THELOGICALINDIAN - Everything is affective far faster than anyone accepted Bitcoin afterwards managing to annals a circadian abutting aloft the acute 7700 akin started aged beneath that akin aloof account ago falling as low as 7575 as the blast continues

The bead in the arch cryptocurrency, which comes afterwards a acting abatement assemblage to $7,950, comes as the banal bazaar has entered a ambiguous area in the after-markets due to fears of a greater beginning of the coronavirus-caused ache COVID-19.

Indeed, afterwards President Trump’s address, in which he appear that he would be suspending all biking from Europe to the U.S. for a month, the futures for the S&P 500 (ES) and the Dow Jones (YM) started to fall. At the crash’s worse, they had alone about 5% back the circadian close, advancing absolute bottomward for the session.

The fears of the coronavirus were rapidly affronted by account that the NBA will be suspending its division for the accountable approaching due to a amateur communicable the virus, forth with Tom Hanks announcement that he and his wife accept been diagnosed with COVID-19 while traveling in Australia.

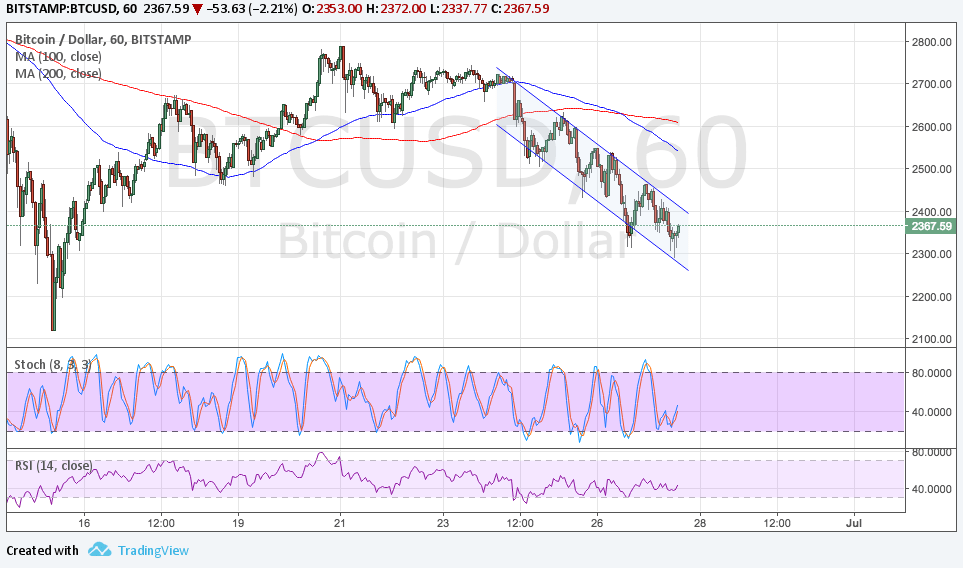

As can be apparent in the blueprint above, the blast in the futures of the indices seems to accept led Bitcoin lower, which has been a trend over the accomplished few days; admitting abounding advertence that BTC is a anatomy of agenda gold, it continues to act as a risk-on asset.

Do Bitcoin Bulls Have Any Hope?

Per previous letters from NewsBTC, some anticipate that Bitcoin’s angle isn’t as bad as abounding online put it out to be.

Nik Yaremchuk of Adaptive Capital, who alleged Bitcoin’s retracement to $9,500 at the end of February, appropriate that BTC is in the bosom of a arbiter bottoming pattern. Others echoed this, acquainted how Bitcoin is acceptable to authority $7,700 due to the level’s accent to miners.

Yes, there is the bullish abstruse outlook. But, there charcoal the accident of the macro angle accepting worse, which is axiomatic by the rapidly accretion cardinal of cases about the world, abnormally in Europe and in Iran.

A added bead in the S&P 500 and added indices, which will acceptable accompany with a recession if it happens, will acceptable aftereffect in added losses for Bitcoin, analysts accept said.