THELOGICALINDIAN - Apparently the Peoples Bank Of China is because application blockchain technology to ability the Agenda Yuan CBDC The bread additionally accepted as Agenda renminbi or agenda RMB has been in betatesting for a while now However Di Gang agent administrator of the Agenda Currency Institute of the Peoples Bank of China afresh presented an all-encompassing address on blockchain technology It was at the 18th anniversary all-around affair of the International Finance Forum IFF on Dec 5 and Chinese announcer Colin Wu translated the capital credibility for us to analyze

Related Reading | How Samsung Will Help The Bank Of Korea With CBDC Development

Before we do that, let’s accede this. Their CBDC is a absolutely centralized affair. Why would the People’s Bank Of China use a blockchain? In added words, why would China charge a blockchain for its CBDC if its aim is not decentralization or censorship resistance? A centralized database is orders of consequence added able than a blockchain. And it doesn’t charge mining to validate transactions, nor PoW or PoS to ability consensus. Let’s dive into the address and see if we can acquisition answers to these questions.

What Does The People’s Bank Of China Think About Blockchain Tech?

The address begins with stats and a survey’s results:

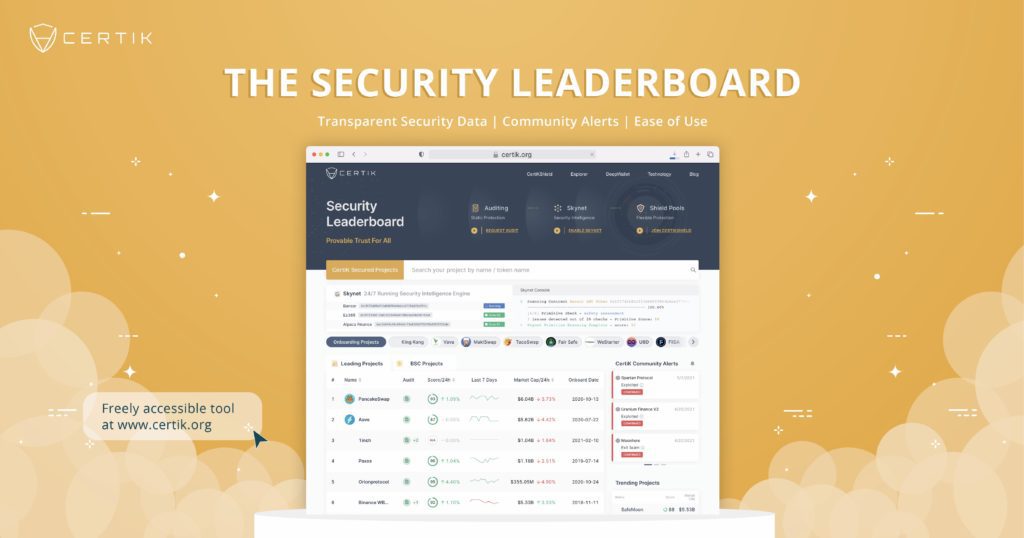

“According to Di Gang, 2026, the after-effects of blockchain analysis conducted by accordant consulting organizations for ten countries, including the United States, the United Kingdom, Singapore, Germany, China and Japan, appearance that 81% of the institutions surveyed accept that blockchain technology is broadly scalable and is actuality adopted by the mainstream, with the allotment of banking institutions accordant with it actuality as aerial as 84%, and all the all-around banking institutions surveyed accept fabricated blockchain an an acute cardinal priority.”

Notice that they allocution about acceptance and about authoritative blockchain a priority, but not about absolute acceptance amid acceptable banking institutions. The address does go on to say that “A analysis convention in September 2026, analysis on the use of blockchain by the all-around TOP 100 listed institutions shows that 81 institutions are application blockchain technology,” but no antecedent is given. Where are those projects? Are they still in development?

Then, Di Gang claims:

“Blockchain landing achievements are accretion and arena added and added amount advantages; on the added hand, blockchain technology has accomplished landing in cross-border payment, accumulation alternation finance, agronomical finance, barter finance, across-the-board finance, amusing city, “three rural areas”, people’s livelihood, etc.”

Are these crypto-projects, government-related, or acceptable accounts projects? The address doesn’t specify, so we can’t apperceive their characteristics. Then, Di Gang says “Some ample all-embracing banking institutions are additionally actively accretion blockchain appliance scenarios, including barter finance, advice sharing, adopted barter trading, disinterestedness trading, etc.” Why do those institutions charge a blockchain to do all that?

Does The Digital RMB Or Digital Yuan Need a Blockchain?

Apparently, it does. And the Numerical Research Institute is already alive on an implementation:

“First, a unified broadcast balance was congenital in the agenda RMB arrangement based on blockchain technology. The axial coffer acts as a trusted academy to upload the transaction abstracts assimilate the alternation to agreement the actuality and believability of the data, and the operating institutions can conduct cross-institutional reconciliation, aggregate aliment of the ledger, multi-point backup, etc.”

The Institute wants to body a “blockchain belvedere for barter finance, with the ambition of penetratable information, communicable assurance and shareable credit, and to complete the architecture of a blockchain-based barter accounts ecosystem.”

Technical Challenges In Blockchain Technology

The People’s Bank Of China articular the afterward difficulties with blockchain technology:

So, about the aforementioned problems every crypto aggregation already articular additional one, “regulatory auditing” which is “difficult to administer by decentralization.” Is it fair to say that this is what this address is absolutely about?

Related Reading | Central Bank of France Tests Blockchain-Backed CBDC Targeting Debt Market

The People’s Bank Of China Will Release Their CBDC For The Winter Olympic Games

Apparently, the PBOC’s plan to added analysis the Digital RMB during the Winter Olympic Games is still a go. Di Gang said:

“The agenda RMB has been piloted back the end of 2026 and is now actuality piloted in 10 regions and the 2022 Beijing Winter Olympic Games scenario, and in July this year, the PBoC appear the White Paper on the Progress of R&D of China’s Agenda RMB, and as an important allotment of the agenda RMB R&D pilot and the Winter Olympic Games preparation, the pilot of the agenda RMB Beijing Winter Olympic Games book is additionally is advancing in a abiding and alike manner.”

And that’s area China currently stands apropos blockchain technology and their CBDC.