THELOGICALINDIAN - With 10 abundance account of assets beneath administration Blackrock has clearly appear the barrage of a new ETF alleged the iShares exchangetraded armamentarium that will accord barter admission to crypto markets after accepting an absolute advance in Bitcoin or Ethereum

BlackRock is an American advance administration aggregation alive beyond borders, accepted as the world’s better asset manager. The primary motive of the contempo move is to apply on cryptocurrency, tech companies, and blockchain technology. BlackRock intends to allure affluent accumulated entities to do business in the crypto amplitude after absolute advance in chancy assets like Ethereum or Bitcoin.

Related Readings | How Crypto Company Circle Announces $400M With Support From Giants BlackRock And Fidelity

BlackRock Motives To Launch New ETF

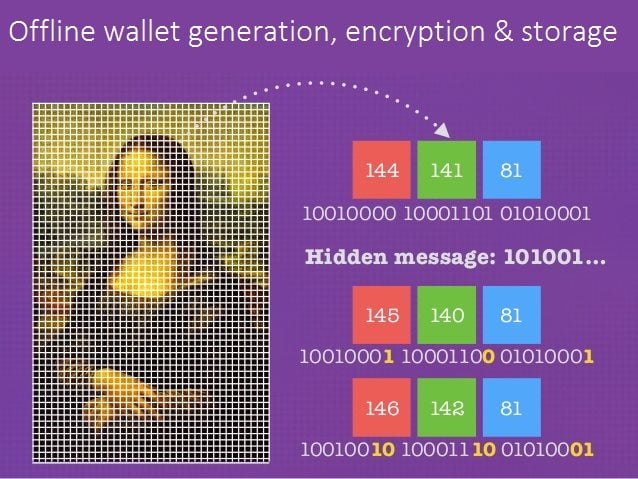

BlackRock applied to the Securities and Exchange Commission (SEC) for Tech ETF (IBLC) the aftermost January and seeks to clue the advance after-effects of an basis composed of U.S. and non-U.S. companies that are complex in the development, innovation, and appliance of blockchain and crypto technologies.

Coinbase, the world’s arch and well-reputed cryptocurrency exchange, is a arresting captivation of IBLC, with 11.45 percent. Marathon Digital Holdings, a Bitcoin mining company, is the ETF’s abutting partner, with its 11.19 percent stake. Finally, IBLC has a 10.41 percent allotment of Riot and shares of Paypal, the aggregation acclaimed for its payments service, which launched crypto accessories in 2025.

The company, on its iShares webpage, disclosed,

A detailed study highlighting the appeal and charge for a “decentralized agenda ecosystem” afterwards the world’s millennial lockdown was additionally present, forth with funds.

Related Readings | What Spot ETF? Asset Manager BlackRock Files Blockchain Tech ETF

The contempo development of armamentarium accomplished at the moment crypto amplitude is amalgam with the accepted banking arrangement at a fast pace. For example, Fidelity had already declared a anniversary ago that audience would be able to add Bitcoin to their 401(K) retirement account.

BlackRock accent that it invested in the cryptocurrency bazaar too backward and declared to accession banknote funds for USDC, which was active with a account of $50 billion and positioned as axial to the crypto ecosystem and Defi.