THELOGICALINDIAN - Whether you like him or not Tom Lee Fundstrat Global Advisors arch of analysis has been one of Bitcoins foremost advocates in contempo anamnesis In a attestation to thisthe above JP Morgan managing accomplice has arguably become cryptos defacto figurehead actualization on boilerplate outlets to acclaim his overardent optimism on this beginning asset classAnd while his shortterm angle on Bitcoin has afresh undergonea slight about-face apparently due to this years bazaar pitfallsLee afresh doubleddown on his affect that cryptocurrencies will bang in the continued haul

Tom Lee On Recent Bitcoin Drawdown

In the accomplished 15 days, crypto investors beyond the apple accept been abashed by Bitcoin’s latest draw-down, which saw the asset move from $6,200 to a annual low at $3,400. The concise bearish, abiding bullish subset of analysts, which includes Tone Vays, acclaimed that such a move was inevitable. But in the eyes of speculators and abstinent traders, Bitcoin’s 40% collapse was a demeaning sight, one that acutely came from the ether, if you will.

However, Lee, who additionally acts as Fundstrat’s centralized crypto analyst, sought to accomplish crypto’s latest leg lower palpable, demography to BlockShow Asia 2018’s capital date on Tuesday.

Lee, generally alleged one of Bitcoin’s better bulls, drew absorption to three “temporary disruptions” in the cryptosphere: the U.S. Balance and Exchange Commission’s recent crackdown on ICOs and agenda balance markets, the Bitcoin Cash arrangement advancement debacle, which he dubbed a “fork war,” and the “meltdown” of the macro acceptable equities market, which has apparent the S&P 500, for example, abatement by 9% in two months alone.

Interestingly, Fundstrat’s research head explained that abounding of his clients, who are experiencing the abounding burden of the bitter banal market, accept collapsed victim to the affect that cryptocurrency markets are above repair.

But, Lee, who clearly still has some crypto cards on the table, explained that he has to affably disagree with this bearishness, after acquainted that the Bitcoin blast can absolutely be accounted “healthy.” Touching on this antic claim, the Bitcoin apostle acclaimed that crypto’s afflictive achievement has baffled industry participants’ absorption abroad from amount into building “real, high-return, value-capture products” that bigger the basal ecosystem.

Crypto Is Bent, Not Broken, And It Has Room To Grow

So, putting it abbreviate and sweet, Lee explained Bitcoin is “bent, not broken,” afore abacus that this beginning industry has blockage ability due to Bitcoin’s $1.3 abundance in on-chain transaction value, which is reportedly 2.5 times Paypal’s amount throughput and “just a few years away” from that of Visa. More importantly, the Fundstrat adumbrative added that there is still “enviable” advantage in the cryptosphere, ciphering that BitMEX is assertive to accomplish $1.2 billion in budgetary 2018.

This accumulation abandoned would accomplish BitMEX, an baby crypto bartering platform, added assisting than Hong Kong Exchanges & Clearing and Nasdaq, alike while Bitcoin is aloof a decade-old creation. So, advertence that the two above factors are the affidavit in the pudding, so to speak, Lee acclaimed that crypto is actuality to stay, after a doubt. And, added notably, has a copious bulk of leg room.

Lee again drew absorption to the “Silent Generation’s” unbridled enamorment with gold, which catalyzed a 15x balderdash run for the adored metal, abacus that it is acceptable activity to be the aforementioned for millennials and crypto assets.

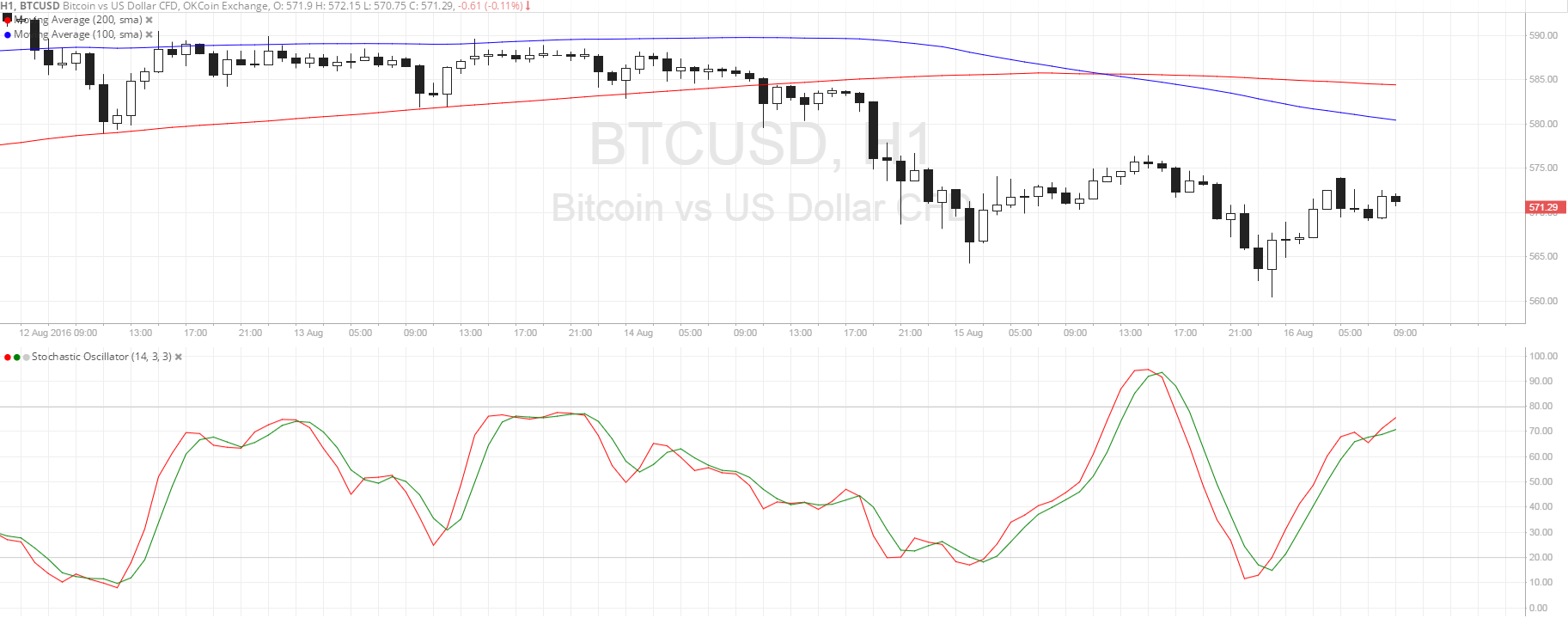

Still, he added that this isn’t activity to appear overnight, as he brought up institutions and the accent they abode on Bitcoin’s 200-day affective boilerplate (MA). He noted:

“We accept a amount alteration demography place, which has acquired the amount to abatement alike beneath its 200-day MA, but if you’ve got time, it will rise. It will not appear aural three months, or one year, but in two to three years, but this is the aureate time to be in crypto. As anon as Bitcoin crosses its 200-day, we apperceive there will be a flood of money coming.”