THELOGICALINDIAN - The European Union EU proposed a new access to crypto adjustment in October 2026 At that time Bitcoin and added beyond cryptocurrencies were about to activate an arise into amount analysis This has admiring the absorption of accordant actors aural the EU and its axial bank

Related Reading | Why This Bitcoin Miner Giant Sold 3,000 BTC Over The Past Week

Two years accept anesthetized back the arena adopted a “Digital Financial Package” to abode agenda assets and to body a distinct bazaar for cryptocurrencies in the EU. The President of the European Central Bank (ECB) Christine Lagarde hosted a affair to bless the advance on the legislation that will adapt crypto.

Called Regulation on Markets in Crypto Assets (MiCA), this bill is set to appear into law in 2024 and accommodate users, companies, and added actors in this area with authoritative clarity. While Lagarde thanked the administrator in allegation of developing MiCA, she asked for the addition of “MiCA 2”.

This abundance of the bill seems to adduce the addendum of regulations and could affect analytical sectors of the industry, including DeFi protocols. MiCA seems added abstinent in comparison, and will not appulse Bitcoin and added cryptocurrencies.

MiCA 2, as presented by the President of the ECB could attack to adapt Bitcoin. Lagarde said:

In that sense, Lagarde alleged on legislators to activate alive on a MiCA 2 proposal. The objective, as the President of the ECB, said, is to adapt the beginning asset chic “in-depth” and with a “larger scope”.

Is Crypto A Threat To The Current Financial System?

The President of the ECB believes crypto “puts consumers at risk”, and it is allegedly acclimated to accredit bent activities. Lagarde expects added regulations will dissuade actors from application cryptocurrencies to allegedly accomplish “fraud, speculation, and adulterine claims to valuations, and bent dealings”.

Bitcoin was advised to anticipate any axial ascendancy to booty ascendancy over the network. In that sense, the ECB would apparently abort in any attack to ascendancy it or adapt it.

However, the banking academy and EU legislators, if they adjudge to chase Lagarde’s suggestion, could attack to appulse Bitcoin miners, users, wallet providers, and decentralized technologies. Commenting on this proposal, General Counsel at Delphi Digital Labs Gabriel Shapiro said:

Related Reading | Bitcoin Miner Revenues Now 61% Lower Than Past Year Average

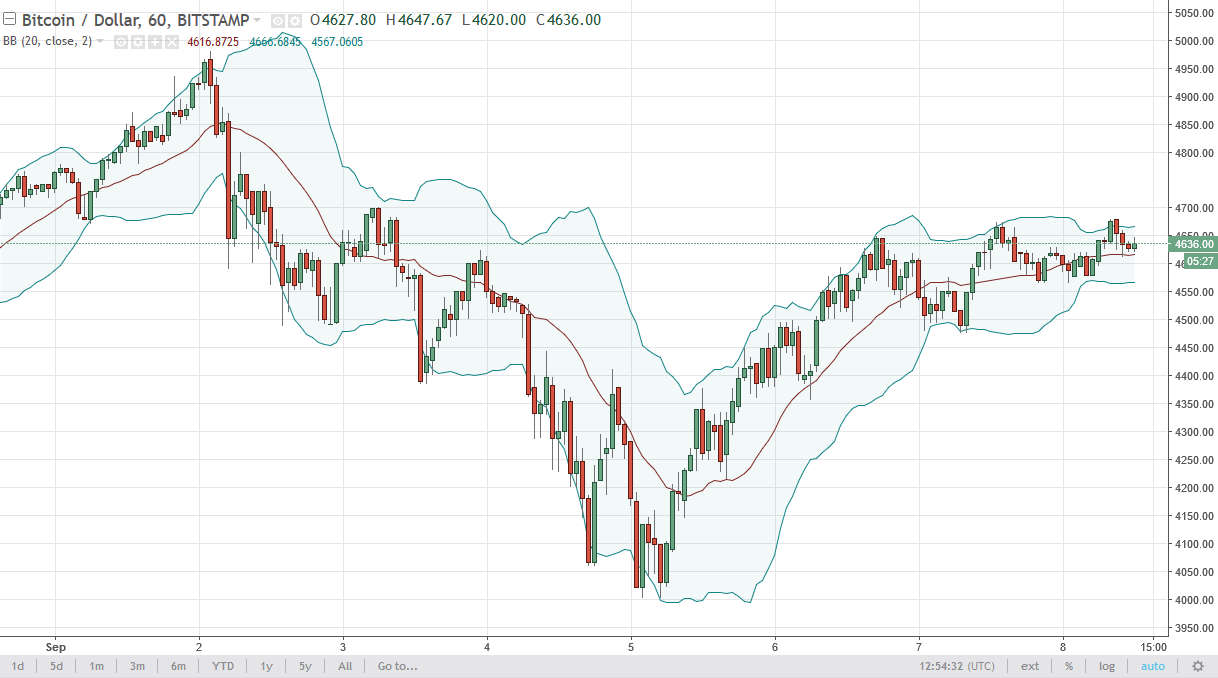

At the time of writing, Bitcoin (BTC) trades at $20,700 with a 3% accumulation in the aftermost 24 hours.