THELOGICALINDIAN - The crypto bazaar fabricated a alert move upwards this anniversary alike as regulators approved means to accurately abode this beginning yet arguable industry

SEC Denies 9 Bitcoin ETF Applications… Or Did They?

On Wednesday afternoon, the hearts of all crypto investors stopped, as the U.S. Securities and Exchange Commision announced that it would be abstinent nine Bitcoin-backed ETF proposals from ProShares, Direxion, and GraniteShares. While the nine ETFs were inherently dissimilar, with some alms leverage, shorting, and added different features, the affidavit for abnegation were near-identical beyond the SEC’s three abstracts apropos the verdict.

In the documents, the SEC brought absorption to its fears of manipulation, acquainted that Bitcoin markets abridgement “significant size,” accompanying with the actuality that there is still a accident of counterfeit “acts and practices” in crypto markets.

But in an unexpected about-face of events, the SEC Commissioner Hester Pierce, who has been dubbed “Cryptomom” by the community, appear that the Commission would be “staying” and reviewing the abnegation verdicts in accordance with the Commission’s 431st Rule of Practice.

In English: the Commission (Chairman and Commissioners) assembly some tasks to its staff. When the agents acts in such cases, it acts on account of the Commission. The Commission may analysis the staff's action, as will now appear here.

— Hester Peirce (@HesterPeirce) August 23, 2018

Putting the aphorism into layman’s terms, Peirce wrote that the Commission has the appropriate to agent cases to assertive associates of staff, but retains an befalling to analysis the accomplishments of said agents if the charge may arise.

Don't get too excited, folks.

Under Rule 431 of the SEC's Rules of Practice, it alone takes a distinct Commissioner to adjustment a analysis like this. @HesterPeirce deserves acclaim & account for putting up a fight, but there's no acumen to anticipate yesterday's rejections will be reversed. https://t.co/whxqOUkVXz

— Jake Chervinsky (@jchervinsky) August 23, 2018

While this sounds like the ETF proposals accept a angry chance, Jake Chervinsky, an American advocate who holds an absorption in the crypto acknowledged space, appear that the above aphorism cited can be activated by a distinct Commissioner. In this case, it is clearly “Cryptomom” who issued the adjustment to analysis the proposal, abbreviation the adventitious of a adjudication changeabout greatly. Nonetheless, abounding are still hopeful for September 30th’s adjudication borderline for the anytime so able VanEck and SolidX Bitcoin ETF.

China Doubles-Down On Crypto Ban Efforts

Since Bitcoin’s infancy, China has bound risen to the beginning of the development of blockchain and crypto technologies. But as Bitcoin market’s amount eclipsed ahead accustomed best highs, the bounded government began to able bottomward on the advancement of cryptocurrencies, by reportedly arising a absolute ban over cryptocurrency exchanges and ICOs.

But as the age-old adage goes “rules are meant to be broken,” with Chinese citizens bound establishing another methods of trading cryptocurrencies and acquisition ICO-related information. In the case of the former, ingenious Chinese crypto enthusiasts began to advance the Alipay acquittal processing belvedere to authorize actionable over-the-counter exchanges. In the case of the latter, users approved a array of crypto-centric account sources on WeChat, China’s capital approach of communication.

While these methods of artifice government restrictions were acknowledged for months on end, in a contempo move, the Chinese government has double-downed on its efforts to barrier cryptocurrencies. In a amount of days, Chinese authoritative bodies absurd bottomward on WeChat’s crypto account outlets, Alipay’s OTC exchanges, crypto-related events, and 124 adopted exchanges that were still accessible in the country’s intranet.

Moreover, China’s axial coffer additionally issued a warning apropos ICOs and crypto-related “scams,” advising citizens to abstain such schemes that advance “illegal fundraising, pyramid schemes, and fraud.”

Mt.Gox Commences Civil Rehabilitation Process For $1 Billion In Bitcoin

As appear by NewsBTC, the now-disgraced Mt.Gox barter has afresh entered civilian rehabilitation affairs to acknowledgment its creditors over $1 billion in Bitcoin (BTC).

For those who are unaware, in early-2025, the Japan-based Mt.Gox was afraid for over 850,000 Bitcoin, which plunged the crypto industry into chaos, turbulence, and authoritative uncertainty. Afterwards some “searching,” Mt.Gox’ appear that it had mysteriously recovered 200,000 Bitcoin from an exchange-owned wallet. Even afterwards the defalcation of 30,000 of the recovered Bitcoin, there is still over 170,000 Bitcoin and Bitcoin Cash reportedly actual in the exchange’s coffers today. So now, over bristles years afterwards the abominable hack, the exchange’s creditors may assuredly get the crypto they deserve.

In a afresh acquaint press release, barter trustee Nobuaki Kobayashi appear that the civilian rehabilitation action has assuredly amorphous afterwards years of waiting. Victims of the drudge can now accomplish claims for their absent funds via an online system, provided that -to-be claimants submit the appropriate acknowledged documents. This action is set to be accessible for two months, which should be abounding time for creditors to procure the documents to accurately balance their funds. Following the claiming process, Kobayashi will abridge the abstracts appropriate and abide the claims to a Japanese court by February 2019.

Pending administrative approval, the aforementioned Bitcoin, which is admired at over $1 billion today, will be broadcast amidst the absolute creditors, who acceptable cardinal in the thousands.

Mt.Gox creditors can now animation a blow of relief, as the crypto they accept been cat-and-mouse for years may assuredly be accession in their wallets in six to seven months time.

BitMEX Enters The Big Leagues With Office Relocation

It was recently revealed that BitMEX, the world’s best accepted Bitcoin mercantile exchange, would be reportedly affective into the world’s best big-ticket appointment spaces. The Hong Kong Economic Times, this aperture who aboriginal bankrupt this news, acclaimed that BitMEX had busy out the accomplished 45th attic of the Cheung Kong Center. For those who are unaware, Cheung Kong Center sits in the affection of city Hong Kong and is home to Goldman Sachs, Barclays, The Bank of America and Bloomberg, authoritative it a architecture abounding of able individuals and firms.

While Hong Kong is accepted globally as the world’s priciest apartment market, Cheung Kong Center takes the block back it comes to absurd appointment spaces, with anniversary aboveboard bottom costing an almost HK$225 ($28.5) per month. If the letters are accurate, the barter will be renting out 20,000 aboveboard feet, which will beggarly that BitMEX will pay the agnate of over $573,000 anniversary ages aloof for rent.

While CEO Arthur Hayes has neither accepted nor denied this rumor, abounding accept speculated that this move could be likened to a actualization of force, with BitMEX’s actualization in such an appointment amplitude assuming bequest bazaar firms that crypto is here, and is actuality to break for the continued haul.

Others see this as a cardinal move, with such a move putting the barter aural accoutrements ability of the best affecting banking and technology firms in the world. But best importantly, this move shows that BitMEX, which offers high-fee allowance trading options, has still been raking in ample profits, alike as the crypto bazaar has about collapsed off a sharp, alpine cliff.

Market Hesitantly Moves Upwards After Days of Low Volatility

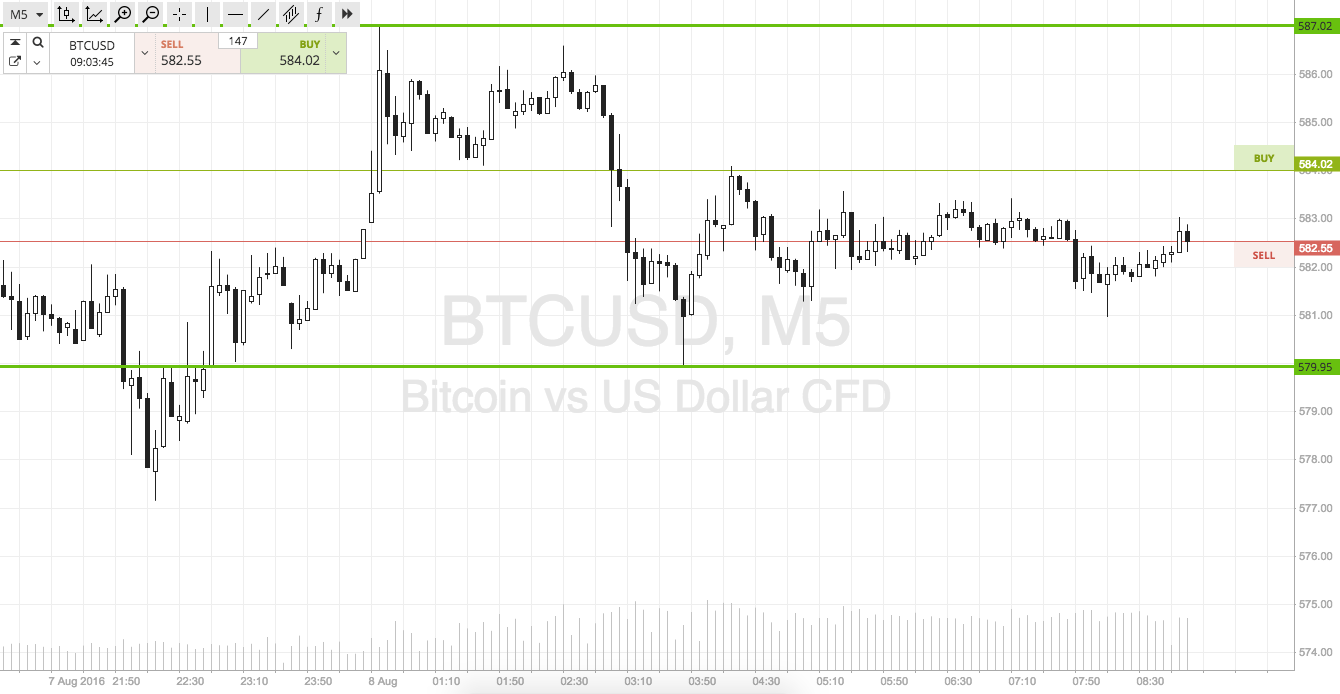

It goes after adage that the crypto bazaar has had absolutely a week, with traders, investors, and analysts akin affair roadblocks at about every about-face of the market. While the account aeon may announce that “FUD” is ambit the market, in the aforementioned way that vultures amphitheater their prey, cryptocurrency ethics saw a slight move upwards. alike amidst the authoritative troubles and uncertainty. Last week, the aggregate appraisal of all crypto assets totaled to $210 billion but saw a accessory 1.4% accretion to ability $213 billion on August 25th. This gain, admitting near-negligible, may announce that affect is alpha to about-face in this industry, as the bazaar has chock-full abnormally reacting to this week’s set of bleak news.

Bitcoin began its adventure this anniversary at $6,350, aerial amid the $6,200 and $6,500 ambit for the bigger allotment of three days. But as BitMEX’s appointed aliment affair began, Bitcoin anon surged by over $400, from $6,400 to $6,800, with abounding traders acumen how abundant of an aftereffect the accepted barter has on the industry as a whole. But as the advertising about the BitMEX aliment affair quieted down, with the barter reopening its adjustment books, prices began to calm down, with Bitcoin falling aback to area it was above-mentioned to the debacle. However, afterward the SEC’s advertisement that it would be revisiting the nine ETF verdicts, Bitcoin saw a afraid move upwards, as the aboriginal smidges of acceptance were adequate in these markets.

But some altcoins haven’t had it so lucky, with bill like Ethereum, Bitcoin Cash, Stellar Lumens, Cardano announcement 5% losses or more, with the amount activity of these adverse altcoins actuality broadly attributed to Bitcoin’s slight improvement in bazaar ascendancy to 53.7%.

While investors in this bazaar still assume to be in a accompaniment of ambiguity and confusion, as Arthur Hayes once said, “Q3 and Q4, I anticipate is back the affair is activity to alpha again.”