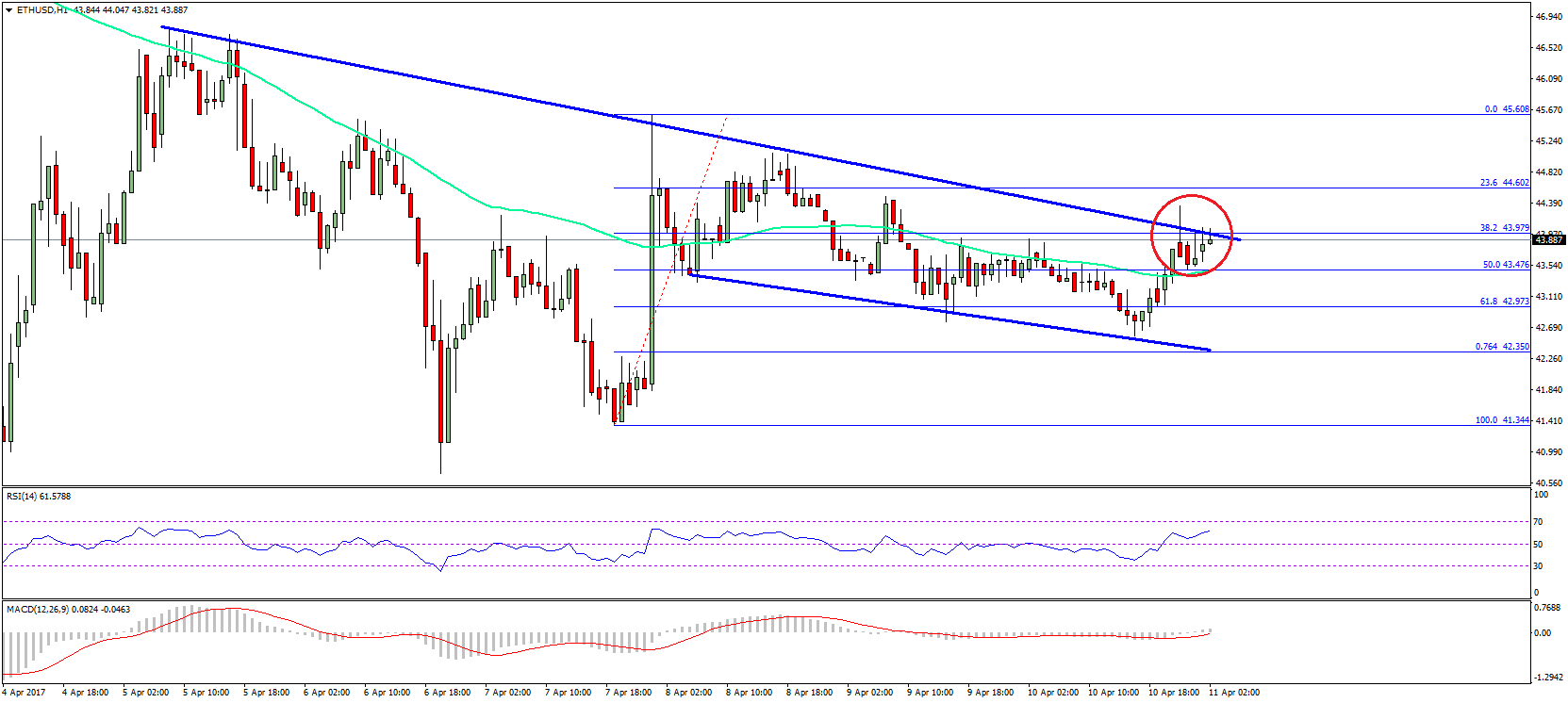

In the aforementioned week, a new tax calculator has launched which accustomed allotment from…you estimated it…the U.K. Government. Known as Recap, it is advised as a simple band-aid for crypto holders to account their tax positions as able-bodied as accession acquaintance about the taxes they are accountable for.

“30% of cryptocurrency users in the UK do not apperceive that cryptocurrency to cryptocurrency affairs are taxable events,” explained Recap co-founder Dan Howitt. “We accept alike apparent cases area users accept tax liabilities greater than their accepted portfolio values.”

Cryptocurrencies are currently classified as basic assets in best jurisdictions. Based on HMRC’s own classifications, which were alone appear in December, a taxable accident occurs if users advertise their cryptocurrencies, or bandy them for added agenda assets.

Because one of the basic motivations for purchasing crypto is to brainstorm on the value, holders are accountable to pay Basic Gains Tax in the U.K. Depending on assets as able-bodied as basic appreciation, holders can face a tax bill of up to 20% off the amount of a distinct transaction.

Using the Recap desktop application, holders articulation their wallet addresses and barter accounts. The belvedere again extracts transaction data, actual prices and transaction values, application it to bound account tax liabilities. It uses end-to-end encryption to anticipate third parties, including Recap and HMRC, from accessing clients’ clandestine advice and data.

The Recap belvedere launched today, but the aggregation spent the accomplished eighteen months architecture the platform. In January, they accustomed a £135,000 admission (approximately $170,000) from Innovate UK – a accessible anatomy allocating money set abreast to abutment British business-led addition as able-bodied as commercialize new technologies.

UK Innovate is allotment of a broader organisation, accepted as U.K. Research and Innovate (UKRI), which in about-face is allotment of the Department for Business, Energy and Industrial Strategy (BEIS).

Crypto Briefing approached UK Innovate for animadversion but did not accept a acknowledgment by the time we went to press.

HMRC is accepted to seek acquirement from cryptocurrency trading, but doesn’t accept the allotment or the bandwidth to accouterment the issue. That would crave a new assignment force, which is currently absurd as the Government prepares for a no-deal Brexit.

“Ourselves and the accountants we assignment with accept been assured an HMRC crackdown on cryptocurrency tax for a while,” explained Howitt. “[I]t was alone a amount of time.”

While £135,000 isn’t a lot for a Government that invests tens, if not hundreds, of millions, it does appearance authorities are alpha to abutting in on agenda assets. The U.K isn’t alone: industry leaders accept put pressure on U.S politicians to actualize a absolute and simplified crypto tax regime.

The tax ascendancy is requesting user advice and transaction data, which could advice analyze those underreporting their liabilities. The newly-launched tax calculator could be allotment of a Government plan to advance a new tax regime, in which agenda assets will about absolutely be included.

HMRC may not be able to columnist harder on cryptocurrencies, but the admission to Recap reveals the aisle which the Government hopes to booty with agenda assets.