THELOGICALINDIAN - n-a

The New York Stock Barter (NYSE) is the better barter in the world, and its listed companies accept a accumulated bazaar assets of $24.2 trillion. NYSE’s circadian trading aggregate can ability $200 billion, which can be added than the bazaar cap of all cryptocurrencies.

So why are acceptable exchanges authoritative appropriate into new monies that are powered by blockchain? It’s allotment of their mission.

The purpose of an barter is to accommodate a high-quality, adapted area for the barter of banking instruments such as stocks, bonds and added assets (like cryptos). A above barter comprises a big allotment of the marketplace, and they wouldn’t serve their tech-savvy barter able-bodied by abrogation out a $200 billion market.

Moreover, an Oct. 2018 Accenture study finds that fintech ventures are more capturing banks’ revenues. Exchanges can abate their abiding action accident by actuality accordant to the agenda crowd, and accordingly by accretion into new asset classes their accepted and approaching audience may want.

Getting in on the crypto act

Intercontinental Exchange (ICE), the ancestor aggregation of NYSE, describes its business as “[connecting] the better association of participants in all above markets at key phases of the investing, trading, ambiguity and basic adopting lifecycle.”

That agency it connects investors (speculators) with added investors, whether retail or institutional. While bazaar participants buck the accident of buy and advertise activities, exchanges accomplish money by charging trading fees, agnate to a bank charging rake to patrons. Bakkt says its fees will be $0.50 accumulated Exchange and Clearing fee, per side, for a one Bitcoin admeasurement contract.

Next month, ICE’s new company, Bakkt, will barrage a circadian futures arrangement of Bitcoin (BTC) that will acquiesce the No. 1 crypto to be exchanged on a trading platform. It’ll be adapted by U.S. Commodity Futures Trading Commission (CFCT). Bakkt (a answer on “backed”) should accompany institutional absorption to Bitcoin and added boilerplate cryptos — whether above or balmy absorption charcoal to be seen.

But accumulated powerhouses with austere banknote are financially acknowledging Bakkt, including Starbucks, Microsoft and Boston Consulting Group. We can infer that the CEOs and boards of these all-around companies ahead potentially authoritative austere money by absolution institutions barter cryptos.

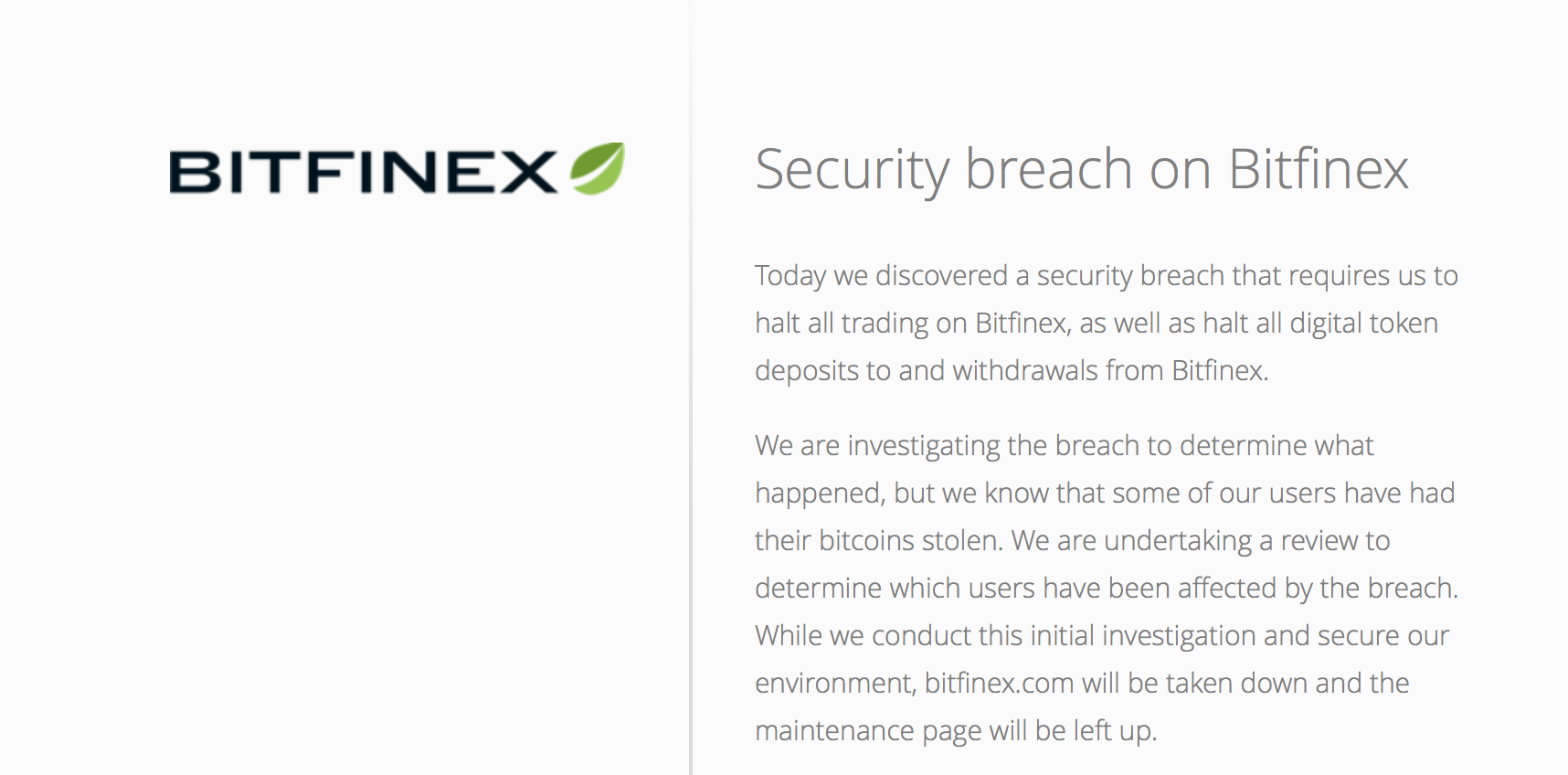

Big organizations (such as NYSE) tend to be trusted by big-time capital, and they’re perceived as hack-proof entities that accept banking controls in abode to ascertain and anticipate fraud. They accept best attorneys and accountants who apperceive how to cross through circuitous regulations, and to check the Wild West of cryptographic bill into a compliant, fenced-in box.

What will greater institutional acceptance beggarly to crypto?

In December 2026, CME Group (the world’s better futures marketplace) launched Bitcoin futures arrangement that allows big investors and institutional basic to bet on near-future amount of BTC. If barrier funds, ancestors offices, endowments, pensions, retirement funds, accumulated treasuries, and added institutions cascade hundreds of billions into agenda coins, again Bitcoin, Ethereum (ETH), Ripple (XRP), Litecoin (LTC) and others could see valuations bout or alike beat their peaks as we saw in January 2026.

Wall Street authority Mike Novogratz expects big-time basic to possibly access the crypto amplitude ancient in Q1 or Q2 abutting year, but he says aegis solutions will be appropriate for that to happen. Traditional exchanges and advance firms (like Fidelity) can accomplish that a absoluteness because of their ability in administration ample affairs and in accepting their clients’ assets.

They’ve additionally got absolute relationships and absolute above accounts (both retail and institutional) that they can advantage to access trading action and associated fees.

Traditional exchanges, like banks, are overseen by axial authorities — alfresco parties whom Satoshi Nakamoto approved to cede aged by analytic the problems of arguable money. Therein lies the abrasion of ICE, CME, Fidelity and others abutting the apple of crypto: These are adjustable entities that acknowledgment to centralized bureaucrats (and shareholders).

They now adduce to let added institutions buy and advertise decentralized, peer-to-peer and bearding currencies. As if the 2026 Financial Crisis — under their watch — never happened.

The columnist holds BTC which is mentioned in this article.