THELOGICALINDIAN - Chainlink Ticker LINK rebounded from its shortterm antidotal declivity on Wednesday as its amount surged 9 percent on a 24hour timeframe

The LINKUSD barter amount accustomed an intraday aerial abreast $14.11 on Binance exchange, up 21.95 percent from its week-to-date low. The pair’s assets appeared admitting a broader sell-off in the cryptocurrency market, wherein the all-embracing appraisal fell by added than $8 billion.

What helped the Chainlink token during the agitated 24-hour aeon is the growing appeal for DeFi assets. Traders added their bids for LINK, COMP, MKR, and added decentralized accounts tokens afterwards the barrage of Yam Finance.

Staking Craze

The new “yield agriculture protocol” went alive on August 11. It issued about 2 out of 5 actor of its built-in YAM tokens so to accomplish them accessible as yields for users who pale the afterward assets:

The advertisement led to a new beachcomber of a affairs aberration in the DeFi space. Like Chainlink’s LINK, Compound’s COMP badge rallied by added than 35 percent in aloof 24 hours. Aave’s LEND jumped 16 percent – and Maker’s MKR climbed 24 percent aural the aforementioned period.

Non-DeFi tokens were not that lucky. The criterion cryptocurrency Bitcoin fell 1.91 percent on ascent US Treasury yields. Other proof-of-work assets that had the atomic anticipation of acceptable a staking badge for a DeFi pool, additionally fell, with Ethereum, XRP, and Litecoin coast by 2-5 percent.

It is additionally accessible that traders larboard the top assumption to seek barrier in the booming DeFi market, abnormally afterwards the launch of Yam Finance. Each of the DeFi badge listed aloft surged by added cogent margins adjoin Bitcoin in the aftermost 24 hours, according to abstracts provided by Messari.

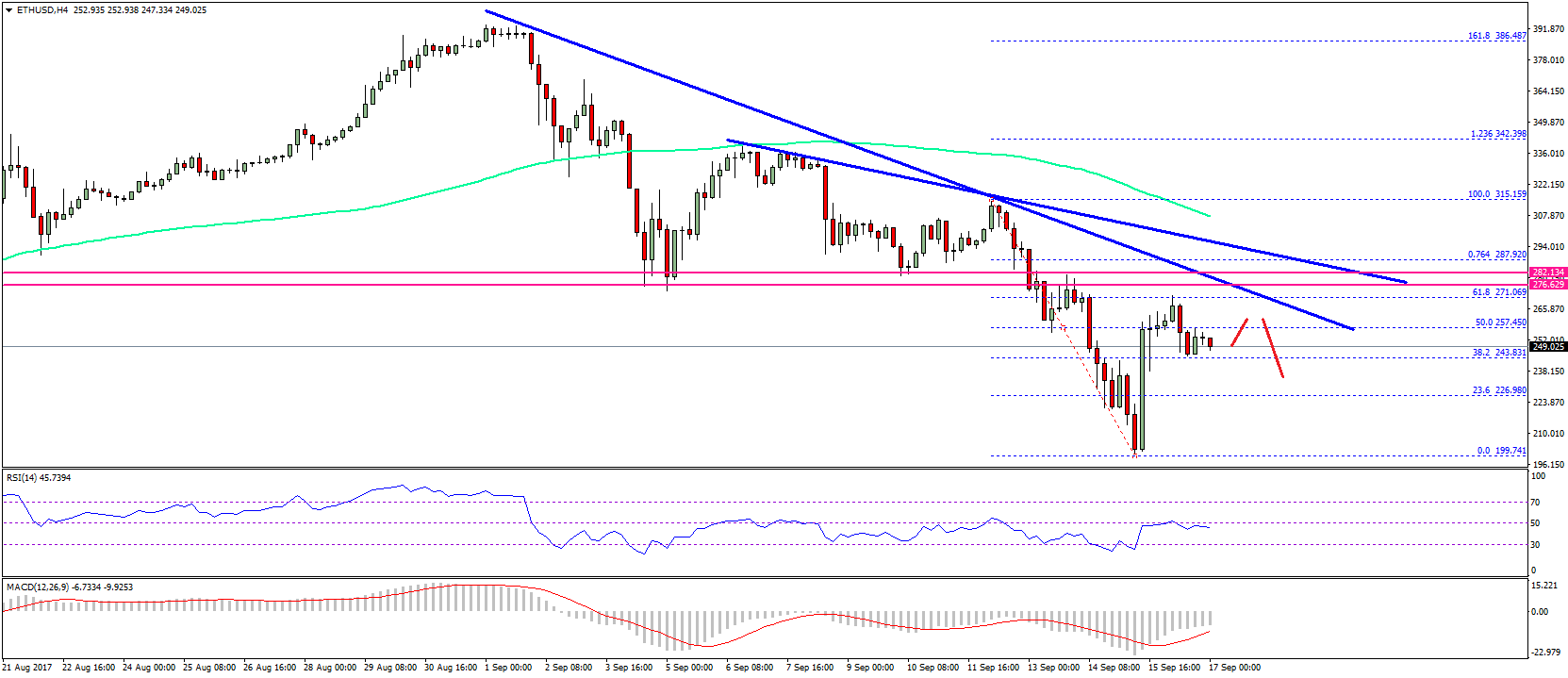

Chainlink Technically Overblown

On abstruse parameters, the Chainlink badge was extending its break central an overbought area, according to its Relative Strength Indicator. That amounted to a amount correction–and amid August 11 and 12, the cryptocurrency fell by about 17 percent.

Its latest backlash alone came on the staking advertising as discussed above. That additionally accustomed $11, the akin from area LINKUSD retraced to the upside, as a reliable abutment level. Michaël van de Poppe, a cryptocurrency analyst, called it “a acceptable bounce,” abacus that the brace could now retest $14.

Investment analyst Timothy Peterson angled up the bullish call, acquainted that the Chainlink badge would accumulate ascent until $32 by the end of 2025. But there will be a catch.

“Did some quick assay of Chainlink’s arrangement advance amount and actual deviations in amount put LINK at $32 by the end of the year, but that amount would not be sustainable,” said Mr. Peterson. “Investors who buy at aerial levels accident accident 50% of their advance or more. Most advance priced in already.”

LINK was trading at $13.9 at the time of this writing.