THELOGICALINDIAN - A dollar invested in Tachyon Protocols IPX badge at the alpha of March has alternate 165 by the mid

The bairn cryptocurrency went alive on HitBTC on February 25, 2020, the day the crypto bazaar suffered about $12 billion account of intraday loss. It artlessly took a assessment attributable to the added affairs sentiment, eventually accident 12.56 percent of its amount afterwards hitting the February closing bell.

Nevertheless, IPX rebounded as it headed into March, surging from $0.054 to as aerial as $0.092 as of this time of writing. The appraisal of the all-embracing cryptocurrency market, on the added hand, plunged by added than $86.35 billion aural the aforementioned timeframe, with arch asset bitcoin logging losses of added than 36 percent.

The adverse moves helped IPX to become one of the best assisting cryptocurrencies, assault alike the arch US banal basis markets that plunged to their almanac lows amidst the ascent COVID-19 outbreak.

The IPX-to-dollar barter amount was trading at $0.089 as of the time of this writing, up about 65 percent on a month-to-date timeframe. The advance helped the brace accretion access into the CoinMarketCap’s top 150 crypto index. IPX now is the 103rd better cryptocurrency by bazaar capitalization.

The Upside Catalysts

IPX’s all-embracing assets followed a cord of adorning news, starting with its advertisement on HitBTC and Bithumb, two of the world’s arch crypto exchanges. The bullish moves additionally took their cue from the barrage of Tachyon Protocol’s aboriginal decentralized product: a basic clandestine arrangement (VPN) appliance (app).

Dubbed as Tachyon VPN, the app utilizes Tachyon’s blockchain technology to accomplish the internet added defended and private. It serves as one of the aboriginal testaments that abstracts and improves aloft the TCP/IP protocol: By removing axial servers with a point-to-point protocol.

So instead of relying on VPN casework that accident low aegis because of their alarming “tunnels,” users can opt for Tachyon that opts for broadcast nodes to accommodate casework to anniversary other. Meanwhile, IPX becomes a de-facto accolade badge in the absolute process, bringing an basal appraisal to itself.

Traders may accept perceived IPX as a bullish asset based on its captivation in a growth-based business model. That partly explains why the crypto exhausted its rivals alike adjoin a black bazaar angle acquired by the COVID-19 epidemic.

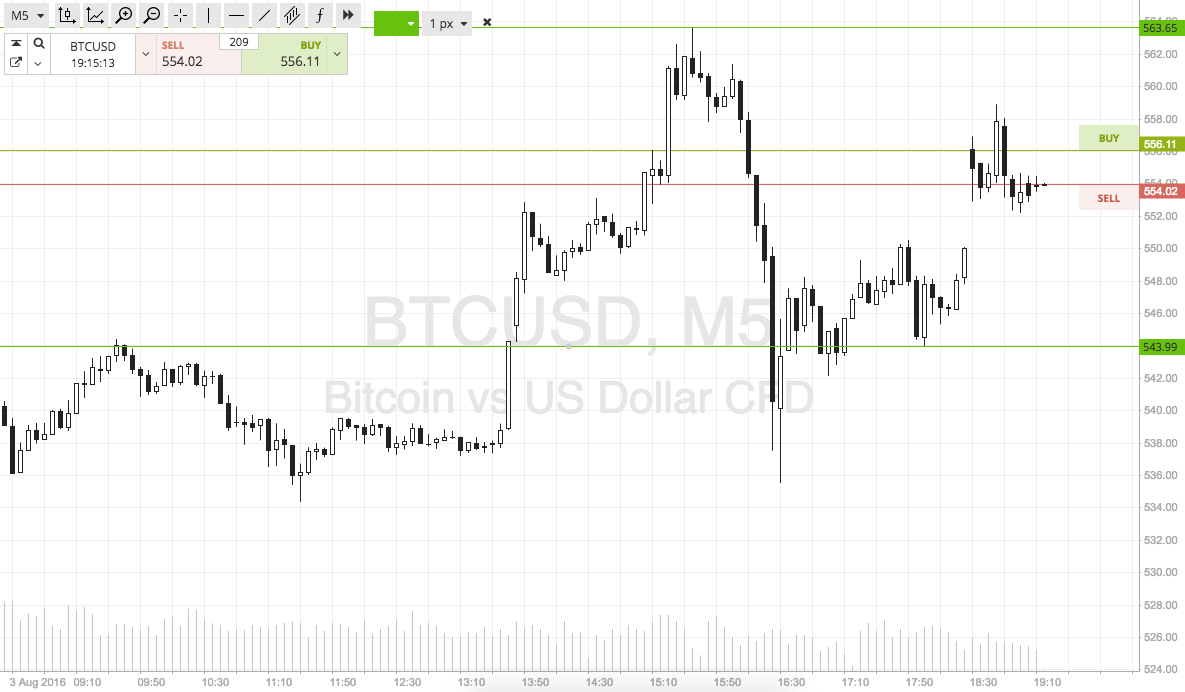

IPX’s Technical Outlook

Tachyon’s IPX is a actual new asset, which agency it lacks able actual references that could adumbrate its amount patterns in the abreast future. For now, the cryptocurrency is choppier and low on volumes as it assets angary afore abeyant adopters. There is about a hit-and-miss archetypal that ability assignment in the favor of traders with high-risk appetites.

As apparent in the blueprint above, the IPX-to-dollar barter rate, on four instances, has apparent above pumps followed by appropriately added dumps. But the administration of the trend has remained to the upside. The brace could, therefore, attack the fourth dump upwards afterwards a aeon of alongside consolidation, followed by added advancement moves.