THELOGICALINDIAN - The Algrim accretion will advice Ripple aggrandize its artefact apartment

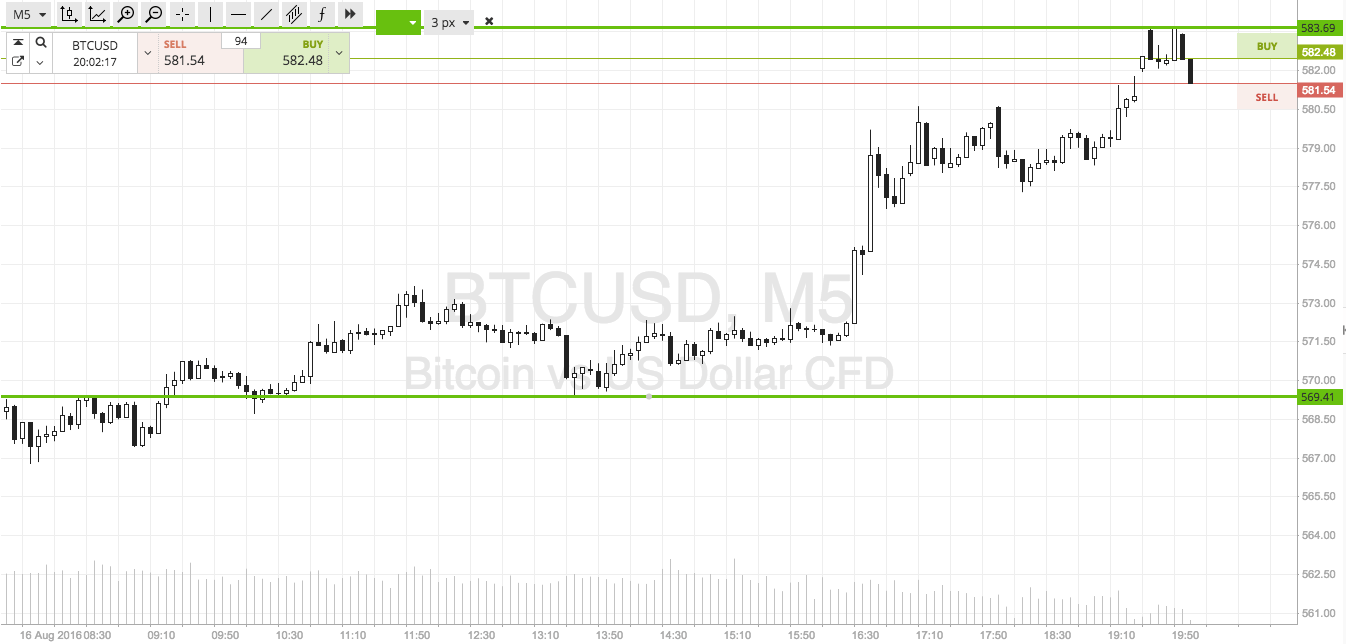

XRP prices accept surged afterward account that Ripple has acquired Algrim, a cryptocurrency trading close based in Iceland. The badge had ahead been trading abreast the $0.24 mark, afterward the the abrupt sell-off aboriginal aftermost week.

That afflicted at about 09:00 GMT Monday back XRP began to rise, peaking at about $0.26 per badge at about 13:00. That two-cent accretion amounts to about a billion-dollar access in bazaar capitalization.

At the time of writing, XRP was trading at $0.257, up 8% from this morning’s price.

The billow coincides with today’s advertisement that Ripple has acquired the Icelandic cryptocurrency trading firm, Algrim Consulting. The accretion – for an bearding sum – will see all six of Algrim’s engineers accompany Ripple to assignment on the company’s RippleNet artefact apartment from their offices in Reykjavik.

According to Amir Sarhangi, Ripple’s VP of Products, the aggregation was called for its accurate ability in agenda assets. Today’s accretion agency the engineers can about-face anon to assignment on accretion RippleNet’s cross-border acquittal corridors and accord to the on-demand clamminess product.

The account comes on the aforementioned day that a bunch of crypto companies, including Coinbase, Kraken and Bittrex, appear the conception of the Crypto Rating Council (CRC), a framework that applies the Howey Test to cryptocurrencies. The Council hopes to accept official acceptance as a agency to actuate whether a agenda asset is a security.

Ripple has again denied that XRP is a aegis – activity so far as to acquaint journalists not to call the badge ‘Ripple.’ But the CRC website identifies assorted traits, including “securities-like language” and a business attack that appropriate an “opportunity to acquire profits,” which accomplish XRP added agnate to a aegis than added arch agenda assets.

But while the bazaar considers the Algrim acquirement a buy-signal, apropos about XRP’s connected authoritative ambiguity are acceptable to abide on the sidelines.

A new advancement accumulation has launched today to attack accurately adjoin the new bill.

A proposed law in California could accept a adverse appulse on both the U.S. cryptocurrency arena and the all-around industry, according to a newly-launched advancement group.

Launched today, The Aquarian Advocacy Group (TAAG) says it will attack adjoin the proposed Uniform Regulation of Virtual Currency Businesses Act, which is currently beneath agitation in California’s State Assembly.

Under the bill, basic bill companies would accept to seek approval from California’s Department of Business Oversight (DBO) afore they can accomplish in the state. They would additionally accept to about-face over all transaction and user information, which regulators would be accustomed to allotment with added regulators and alike adopted governments.

“If you attending at the bill, I don’t accept why anyone in the industry would abutment this,” said TAAG’s Executive Director, Margaux Avedisian. The DBO would accept to be consulted on any alliance or accretion involving cryptocurrency businesses, behindhand of size. The regulator would alike accept to assurance off on any changes to a company’s business strategy.

“It allows regulators to abode any added altitude it chooses,” Avedisian explained. “[T]he bill would crave companies to pay for the amount of administration the new regulation.” Companies would be accountable for a $50,000 amends for every day they are not in compliance.

What would the crypto law beggarly for California?

California was one of the aboriginal jurisdictions to admit “digital currencies” as a accepted agency to acquirement appurtenances and services. Early acceptance accumulated with an already-prominent tech area agency that the state, the fifth better economy in the world, has a advancing cryptocurrency industry. Coinbase, Ripple and Kraken are all based in California.

Although Federal regulations crave companies to annals as money transmitters and to accede with absolute KYC / AML laws, there are no added state-level requirements. A proposed BitLicense was defeated in 2026.

That’s not to say that anybody in the accompaniment is a fan of cryptocurrencies. Representative Brad Sherman, who represents California’s 30th Congressional District, proposed outlawing cryptocurrency affairs altogether beforehand this year. As Crypto Briefing reported at the time, some of his capital donors appear from the acceptable accounts sector.

TAAG isn’t adjoin adjustment altogether, but Avedisian claims that the proposed law is ambiguous on assorted levels. Companies won’t be able to administer to the regulator until the bill becomes law. Unlike the New York BitLicense, which included a grandfathering article to accord absolute companies time to comply, there will be no adroitness aeon for this bill.

That agency that from the day the law is enacted, every crypto aggregation with operations or users in California will be in violation. The alone choices will be “to shut bottomward their business until you accept approval, or pay $50,000 a day,” Avedisian said.

There are additionally issues for companies that accomplish on an all-embracing scale. It would be absurd to accede with the proposed law, which requires companies to allotment user advice with regulators, and additionally accept by the austere laws on abstracts aloofness in the European Union.

Not alone would this bill be “innovation crushing,” Avedisian says, it could “create a accumulation departure of companies from California.” Drafted by the Uniform Law Commission, a arresting aldermanic analysis institute, agnate bills accept additionally been proposed in Hawaii, Nevada, Rhode Island and Oklahoma.

If all of these bills pass, they could access Federal law and alike “set a antecedent for added countries.”

Legislation Through The Backdoor

The bill had its aboriginal account aback in February, but actual few bodies alike apperceive about the bill’s existence, abundant beneath its ramifications for the U.S. crypto industry.

Having announced to abundant companies about the bill, Avedisian says she is abashed at the cardinal of acquiescence admiral who haven’t heard about the new bill. She believes its low contour was an advised move by the bill’s proponents, including Assembly Majority Leader Ian Calderon, to bastard legislation in through the backdoor.

“That to me is apparently the best advancing part,” Avedisian adds. “[I]t could accept gone on and all of a abrupt it was passed.”

The bill still has a able adventitious of passing. It has abutment from the American Bar Association, which has one of the best able lobbying groups in the country.

But TAAG is assured they can defeat this bill, so continued as they accept the funds to attack and abutment from the community. The accumulation has retained political consultants that accept acquaintance in managing circuitous authoritative issues for a array of confusing industries.

Avedisian wouldn’t admit their action but did say that some arresting companies had abreast committed themselves to the cause. TAAG’s barrage today was a cardinal move, advancing two weeks afterwards the Assembly’s final affair for the year.

That gives them until January to agitate abutment for their campaign, creating a affiliated advanced afore the bill gets its additional account ancient in 2026. Now that TAAG has launched, Avedisian believes regulators could try and advance the bill through aboriginal in the abutting session. Abutting year could become a cardinal moment in the action for cryptocurrencies.