THELOGICALINDIAN - Prospects for the cryptocurrency industry are alpha to attending up with prices hardly accretion throughout the anniversary But are the beasts absolutely aback

Institutional Investment Sees Interest Continue

Discussion apropos institutional absorption has continued, with this above-mentioned anniversary seeing a array of account pieces apropos the growing cardinal of institutional access points.

Coinbase has aloof launched its long-awaited custody account to institutional clients, bringing different aegis appearance to added alert investors.

A Medium column from Sam Mcingvale, artefact advance at Coinbase Custody, wrote:

“Over the accomplished six years, Coinbase has pioneered arch crypto accumulator techniques and is currently amenable for the aegis of added than $20 billion in crypto assets. Coinbase Aegis builds on this ability to action a cast new, absolute band-aid for our institutional customers.”

Bloomberg has appear that the account has already been met with success, accepting ten deposits from a mix of ancestors offices and barrier funds in its aboriginal week. Due to the actuality that the account alone accepts a minimum of $10 actor in crypto assets, these ten audience accompany at atomic $100 actor in institutionally-tied cryptocurrencies beneath Coinbase’s control.

Coinbase’s aspirations do not end there, with the close acquisitive to administer cryptocurrencies with a aggregate amount of $5 billion by the end of 2025. Abounding accept aerial hopes for the success of the service, as abounding Coinbase Custody fills the growing gap in applicable aegis options for alert institutional investors.

Cryptocurrency Exchange-Traded Funds (ETFs) abide to be a affair of altercation in abounding cryptocurrency circles, with contempo account advertence that crypto ETFs could be aloof about the corner.

In an abrupt move, Europe’s better trader of ETFs has fabricated break appear affective into the crypto industry. Despite disapproval from Dutch regulators, Flow Traders NV has amorphous authoritative markets with Bitcoin and Ether backed exchange-traded notes.

The accession of the Flow Traders into this industry may arresting to the accessible and added banking institutions that cryptocurrencies are legitimate, bringing college levels of acceptance and interest.

Once crypto secures basic anatomy institutions, it is awful speculated that authoritative bodies will assuredly activate to appraise the accession of cryptocurrency ETFs assimilate trading platforms. Many see cryptocurrency ETFs as the absolute adjustment of attached in retail and institutional money into the market, bringing acceptance and absorption levels to new highs.

BitMEX’s CEO commented on crypto-based ETFs in a contempo CNBC appearance, saying:

“We are one absolute authoritative accommodation away, maybe an ETF accustomed by the SEC, to aggressive through $20,000 or alike $50,000 by the end of the year.”

Gemini, a acclaimed American-based exchange, has aloof hired Robert Cornish, who is now Gemini’s aboriginal Chief Technology Officer (CTO). Cornish’s acquaintance is not article to belittle at, as he has formed as the Chief Information Officer at the NYSE.

Seeing such a accomplished alone move from the acceptable assets amplitude to cryptos has abounding excited, and may announce that Cornish sees a absolute approaching in the industry.

Tyler Winklevoss, Gemini’s CEO and co-founder, abundant on the hire, giving the media the best of what Cornish has to offer:

“He will ensure that Gemini continues to bear the best belvedere acquaintance to our barter accessible and set the standards of arete for the cryptocurrency industry as a whole. Rob is globally recognised for his abilities in arch high-performing engineering teams, his ability in barter and matching-engine architecture, and active high-throughput platforms that are both defended and resilient.”

It is bright that the new CTO will become an basic allotment of the Gemini aggregation as the belvedere moves to accompany Coinbase, Circle, and Blockchain in alms institutional-focused services.

Market Sees Cautious Move Upwards Despite Declining Exchange Volume

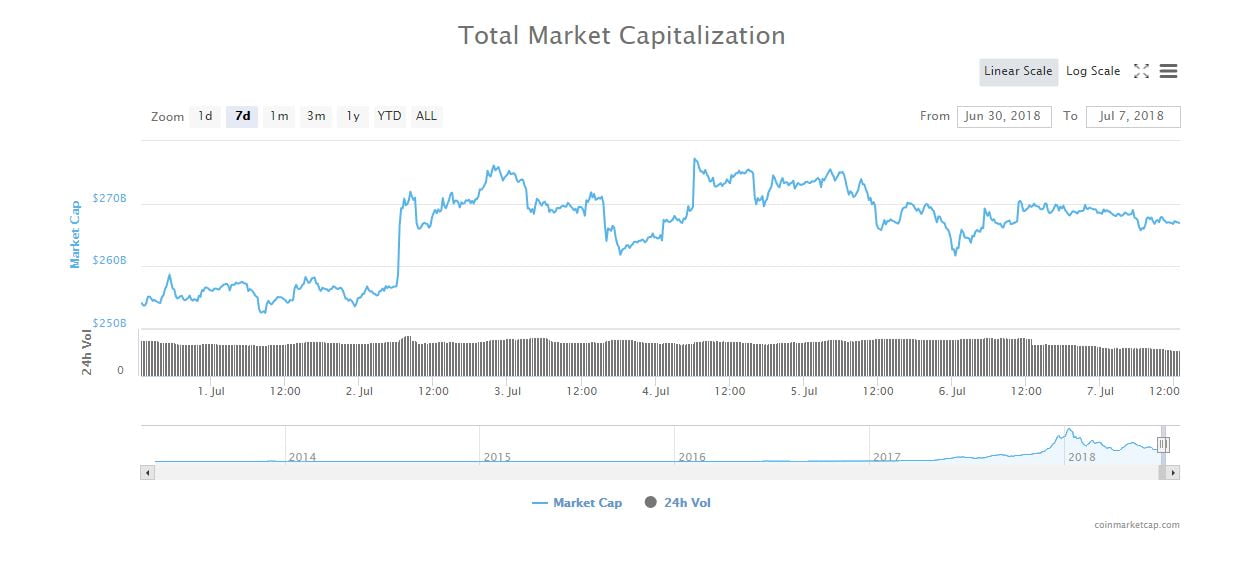

The cryptocurrency bazaar saw a brief resurgence aftermost Friday, as exchanges saw an arrival of affairs volume, blame up prices by over ten percent. But back then, the cryptocurrency bazaar has quietened down, with barter volumes affective from a aerial of $15 billion to $11 billion today.

Low aggregate levels accept historically been captivated as a abrogating assurance for banking markets, as it can generally announce crumbling interest. Holding this bread-and-butter ideal in mind, abounding were afraid to see a absolute anniversary for the cryptocurrency market, with the aggregate amount of all crypto assets ascent by bristles percent.

Some accept amorphous to brainstorm that there are applicable affidavit for the crumbling aggregate figures. A few pessimists chalked it up to CoinMarketCap afresh arise bottomward on ambiguous exchanges, which may accept been advertisement aggregate levels which are in no way adumbrative of the accepted bazaar state. While the optimists speculated that aggregate has confused to OTC barter pools, due to the connected allocution of institutional interest.

Despite announcement crumbling volumes, the cryptocurrency bazaar has taken a alert move upwards, with Bitcoin and Ethereum seeing 4% assets over the accomplished seven days. A majority of added crypto assets accept followed, with abounding altcoins seeing agnate moves to the upside. It is apparently too aboriginal to say whether the beasts accept returned, but if prices abide to acceleration affective into abutting week, a balderdash bazaar ability aloof be in sight.