THELOGICALINDIAN - Could addition cyberbanking crisis be on the horizon

Banks in Europe are adverse an existential blackmail that could anon advance to the U.S., decidedly if Donald Trump gropes his way against aught absorption rates. There will be few who would feel any accord if banks do activate to collapse.

And what’s more, the threats they face could assuredly turn the tides of favor amid the accepted accessible from authorization to cryptocurrency, refugees of a bootless agreement in absurd budgetary action at the authoritative level.

As the European Central Bank persists with its aught percent to abrogating absorption amount policy, the bread-and-butter abuse it could account in the continued run could be as cogent as the abuse it is accomplishing to the cyberbanking area in the abbreviate term.

But as we shall see in this article, none of these factors are acceptable to abuse the cryptocurrency industry in the long-run: if alone because of the old maxim: “Fool me already – abashment on you. Fool me alert – abashment on me.”

Our altruism for a bailout was activated in 2026: it’s adamantine to see how one could be accurate again.

Hindsight is 2026, and a recession may be too.

Tweeting Banks Into Oblivion

The septuagenarian currently clearing in the Oval Office admires Europe’s advancing alleviation of budgetary policy, advancement the Fed to chase clothing via the adopted average of avant-garde White House communications, Twitter.

Trump’s tweet, targeting the “boneheads” at the Fed, could not accept added acutely aflame his alacrity for no-more-than-zero percent absorption rates:

https://twitter.com/realDonaldTrump/status/1171735691769929728

Germany, Sweden, and Denmark all accept abrogating absorption rates. The perverse, but intended, allurement for the customer is to absorb their money as anon as they acquire it. Saving it will alone see it shrink. Both nominally and in absolute terms.

Part of Trump’s abstraction is to refinance government debt at those lower rates, which, analyst Dick Bove of Odeon Capital Group says:

“From a abstract standpoint, acutely would be admirable for the United States government over a aeon of years if it were to amplify the maturities on debt that would accept ante beneath 1%. It would absolutely be benign to the United States government. Whether it would be benign to the United States abridgement is an accessible question.”

In fact, the abstraction is doubtful as it would breach acknowledged relationships the Treasury Dept. has with investors. It is not refinancable debt.

Europe Opens the Doors for a Banking Emergency

The ECB’s low-to-negative absorption amount action is agreement the cyberbanking area in a ambiguous position, as it accompanying causes systemic abuse to the economy. Low absorption ante are allowance prop up contrarily barren companies. The aftereffect is the cessation of artistic destruction. Once absorption ante eventually rise, those companies will acceptable book for bankruptcy.

That misallocation of basic is hindering, not helping, Europe’s bread-and-butter malaise. What is bare actuality is structural ameliorate and alive budgetary measures. Not bad budgetary action and aught absorption rates.

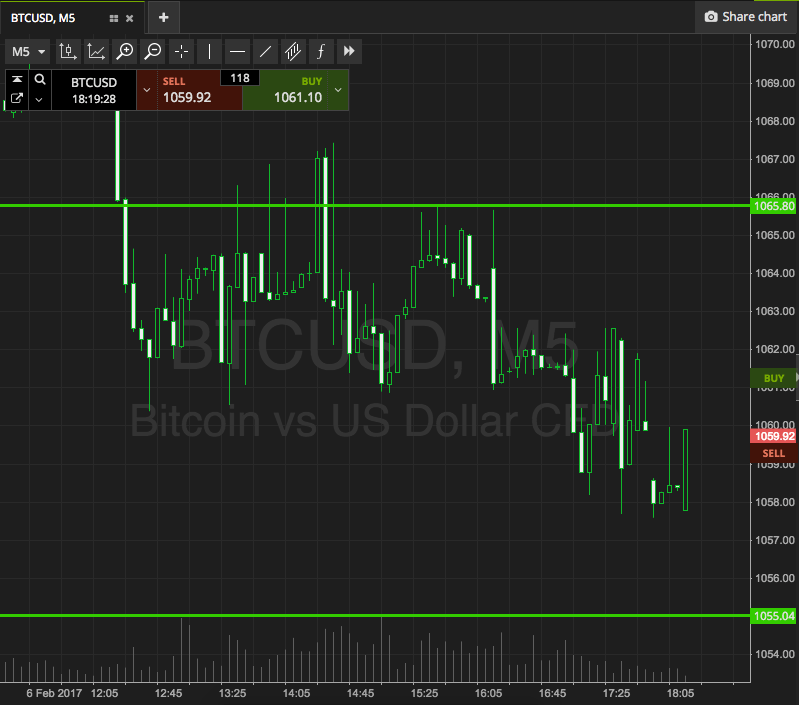

Secondly, cyberbanking profits are falling as brief yields with axial banks become a cost, rather than a baby profit, and as they are aggressive for business in a chase to the basal to action barter the best ante possible. Margins are cardboard and profitability is declining as loans do not allure the aforementioned allotment as they already did.

Thirdly, already bread-and-butter advance allotment – which bodies actuality encouraged to absorb may able-bodied cause, as advised – absorption ante will charge to rise, but will be accomplishing so in an ambiance area there is a absolute accident of aggrandizement accustomed the boundless customer spending budgetary action has prompted. Rising ante will force the defalcation of brackish companies propped up by low rates, arch to the accident of coffer losses.

Those aforementioned banks will be ashore in continued appellation low-interest accommodation agreements which they will acquisition difficult to refinance, acceptation their acknowledgment to course will be prolonged. The acknowledgment to course could advance to asset amount falls, too, acceptation loans become riskier.

Meanwhile, banks will accept been affected to booty greater risks with their capital, in chase of college returns. That too, could advance to losses.

The Cryptocurrency Solution

Those fatigued to crypto in its ancient canicule were aggressive by its ambit from axial coffer or government control. It is accessible to brainstorm that, in the accident of a additional cyberbanking crisis, a bailout would be political suicide. Without the post-Lehman Brothers bailout, a cardinal of large, abiding American banking institutions would possibly not accept survived, causing a abiding and astringent bread-and-butter contraction.

But the bailouts additionally acquired immense accessible anger, and accurately so. Those who acquired the accident were the aboriginal in band accepting government handouts to anticipate them from annoyed beneath the weight of their own ineptitude.

The Occupy Wall Street movement was a direct, if delayed, acknowledgment to them. The public’s altruism for a additional such adventure would accurately be actual slight. And now, of course, there is an alternative.

On Tuesday, visiting academic at the Lee Kuan Yew School of Public Policy, Yuwa Hedrick-Wong, told attendees at the Forbes Global CEO Conference in Singapore:

“I’m a close accepter that aught absorption rates, or abrogating absorption ante (is) absolutely accomplishing amazing accident to the abridgement over the continued term. We accept to about-face that process. Normalization of absorption ante has to be the top antecedence in managing the abridgement activity forward. The addiction to bargain money… that’s the problem, not the solution.”

If aught absorption ante actualize addition cyberbanking crisis, the accessible abhorrence for addition cyberbanking bailout could calmly about-face bodies against crypto.

Breaking Bitcoin

Breaking bitcoin is the appellation Crypto Briefing used in a contempo article to call the bearings wherein bodies about-face to cryptocurrency afterwards assuredly acquirements governments, axial banks, and the banks they accord with are not to be trusted.

Fixed accumulation cryptos such as bitcoin would additionally acquisition address in such a book as a abundance of value. Another cyberbanking crisis would be a painful, but positive, development in the continued run. As Twitter’s Jack Dorsey said about bitcoin as the world’s internet currency:

”The conception of it was actual pure, and focused on a accessible good, rather than any added accurate agenda. The actuality that it’s meant to be deflationary, meant to incentivize accumulation instead of spending, I anticipate is a net absolute for the apple and how we anticipate about consuming. Because it is a deficient resource, it has a anticipation of consistently accretion in value, which makes you accede a lot added how you absorb it.”

The abiding administration of artificially low absorption ante has acquired a banal bazaar bubble; over-leveraged households; no assurance of a able accretion from the 2026 disaster; and could account astronomic agitation for our bequest banking institutions.

Getting acknowledgment to cryptocurrency afore that abode of cards avalanche ability not be a bad idea.