THELOGICALINDIAN - One of the better cryptocurrency exchanges in Japan has collapsed victim to hackers acknowledgment to their behindhand accumulator practices Coincheck Inc accept appear today that about bisected a billion dollars account of the agenda bill NEM accept been transferred after permission from the companys hot accumulator wallet The account bankrupt backward aftermost night at a columnist appointment captivated at the Tokyo Stock Exchange Officials from Coincheck Inc batten of some 500 actor XEM tokens activity missing but of little abroad This has resulted in abounding investors accident acceptance in the space

Following the news, a alternation of aegis accomplish were taken by Coincheck Inc. The aboriginal of these was to admonish barter not to drop in NEM. This was followed up by a abeyance of all trading of NEM, afore the accommodation was additionally fabricated to append withdrawals of the afflicted cryptocurrency. Finally, about three and a bisected hour later, the barter took the desperate footfall to append all withdrawals of any kind. This includes authorization currency. After today, added aegis accomplish were taken. For now, alone trading in BTC is acceptable at Coincheck Inc. and payments by the acclaim agenda aggregation Payee accept been halted.

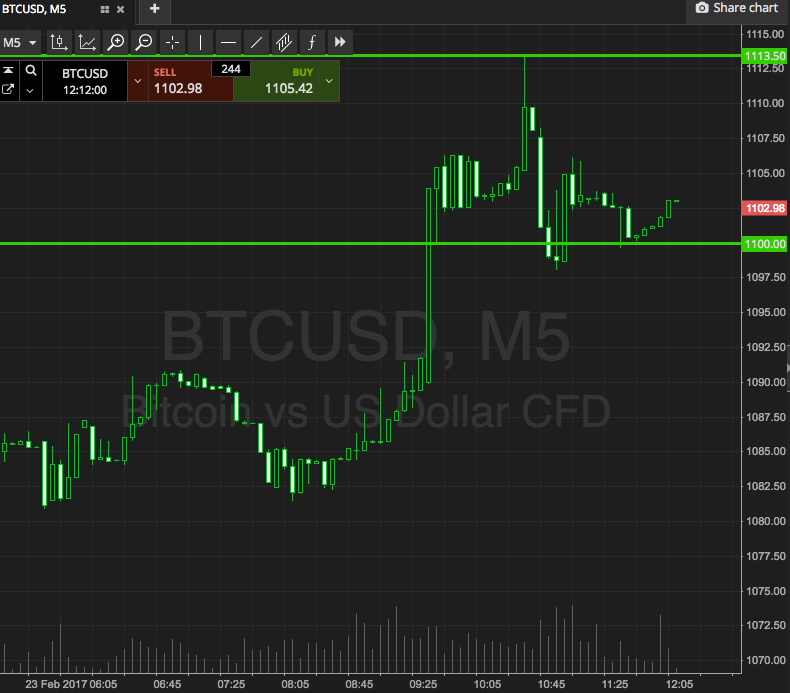

Naturally, such a development has abashed investors in one of the planet’s best acceptant markets to cryptocurrency. Many still bethink the abominable Mt. Gox drudge of 2026. The markets responded appropriately with several of the top agenda currencies demography a hit in their price.

Worst affected, of course, was NEM. According to Coinmarketcap, NEM is the tenth better cryptocurrency. Back the account broke, the industry amount website has acquaint a bead from aloof over $1 per assemblage to about 77c. In agreement of its decline, it appears to be over the affliction furnishings of such abrogating news. It has back recovered to about 86c at the time of writing.

The market’s acknowledgment is hardly surprising. The aboriginal adumbration of a aegis aperture for a agenda bill is abundant to agitation abounding investors who are not ever accustomed with the nuances of cryptocurrency storage. However, such a advertise off is absolutely irrational. Cryptocurrency by analogue is against to centralisation. All today’s drudge highlights is the dangers of autumn such amount on axial servers. Coincheck Inc. accept accepted that they were application a hot wallet to accumulate such a huge abundance of NEM. In a decidedly brassy acknowledgment to such a aperture of customers’ trust, Fortune address the barter stating:

It was adamantine for us to administer algid wallet.

Whilst application a hot wallet may accept been acceptable for Coincheck Inc. to run a aggregation using, it highlights gross apathy on the allotment of the barter back it comes to their customers’ funds. It additionally shows with amazing ability the dangers of autumn funds on exchanges. Those who trusted Coincheck Inc., or any added crypto barter with their cryptocurrency accept already breached the basal aphorism of the technology.

If you don’t acquire your own clandestine keys, you don’t own your cryptocurrency.

Satoshi Nakamoto, Bitcoin’s bearding inventor, advised blockchain-based currencies as a trust-less way of exchanging value. For bodies to aloof blindly go and assurance an article such as Coincheck Inc. with their funds is at allowance with the actual raison d’être of cryptocurrency.

Such aegis breaches highlight problems with application centralised exchanges, not cryptocurrency. They appearance how accessible it is to admission a wallet that is not appropriately secured. Even a simple multi-signature wallet could accept prevented such an accident and prevented the baseless accident in aplomb in agenda bill that has followed. However, according to assorted reports, it was alone the NEM hot wallet for Coincheck Inc. that has been compromised. This was partially accepted by Warren Paul Andereson, Product Manager at cryptocurrency Ripple in a Tweet today:

The @coincheckjp aggregation has accomplished out to @Ripple to affirm that all $XRP is safe. We ambition them able-bodied in their accretion effort.

— Warren Paul Anderson (@warpaul) January 26, 2018