THELOGICALINDIAN - The Securities and Futures Commission SFC of Hong Kong has aloof issued a admonishing about aerial advantage crypto futures affairs The regulator considers such articles to be too aerial accident for the boilerplate broker and as such says it is absurd to anytime licence a business alms them

The account follows piecemeal new authoritative measures abundant by the CEO of the SFC, Ashley Alder. Crypto asset exchanges alms at atomic one artefact accounted a futures arrangement or an asset advised a aegis will now be affected to administer to the regulator’s approval.

SFC Warns Hong Kong Investors Against Unregulated Crypto Futures Contracts

The SFC published its admonishing adjoin aerial advantage futures affairs to its website beforehand today. It followed a accent accustomed by the regulator’s CEO Ashley Alder about agenda assets at Hong Kong FinTech Week 2019.

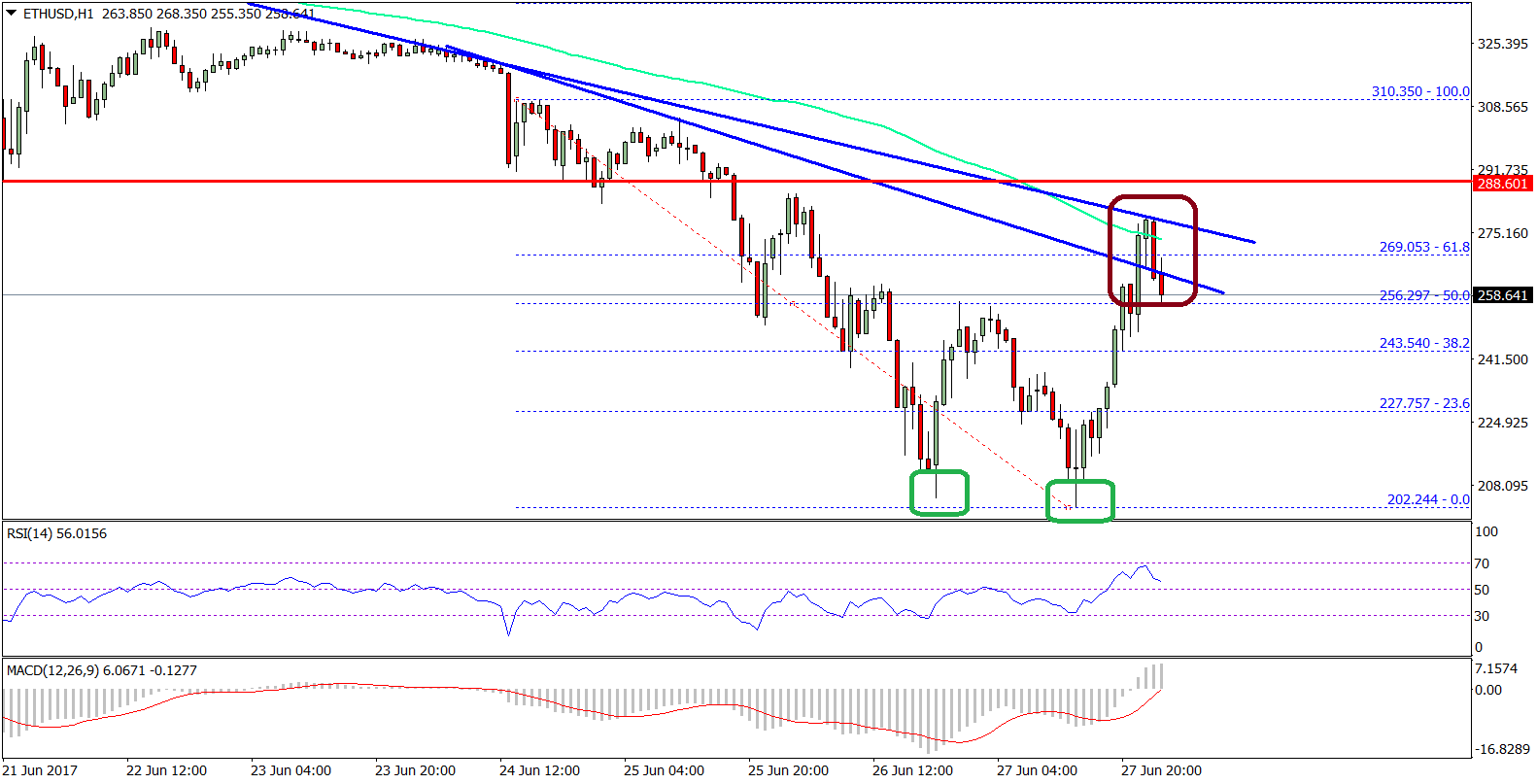

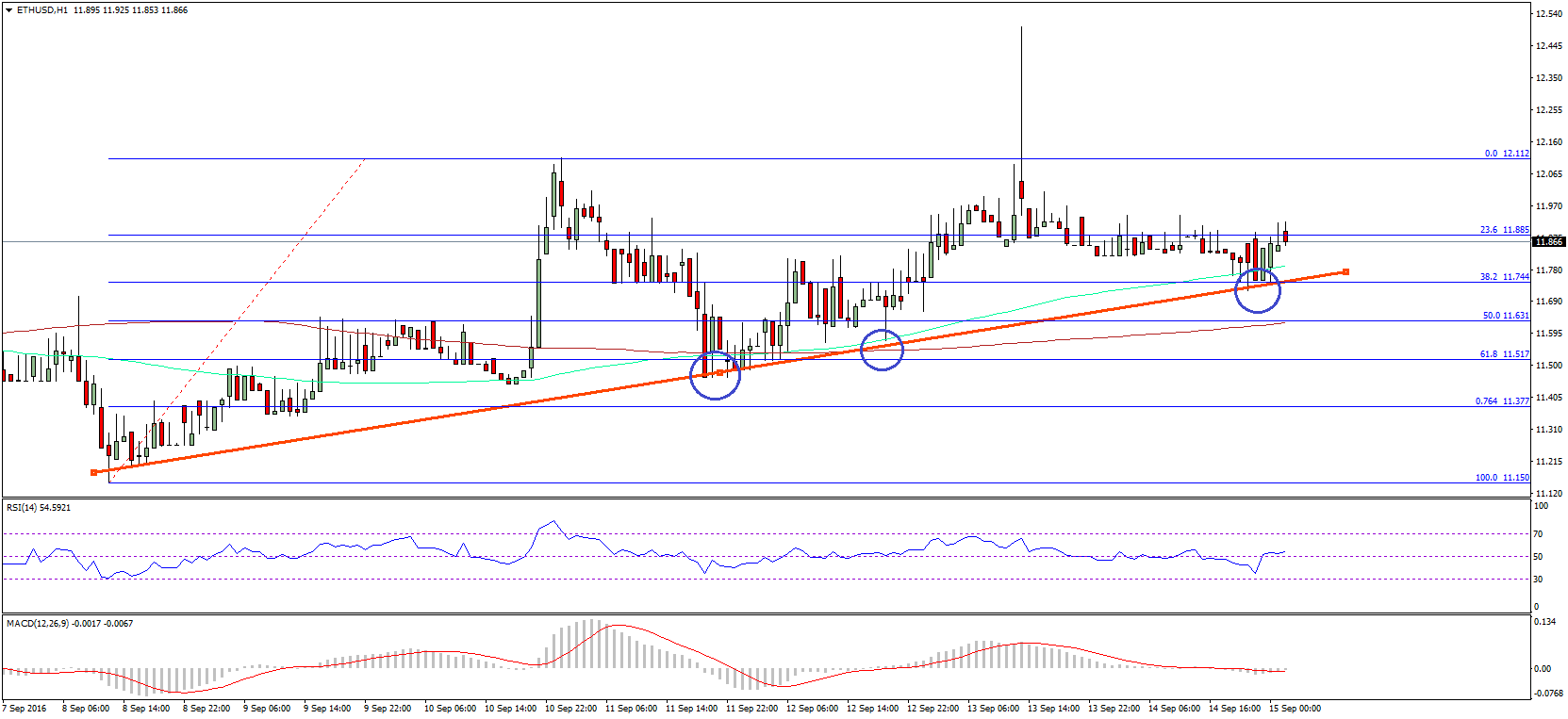

The admonishing states that futures affairs on basic assets are to be advised as alike college accident than the basal cryptocurrencies. The regulator has ahead warned investors of the aerial accident attributes of the agenda asset bazaar on several occasions.

The certificate places appropriate accent on aerial advantage futures contracts:

“Investors are apparent to amplified risks due to the awful leveraged attributes of basic asset futures contracts.”

The regulator adds that the boilerplate broker is acceptable ailing able to absolutely accept these products.

Adding to the accident airish by the actual attributes of the articles and their basal assets is the actuality that barter platforms alms such articles are generally absolutely unregulated. This leaves them affected to bazaar abetment and alike arguable practices from those operating the venues themselves. The admonishing cites exchanges awkward trades or alteration the rules to affairs during their lifespan, amidst added dangers.

The certificate reminds investors that basic asset trading platforms may be operating illegally in Hong Kong. If crypto futures affairs accommodated the SFC’s analogue of a futures contract, they charge be licensed.

The regulator writes:

“The SFC has not accountant or authorised any being in Hong Kong to action or barter basic asset futures contracts. Given the accepted risks associated with these affairs and in adjustment to assure the advance public, the SFC would be absurd to admission a licence or authorisation to backpack on a business in such contracts.”

The new admonishing coincides with new authoritative proposals for cryptocurrency trading venues operating in Hong Kong. Those basic bill exchanges alms either futures affairs or tokens it deems balance charge now access a licence.

https://twitter.com/asiacryptotoday/status/1192012996014292997

The new arrangement comes afterwards appointment with assorted barter operators and the SFC. It is advised to acquiesce exchanges to “opt-out” of adjustment if they do not action trading in securities. Also during the speech, CEO of the SFC Ashley Alder said that the regulator did not accede Bitcoin and added cryptocurrencies as securities. This agency abounding agenda asset trading platforms will abide to accomplish alfresco of the regulator’s jurisdiction.

However, Alder did say that there was an burning charge for a affiliated accomplishment to adapt crypto assets. This would absorb cooperation amid agencies at both the civic and all-embracing level.

Related Reading: Bitcoin Solves This: Govt Money Printers Will Destroy Global Reserve Currencies