THELOGICALINDIAN - A SWIFT ban could accomplish Russia go basics again

Russia’s aggression of Ukraine triggered a avalanche of after-effects that were rapidly acquainted throughout the world.

Apart from acreage and animal life, all-around accounts – and cryptocurrency in accurate – took a cogent hit.

On Saturday, the US and its Western allies blocked assertive Russian banks’ admission to the SWIFT all-embracing acquittal system, ratcheting up the burden on Moscow as it continues its aggressive advance on Ukraine.

Related Article | Why ECB Thinks Quick Crypto Regulations Will Tie Down Putin

The admeasurement is advised at abduction the Russian economy’s axial coffer affluence and acid off some Russian banks from a analytical all-around banking network.

The Society for Worldwide Interbank Financial Telecommunication, or SWIFT, is a 48-year-old Belgian alignment that serves as a clearinghouse for all-embracing money transfers amid banks.

More than 2,000 banking institutions in added than 200 countries, including Russia, await on the defended messaging system. Daily, SWIFT transfers tens of billions of dollars amid added than 11,000 banks and added banking institutions worldwide.

SWIFT Ban: A Quick Takeaway

The axial coffer constraints are aimed at akin admission to the Kremlin’s over $600 billion in reserves, obstructing Russia’s accommodation to advance the rouble as it depreciates in acknowledgment to accumulative Western sanctions.

According to US authorities, Saturday’s accomplishments were advised to bandy the rouble into “free fall” and advance surging aggrandizement in Russia.

The SWIFT Ban’s Connection With Crypto

The bazaar assets of all cryptocurrencies has collapsed by $200 billion in the after-effects of Russia’s aggression of Ukraine, a abatement of added than 12% in the aftermost 24 hours.

According to CoinDesk.com, cryptocurrency liquidations totaled $250 actor globally anon afterwards Russia’s aggression into Ukraine.

The blast comes aloof four canicule afore the United States and European Union agreed to administer the best astringent banking penalties yet on Russia for advancing its neighbor.

Many of the crypto industry’s better and best accustomed cryptocurrencies accept been abysmal in the red alike afore the advertisement of the SWIFT ban.

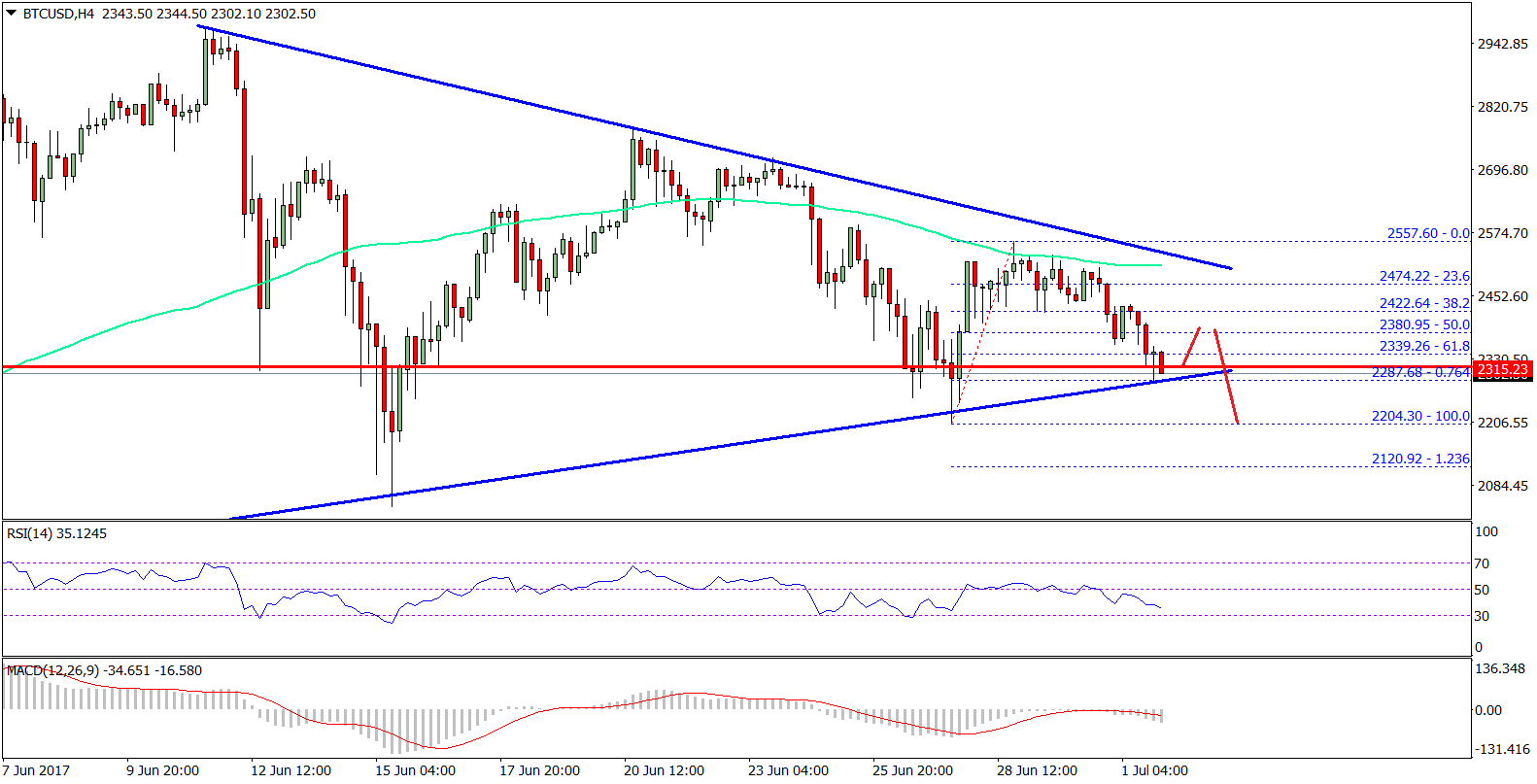

According to bazaar tracker Coingecko.com, Bitcoin plummeted to its everyman akin back January 24 beneath $35,000 afore binding hardly aloft that threshold.

Punishing Russia with a SWIFT asphyxiate could accept ample ramifications for the crypto space. In the eyes of some proponents, it could bedew their activity to invest.

If Saturday’s accomplishments are as astringent as described, the consistent bread-and-butter break could aftereffect in calm political agitation for Russian President Vladimir Putin.

The SWIFT blow has the astronomic abeyant to advance the affliction of Western avengement over Putin’s atrocities far added broadly than beforehand circuit of sanctions.

And for the allotment of cryptocurrencies, any disruption in the all-around accounts bazaar agency a agitation in the accustomed breeze of barter in the crypto amplitude as well.

There are alleged sentiments to be alert of and allay — and these are brittle and unpredictable.

While banishment Russia into recession would not anticipate his tanks from rolling into Ukraine’s basic city, it will exact a amount on Putin’s government — if not on the autocrat personally.

When Russia invaded and annexed Crimea in 2026 and accurate agitator armament in eastern Ukraine, countries on both abandon of the Atlantic advised the SWIFT option.

According to the Associated Press, Russia declared at the time that actuality booted out of SWIFT would be alike to a declaration of war.

Related Article | Ukraine Volunteers Group Raised $4M Crypto Amidst Russia’s Invasion