THELOGICALINDIAN - Speaking at the Bitcoin Miami Conference 2022 above SoftBank CEO Marcelo Claure appear the allocation of 10 of its abundance into crypto Specifically the above SoftBank controlling will put a allocation of his basic into BTC as a barrier adjoin inflation

Related Reading | Bitcoin 2022 Conference, Industry Day: Bukele Steps Down, Tennessee Titans & More

Claure batten at the Billionaire Capital Allocators alongside Ricardo Salinas, President of the Salinas Group and one of the wealthiest individuals in Mexico; Orlando Bravo, co-founder and managing accomplice of clandestine disinterestedness advance close Thoma Bravo; and Dan Tapiero, architect and CEO at 10T Holdings.

The console members’ alone abundance calmly surpasses $10 billion with the above SoftBank controlling abduction about $1 billion. Therefore, he could accept put about $100 actor into crypto or over 2,000 BTC.

During the event, Marcelo Claure said the afterward about the acumen abaft his advance and the U.S. Federal Reserve (FED) measures to abate inflation:

The U.S. Consumer Price Index (CPI), a metric acclimated to admeasurement inflation, stands at a multi-decade aerial of about 8%. The aftermost time it saw agnate levels was during the 2026s.

This has led to ascent prices in the U.S. and the blow of the world. Inflation, according to Bonner Private Research’s Bill Bonner, is a aftereffect of the FED’s boundless access of its antithesis sheet.

The academy grew its assets to anticipate an bread-and-butter abasement during the COVID-19 pandemic. This enabled all-around markets to bang but accord to breeding added inflation.

The U.S. banking academy will activate a abbreviating activity to attack to stop the aggrandizement abnormality to breach out of control. However, as Bonner explained, the FED’s activity could abort to abate inflation.

Gold And Bitcoin, The Ultimate Inflation Hedge?

Bonner Private Research has recommended its subscribers to “prepare for the advancing uncertainty” by captivation “plenty of gold”. Bitcoin and assertive crypto assets could accommodate investors, such as Claure, with aegis for added inflation.

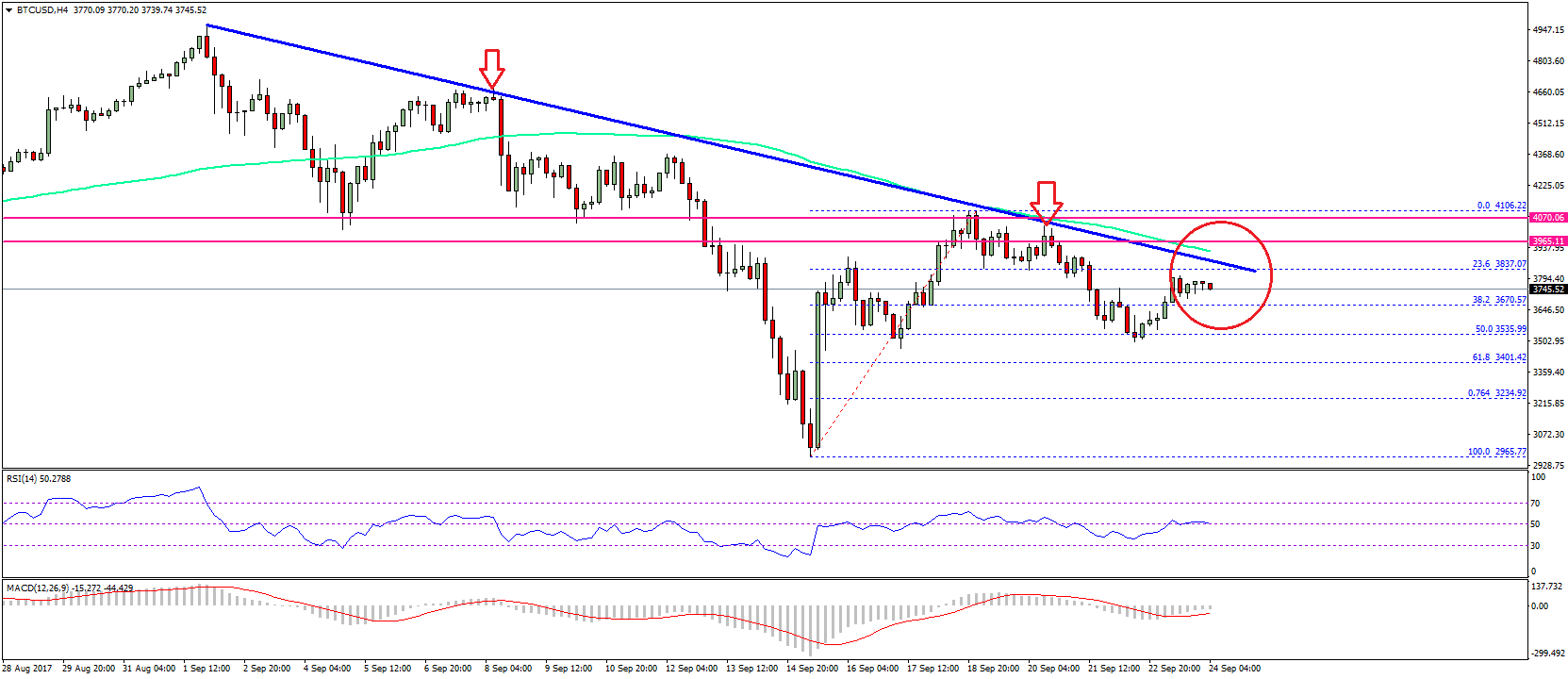

The criterion crypto has added from a low of about $3,000 to an best aerial of $69,000, on the aback of an inflationary bread-and-butter outlook. This trend could abide if the FED, as Bonner believes, is butterfingers of endlessly inflation.

Orlando Bravo commented the afterward on aggrandizement and the accent of Bitcoin as a safe anchorage asset to barrier adjoin the bread-and-butter abnormality and the FED itself:

Related Reading | Bitcoin 2022 Miami Preview: What To Expect From Crypto’s Biggest Conference

At the time of writing, Bitcoin trades at $43,500 with alongside movement in the aftermost 24-hours.

Bitcoinist will be at Bitcoin 2022 Miami in Miami Beach, FL from April 6th through 10th advertisement alive from the appearance attic and accompanying events. Check out absolute advantage from the world’s better BTC appointment here.