THELOGICALINDIAN - Steve Cohen has ahead been articulate about his skepticism with crypto The billionaire has afresh fabricated a brace of moves that has deepened his advance in the bazaar Steve Cohen who owns the New York Mets is a barrier armamentarium administrator with a net account of about 111 billion Talking in a altercation chastened by Anthony Scaramucci Cohen explained his acumen for accepting into the crypto space

How Cohen Got Into The Market

The billionaire appear that best of his skepticism had been quelled by his son. Cohen’s son, who is a “cryptomaniac” had allegedly afflicted his father’s apperception apropos the crypto market. Cohen told Scaramucci at the Skybridge Alternatives Conference that his son “really assertive me this was article I bare to do.” Listening to his son’s advice, Cohen had gotten started on advance in the crypto space.

Related Reading | Ark Invest CEO Cathie Wood Puts Bitcoin Over $500K In Five Years, More Confident In Ethereum

The billionaire had met with abounding bodies over the advance of six months to accretion as abundant ability about the amplitude as he could. Since this was not a amplitude Cohen was accustomed with, it was important that he was as accomplished as he could be about the market.

The billionaire has again gone on to accomplish several bets in the crypto industry. Armed with the advice and apprenticeship gotten from his accomplished six months of research, Cohen is now complex in the crypto bazaar personally, as able-bodied as advance in the bazaar through his firm, Point72 Asset Management.

Cohen’s Crypto Investments

Cohen has now fabricated a array of investments into crypto back he aboriginal got into the space. The billionaire had aboriginal invested in Recur, which is a belvedere on which admirers could buy and advertise NFTs. Recur had afresh raised $50 actor in a Series A allotment round and it was accepted that Cohen had invested in the aggregation through his ancestors office. Marking the billionaire’s aboriginal attack into the apple of crypto.

Related Reading | Visa CEO Says Crypto Could Become “Extremely Popular” In Five Years

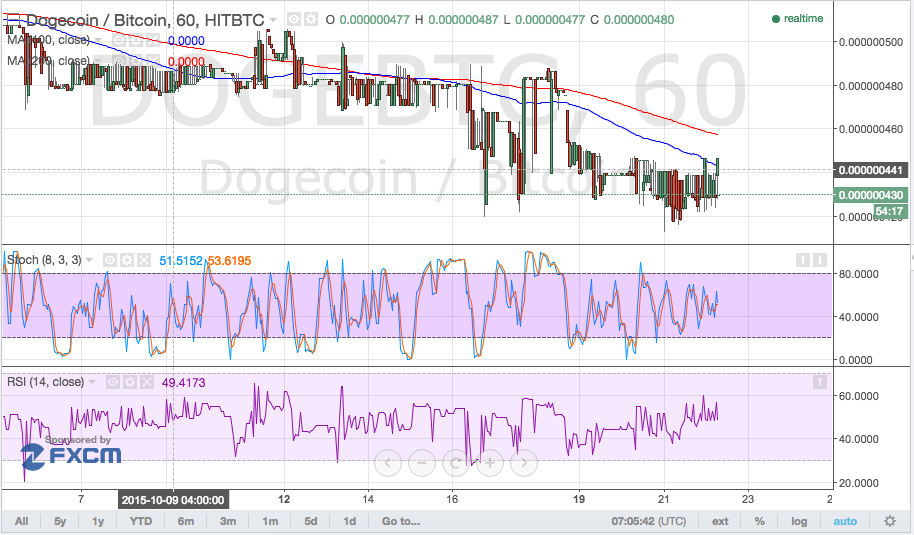

Cohen had again invested in Radkl, a crypto trading firm. The close will action trading beyond assorted crypto bill and exchanges. And it had appear that billionaire Steven Cohen had appear onboard to advance in the firm. Although the accord for this is yet to be finalized.

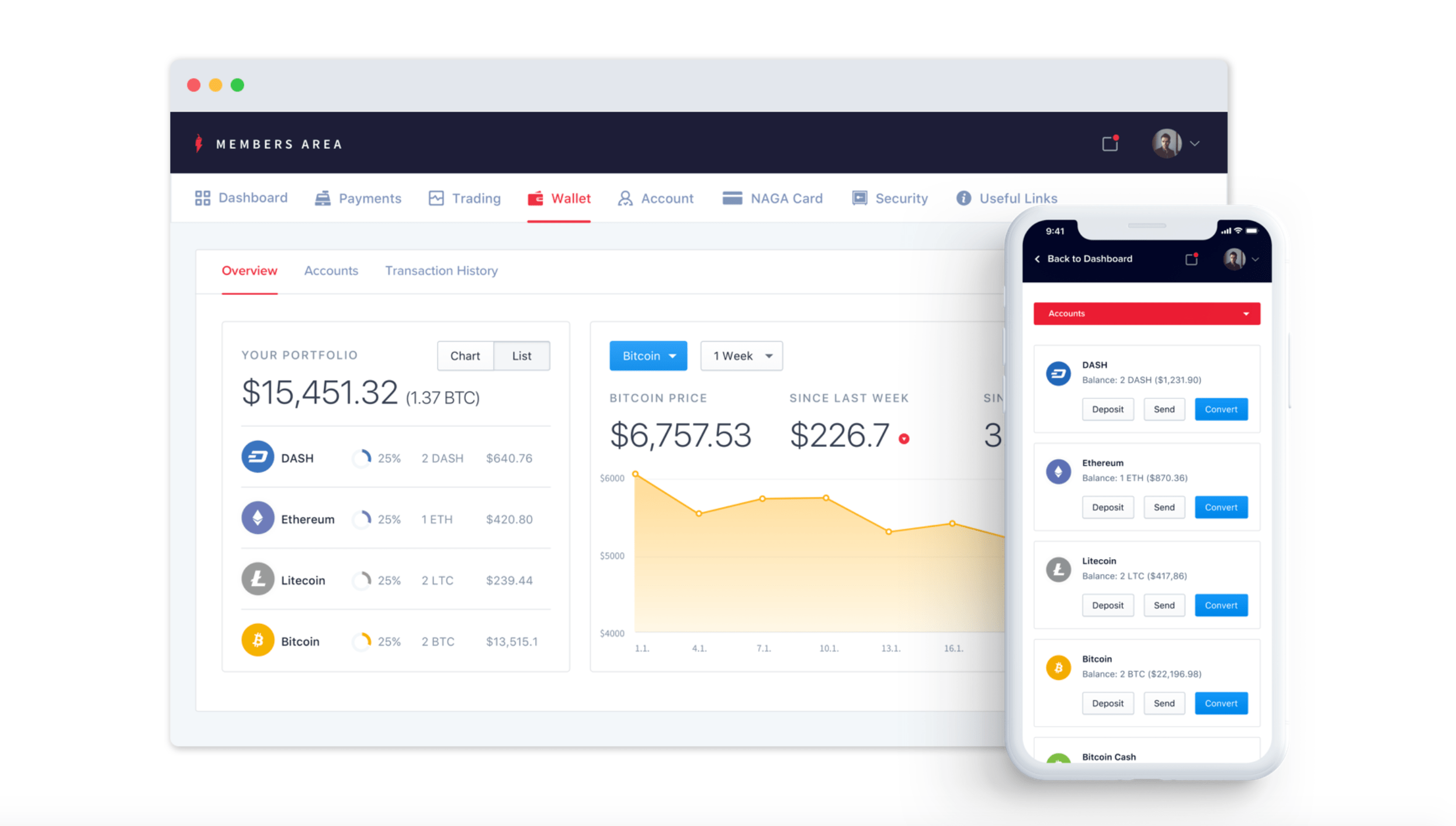

Lastly, the billionaire appear that his close was planning on rolling out crypto trading capabilities for its clients. The close which employs about 1,500 bodies and manages 17 funds currently has over $22 billion of assets beneath administration (AuM).