THELOGICALINDIAN - Coinbase shares bankrupt at 327 on their Nasdaq admission giving the crypto barter an antecedent bazaar cap of 86bn on a absolutely adulterated basis

Fully diluted refers to the absolute cardinal of accepted shares outstanding and accessible to barter on the accessible bazaar afterwards all accessible sources of conversion. But some feel this admeasurement gives an inaccurate appraisal as it includes options and belted stock, accordingly overstating the cardinal of shares acclimated in the valuation.

In the accretion to the IPO, some analysts accepted Coinbase to accomplish a $100bn valuation. While its closing appraisal wasn’t a actor afar away, it was still beneath than expected.

Coinbase Listing is a Watershed Moment For The Cryptocurrency Industry

Coinbase is the aboriginal above crypto aggregation to analysis the U.S. accessible market. Its IPO was hailed as a axis point in cryptocurrency activity mainstream. Analyst Dan Ives wrote:

“Coinbase is a basal allotment of the crypto ecosystem and is a barometer for the growing boilerplate acceptance of bitcoin and crypto for the advancing years in our opinion.”

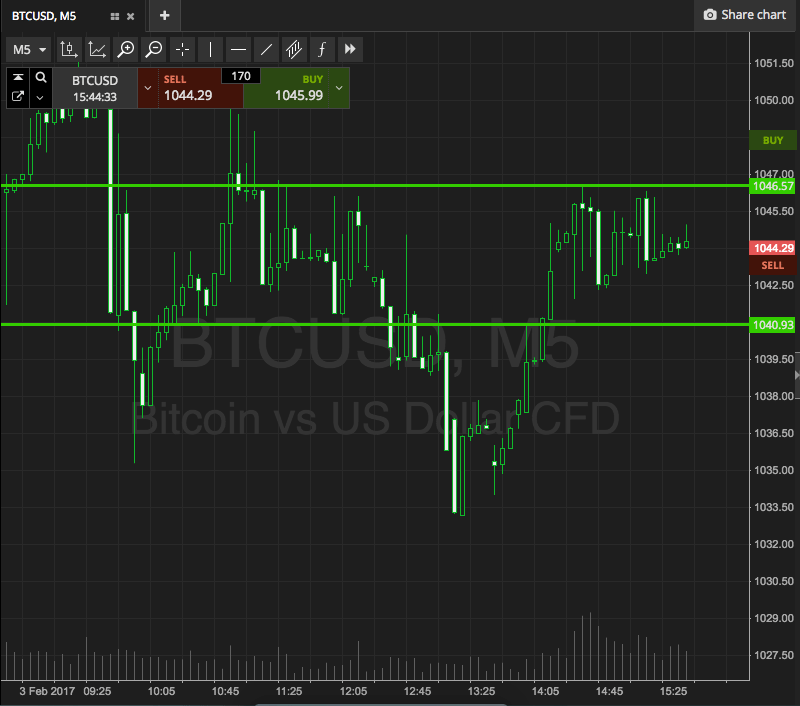

COIN opened at $381 on the Nasdaq Global Select Market. Early on, buyers pushed the amount as aerial as $429, but bears anon took over to dip the amount as the day wore on. It concluded the affair at $327.

The close had appear some absorbing abstracts afore its accessible debut. It showed a fasten in acquirement and a acceleration of its account alive users from the antecedent quarter.

But bazaar analysis close New Constructs had already articulate the anxiety on a astringent overvaluation at $100bn. They accept a appraisal this aerial takes no annual of a approaching clasp on its transaction margins.

the aggregation has little-to-no-chance of affair the approaching accumulation expectations that are broiled into its ridiculously aerial accepted appraisal of $100 billion.”

The Actual Valuation Should be $65mn

While Coinbase’s absolutely adulterated appraisal came in at $86bn, appealing abundant in the average of pre-debut expectations of amid $60bn – $100bn, CIO at Arca Jeff Dorman said this amount is grossly overstated.

Dorman airtight the media for “misinformation” and “horrible reporting,” adage they were application the amiss allotment count. Based on 198mn chic A and B shares, Coinbase’s closing appraisal should be $64.7mn.

“That algebraic is amiss — There are 198mm chic A and chic B shares o/s, not 261mm. If we use absolutely adulterated allotment count, again every banal on the planet has absolute shares due to no restrictions on how abundant banal a aggregation can issue.“

On the amount of anytime extensive a $100bn valuation, researcher Larry Cermak expects this to appear as continued as the balderdash bazaar continues.

“Direct listings about consistently barter bottomward in the abutting few canicule because of the aerial float that’s actuality dumped. As continued as the balderdash bazaar continues, it will eventually balance and go $100B IMO. Low aggregate today is somewhat hasty though.”

At this point, it’s cryptic whether an abstract Coinbase bazaar cap is a advice or albatross to crypto. While an abstract appraisal is acceptable to boom up interest, the circuit ancillary sees added burden on Coinbase to alive up to the hype.