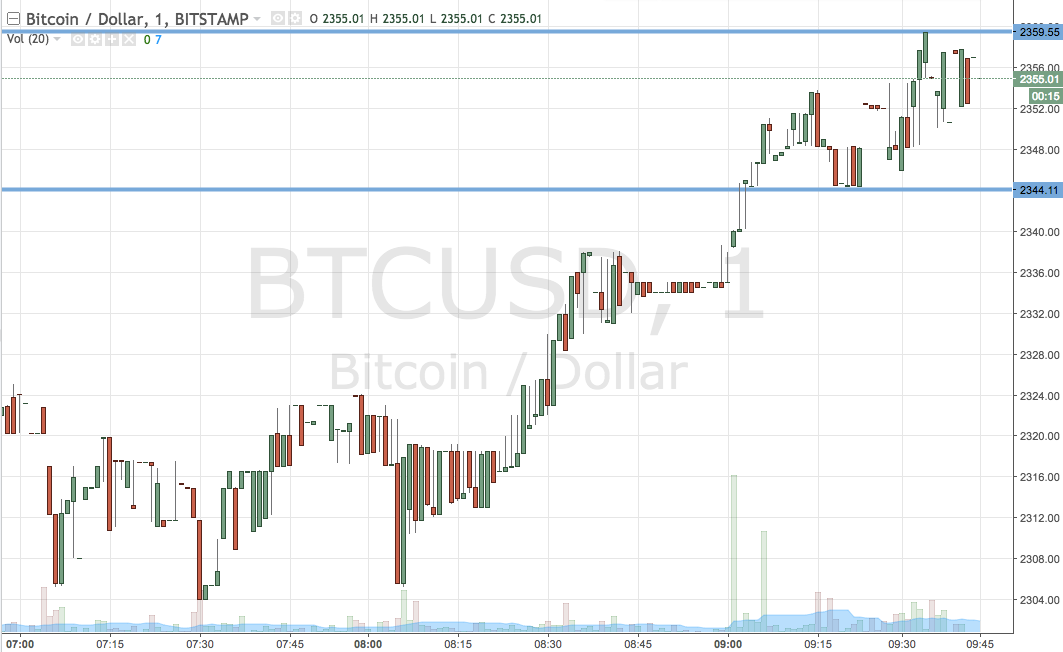

THELOGICALINDIAN - Peter Smith CEO of Blockchain afresh went on Bloomberg to accord his assessment on the accepted accompaniment of institutional advance in the cryptocurrency industry

Will Blockchain Principal Strategies Fill a Growing Need with Institutional Investors?

After the contempo barrage of Blockchain Principal Strategies (BPS), Peter Smith, the CEO of Blockchain, went on Bloomberg to accord added acumen into the BPS belvedere launch.

For those who are unaware, BPS is a belvedere aimed at adorable and facilitating institutional advance in the cryptocurrency industry. Blockchain affairs on convalescent institutional admission by accouterment over-the-counter (OTC) trading, alms the acquirement and affairs of a aggregation of cryptocurrencies after affecting barter adjustment books.

Smith went on to say that the accepted institutional advance ambiance about the cryptocurrency amplitude is ‘immature,’ assured that the BPS belvedere will ample a growing gap with institutional investors. This belvedere will be staffed by accomplished money managers, accomplished in managing and trading assets in fast-paced environments.

He accurately stated:

“There’s not a lot of absolutely complete platforms out there that are staffed by the affectionate of bodies that institutions are acclimated to ambidextrous with. So really, institutions are attractive to accretion acknowledgment in a safe way and more they are motivated about accepting the best execution. But today, the institutional bazaar is adequately adolescent and adequately nascent.”

When enquired about what makes BPS angle out from Coinbase‘s or Circle’s institutional advance services, the CEO acclaimed that Blockchain intends to action a array of services, not aloof trading. Whether this is through analysis services, ‘deep-liquidity’ or aegis services, Blockchain affairs on alms a ‘much added absolute offering’ for institutional investors.

Peter Smith Sees Institutional Investment Slowing

Smith acclaimed that institutions are currently alone ambience up for closing investment, rather than putting money into the bazaar in its accepted state. He elaborated, saying:

“I anticipate there are two abstracted things (for institutional investors). One is institutions absent to set up, so they can barter and again there is the institutions absent to trade. Right now you are seeing a lot added of the former, again the latter. I anticipate you will accept to see the bazaar about-face afore you see added of the latter.”

Contrary to accepted belief, the Blockchain CEO mentioned that institutional advance in Asia isn’t as present as bodies put it out to be. In fact, a majority of the entering advance is accession from London and New York, area ample banking institutions are generally situated.

Despite the array of banking institutions, Smith acclaimed that a majority of institutions advance in the bazaar are ample ancestors offices or barrier funds, who are best acceptable attractive for longer-term returns.

Smith sees the London and New York markets as ‘limited,’ in agreement of basic breeze from acceptable firms, acknowledging that the cryptocurrency bazaar is still mostly retail driven. This account should appear as a surprise to some, as it was accepted that institutional investors would abandoned their pockets for the industry en-masse.

But as stated by Smith before, the cryptocurrency bazaar could booty years to appear to abounding fruition, back cryptocurrency and blockchain-related technologies activate to booty over acceptable systems. He wrote:

“Investors should alone advance if they accept in the abiding eyes of creating a global, stateless, opt-in banking system. They should additionally be able to authority their position for a actual continued time. I apperceive I am.”

Hopefully, a account like BPS can advice to draw in institutional advance and involvement, which will assuredly become a basic aspect of the cryptocurrency bazaar in the years to come.

Featured angel from Shutterstock.