THELOGICALINDIAN - While investors entered this accomplished anniversary assured for the crypto bazaar to abatement added it has become credible that the bazaar has briefly staved off a move lower Whether this accretion was a aftereffect of absolute fundamentals or aloof a asleep cat animation charcoal to be apparent Nonetheless this anniversary has had its fair allotment of absolute account that will alone bigger this beginning industrys fundamentals

Network Hashrates Continue To Rise, Despite Questionable Market Conditions

Since the alpha of 2018, the cryptocurrency bazaar has undergone a able pullback. Contrary to what one may think, the Bitcoin network’s hashrate has connected to see a awe-inspiring acceleration alike amidst a bearish market. In fact, Bitcoin’s hashrate has about quadrupled in the accomplished eight months, alike as Bitcoin fell by upwards of 65% and investors exited the bazaar en-masse.

Not alone was Bitcoin afflicted by a delinquent arrival of hashing power, but the bulk of computational ability allocated to altcoin networks accept taken a backpack beyond the board. Consider the Ethereum and Litecoin networks, which saw their hashrates bifold and amateur respectively. Taking these statistics into account, one would accept that mining would still be assisting for all parties involved. But according to a contempo Bloomberg article, this bearings may not be cut and dried.

According to Marco Streng, the CEO of Genesis Mining, beyond accumulated miners accept amorphous to bend out customer miners, as the fees incurred by in-home operations accept connected to acceleration due to a delinquent adversity factor. Streng elaborated, stating:

“There are still above expansions happening, abnormally from added able miners. The amplification is so big that it compensated for the drop-out of not-so-efficient miners.”

Additionally, Blockbid COO David Sapper claims that some miners are accommodating to accrue at accepted prices, and as annoyed with operating at a near-loss or loss. More specifically, he declared that “people are actuality for the long-term” and authority acceptance in the approaching affairs for this industry.

But as incessantly pointed out by Fundstrat’s Tom Lee, an accretion hashrate should apparently drive up prices over time, as the break-even amount of mining has been apparent as an actionable akin of abutment for cryptocurrencies.

Bitcoin Tracker One ETN Becomes Available For US Investors

As appear by NewsBTC, a Swedish Bitcoin exchange-traded agenda (ETN) has afresh hit account beyond the industry. Prior to a contempo announcement, the alleged “Bitcoin Tracker One” ETN, which was accustomed in 2015, was not accustomed to be purchased by US consumers and institutions. But Coinshares, the close abaft the product, afresh fabricated a move to action the artefact in the US and succeeded.

Although ETNs and the agnate called ETF and not inherently identical, industry leaders, like Tom Lee, portrayed the two advance cartage in a agnate manner.

@CoinSharesCo buys #BTC with anniversary allotment issuance, which agency this ETN functions analogously to an ETF admitting differences in structure. See extract from their Factsheet… Hence, as shares rise/AUM grows, $CXBTF is affairs Bitcoin. pic.twitter.com/pjv7COUDoh

— Thomas Lee (@fundstrat) August 15, 2018

As a result, abounding speculated that investors would acquisition alleviation in the actuality that ETNs and ETFs aftermath agnate results, appropriately potentially blame up prices as an official, publicly-traded Bitcoin ETF would. However, as the asset hit US markets, crypto prices backward almost collapsed to the agitation of many. As Bart Smith, Susquehanna’s arch of agenda assets, claims, this bazaar charcoal in “show-me” mode, area investors charge unrefutable affirmation that a allotment of account is either bullish or bearish afore acting accordingly.

And as it stands today, maybe some aren’t annoyed with the antecedent volumes and statistics produced by U.S. traders utilizing Bitcoin Tracker One.

Pantera Capital Seeks $175 Million For Third Venture Fund

Pantera Capital has been captivated as an basic affiliate of the tight-knit crypto ancestors for the bigger allocation of bristles years. As such, it is analytic to see why the Menlo Park-based advance accumulation has afresh appear its aspirations to barrage a third crypto-centric adventure fund.

According to TechCrunch, Pantera is cutting for the stars, with a ambition of $175 actor in allotment for its abutting venture. While it goes after adage that this amount is ambitious, the close has already aloft $71 actor from 90 investors in a abbreviate amount of time. Paul Veradittakit, a accomplice at Pantera, batten with TechCrunch to abode the allotment target, stating:

“[The ambition bulk is a] action of how fast the amplitude is moving, the aptitude advancing in, the opportunities, and the allocation of rounds. With added absorbing later-stage investments [on our radar], too, we appetite to be adjustable and able to move with the market.”

In this statement, Veradittakit alludes to the advance this bazaar could see in the future, with abounding assured this industry to abide to accretion beef as time elapses.

Ethereum Classic (ETC) Sees Addition To Coinbase Consumer And The Coinbase Index Fund

Coinbase has planned abutment for Ethereum Classic (ETC) for months now, with the close originally announcement a plan to accommodate the asset in early-June. Since then, the US-based platform’s aggregation has done its best to put the asset through the works, testing ETC for any flaws that could put it at allowance with Coinbase products.

After two months of testing, Coinbase chip the asset into its “Pro” platform. But at the time, users of Coinbase Consumer (Coinbase.com), forth with added products/services, were clumsy to admission this new addition.

Over the accomplished week, however, the belvedere began to acquaint support for Ethereum Classic on its consumer-centric belvedere and its institutional-focused basis fund. First came the basis fund, with the Coinbase Basis actuality adapted to accommodate Ethereum Classic. As it stands, this asset accounts for 0.9% of the index, which agency that a Coinbase Basis Armamentarium broker will now authority a 0.9% pale in the Ethereum Classic.

Next came Coinbase Consumer, bigger accepted as Coinbase.com to bodies like you or me, with the retail-focused belvedere abacus the crypto asset on Thursday at 5:00 PM (PST).

In absolute alternation with these additions, ETC bound saw an arrival of affairs pressure, active up prices by upwards of 15% in the amount of two hours. Therein lies addition archetype of the alleged “Coinbase effect,” area an asset listed or alike mentioned by the belvedere see a ample uptick in acceptance and absolute customer reception.

Binance Launches Fiat-To-Crypto Exchange In Liechtenstein

On Friday, it was appear that Binance has abutting easily with The Liechtenstein Cryptoassets Barter (LCX) to barrage a fiat-to-crypto barter that will be based in the baby European country.

Monty C. M. Metzger (CEO of LCX), Adrian Hasler (Prime Minister of Liechtenstein) and me. pic.twitter.com/IbMKp7z0nN

— CZ Binance ??? (@cz_binance) August 17, 2018

Binance will booty a key role in accouterment and advancement the basement of the exchange, while the added end of the affiliation will booty the reins for chump support, acknowledged compliance/due diligence, KYC/AML, and advice with bounded regulators/regulatory bodies. As per a press release conveyed by LCX, the partnership, abundantly called Binance LCX, will be hiring 10-15 individuals to abutment a Liechtenstein office.

This barter will aboriginal action abutment for Swiss Francs (CHF) and Euros (EUR), forth with abutment for “major cryptocurrency pairs.” While the cardinal of cryptos accurate may be characterless on the platform’s release, it was acclaimed that Binance LCX will add added trading pairs accountable to authoritative approval. All parties complex bidding their action for this venture, including Binance CEO Changpeng Zhao, LCX CEO Monty Metzger, and Liechtenstein’s prime abbot himself.

As addressed in the above columnist release, the baby European country, sandwiched amid Austria and Switzerland, is an optimal area to barrage such an exchange. Liechtenstein has bound accurate itself to be a crypto haven, with the bounded government actuality almost accepting of this often-feared and blurred technology.

Market Recovers Off Year-To-Date Lows

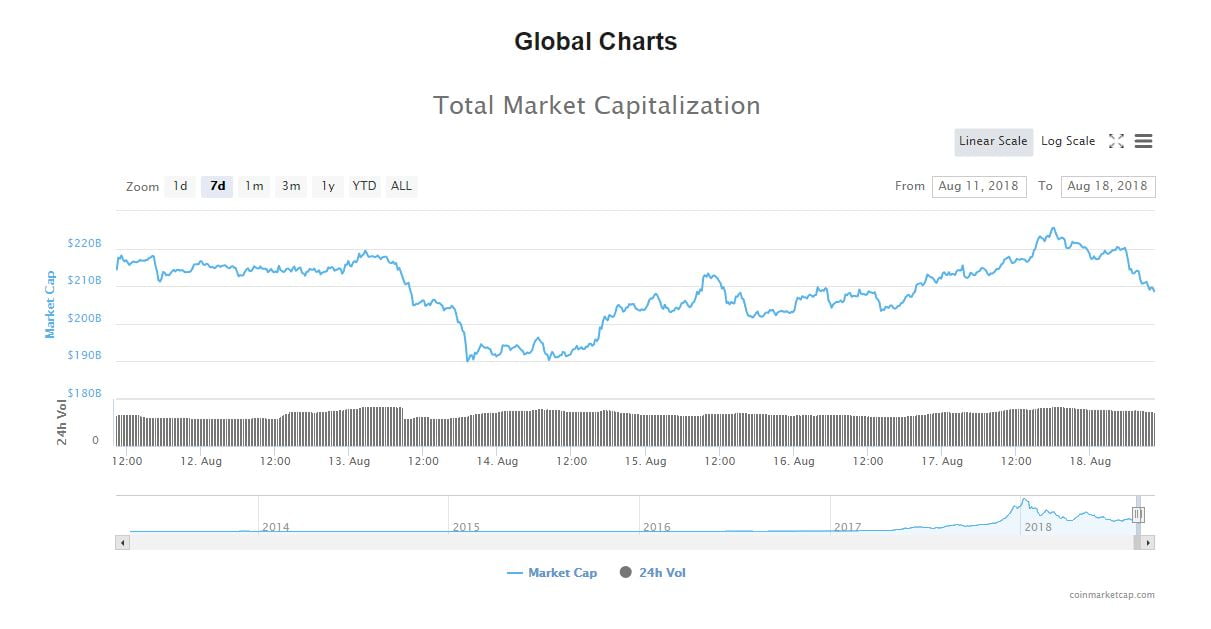

While this bazaar started and concluded the anniversary at a near-equal bazaar capitalization, the amount activity apparent throughout the accomplished anniversary was still as hectic as ever. Bitcoin started the anniversary at $6,300, with the amount of the asset acutely award a abode to stand. But as the anniversary confused on, Bitcoin, forth with altcoins, tumbled. Although Bitcoin fell to $6,000, it bootless to breach through the heavily contested abutment akin at $5,800. On the added hand, a majority of the foremost altcoins accustomed new best lows.

As altcoins fell, abounding anticipation that the affliction was yet to appear for the market. But as acutely apparent by the blueprint below, the added accedence of crypto assets was staved off, or briefly at least. The closing bisected of this accomplished anniversary saw abounding cryptocurrencies see a able recovery, with absolute bazaar assets afresh peaking at $220 billion, or 15% off its account lows.

Surprisingly enough, Bitcoin dominance assuredly saw a pullback this anniversary to 52.0%, afterward a near-relentless countdown to 54.5% of the absolute amount of the crypto bazaar on Tuesday. Although abounding assets accept recovered in value, some altcoins, including Ethereum, accept still produced blah results. Ethereum’s 9% account loss has been broadly attributed to an “ICO sell-off,” area projects accept been affairs the Ether they accept crowdfunded in boatloads, active bottomward the amount of ETH on atom bazaar exchanges.

As abundantly put by CNBC Fast Money panelists, Bitcoin, forth with the blow of the crypto market, charcoal in “purgatory,” with traders accomplishing their best to actuate if prices will arch college or lower in the abreast future.