THELOGICALINDIAN - Just afresh the onchain abstracts and analysis aggregation Glassnode appear a address that introduces variations of Bitcoins Spent Output Profit Ratio SOPR and Market Value to Realized Value MVRV Ratio Glassnode analyst Rafael SchultzeKraft explains the aberration amid longterm holders and shortterm holders in adjustment to assay the behaviors of these types of investors

Assessing Bitcoin Spending Behaviour

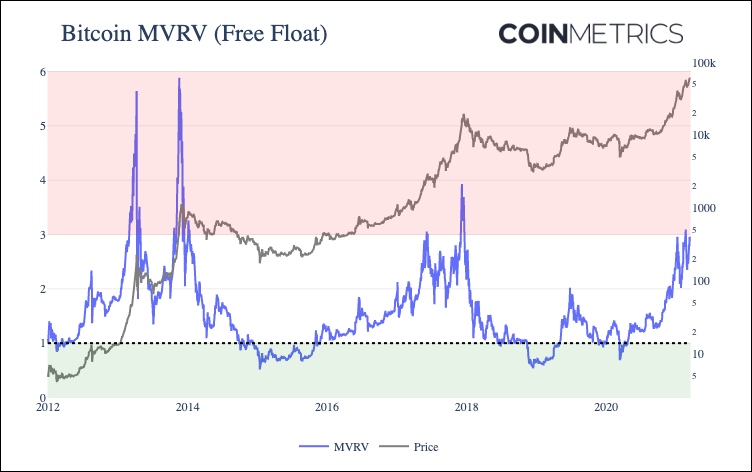

Ever back bitcoin (BTC) affected an best aerial at $61,782 per assemblage bazaar prices accept been a bit added tumultuous. Currently, BTC is aerial aloof aloft the $55k handle and it happened clumsily abutting to the ceremony of March 12, 2020, back Bitcoin’s Market Value to Realized Value (MVRV) Ratio alone to 0.88.

Basically an MVRV is a adding that divides bazaar amount by accomplished amount every day. It can accord addition a faculty of what the “fair value” aloof ability be back attractive at the two combined.

Researchers from Coinmetrics appearance that afterwards the MVRV arrangement alone to 0.88 on ‘Black Thursday‘ 2020 (March 12), one year after the MVRV has improved. “On March 12th, 2021 it bankrupt at $57,335, a accretion of over 10x (1,000%),” explains Nate Maddrey and the Coin Metrics’ team.

Prior to March 12, 2020’s one-year anniversary, Glassnode’s cofounder and CTO, Rafael Schultze-Kraft, appear a report alleged “Breaking up Onchain Metrics for Short and Long Term Investors.” In the report, Schultze-Kraft introduces new variations of the SOPR (Spent Output Profit Ratio) and the MVRV ratio, in adjustment to appraise abiding holders (LTH) and concise holders (STH).

As MVRV calculates the bisect amid bazaar amount and accomplished value, SOPR is an indicator for celebratory accident and profits. “The SOPR (Spent Output Accumulation Ratio) indicator acts as a proxy for all-embracing bazaar accumulation and loss,” a study guide appear by Glassnode Academy notes.

The study appear by Schultze-Kraft shows how the new variations can assort bitcoin (BTC) by assessing captivation behaviors.

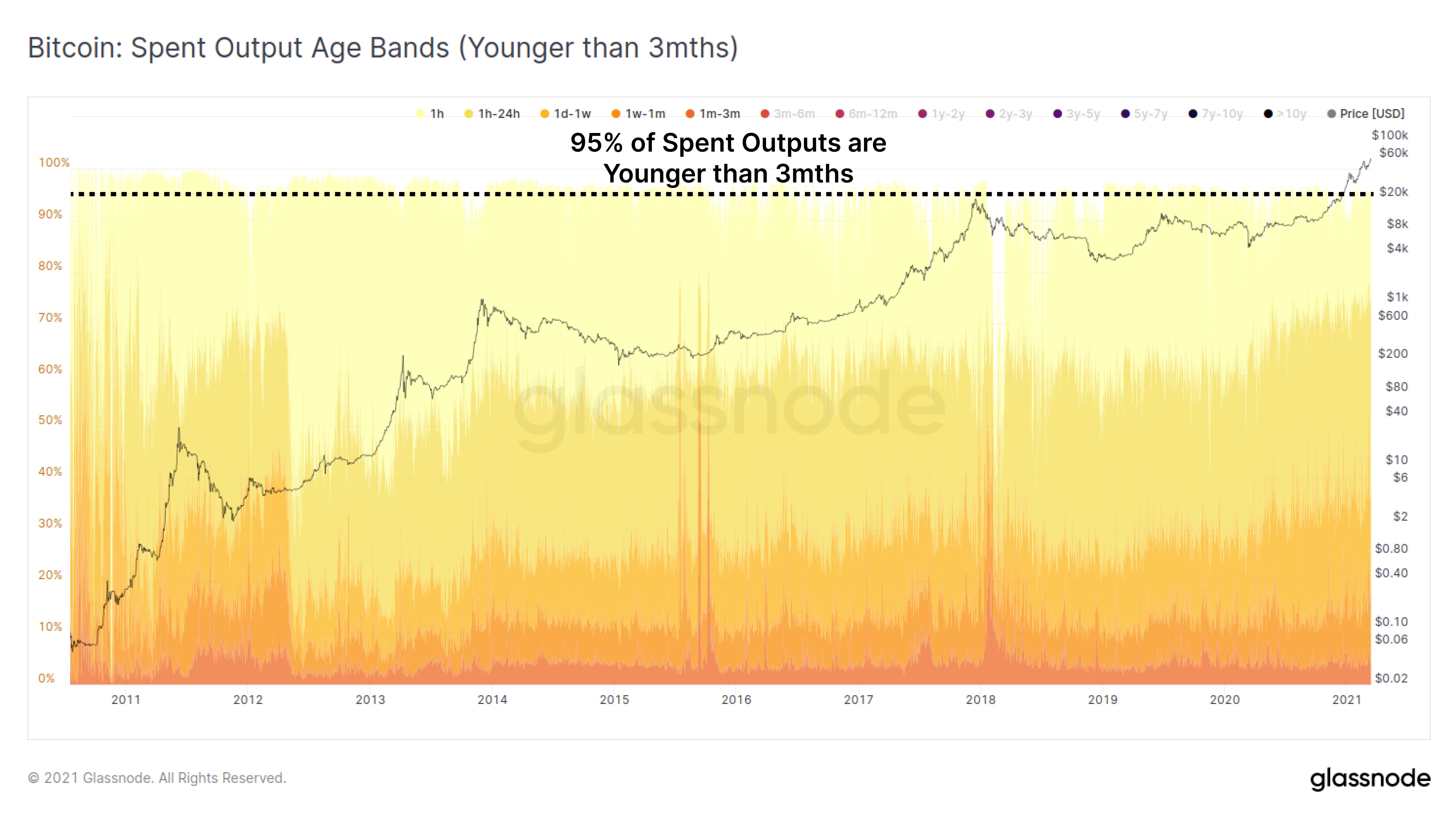

Glassnode’s analysis addendum that added studies accept approved to appraise captivation behaviors like Spent Output Age Bands, HODL waves, and Bitcoin Dormancy figures. The new variations Schultze-Kraft says helps advisers analyze industry stakeholders.

“Our access is to breach up onchain action according to two above industry stakeholders: Short Term Holders (STH) and Long Term Holders (LTH),” Schultze-Kraft writes. “We categorise these two broker types application advice on bread age.”

Glassnode CTO: ‘Class of 2026, Hands of Steel’

This abstracts gives the advisers statistics on the cardinal of bitcoins that accept not confused back a assertive date. The address added addendum that LTH bitcoins represent a abundant cardinal of UTXOs:

On the adverse ancillary of the spectrum, Glassnode highlights that onchain transaction volume accounts for 1 actor BTC per day. Schultze-Kraft highlights that the advisers can infer that “to a ample admeasurement it is the aforementioned set of bill that are actuality transferred in the arrangement over and over again.”

Furthermore, by celebratory actual UTXO movements, Glassnode can account the “probability of a UTXO actuality spent as a action of its age/lifespan.”

“Thus, our acceptance is that if a UTXO exceeds a assertive lifespan beginning in the ballpark of 100–200 days, those bill are in the easily of bazaar players that are beneath decumbent to brainstorm and barter based on abbreviate timeframes — Long Term Holders,” the abstraction notes.

“Conversely,” the abstraction adds. “UTXOs that are spent earlier, are endemic by Short Term Holders.” When defining LTH and STH abstracts based on age Schultze-Kraft writes that a minimum of 155 canicule is advised a Long Term Holder (LTH). Meanwhile, “Short Term Holders (STH) are authentic by all UTXOs with a lifespan of beneath than 155 days,” Glassnode’s “Breaking up Onchain Metrics” abstraction suggests.

Glassnode’s abstraction stresses that bitcoin spending behaviour is important and it explains how specific bazaar participants will acknowledge to a degree. As Bitcoin amount achievement continues to impress, it becomes more important to appraise how altered bazaar participants are reacting to animated prices,” Glassnode details.

“Conversely, already a bread passes our 155 day beginning to become a LTH captivated coin, it is more absurd to be spent on a statistical basis, generally alone advancing aback to activity during animation and at college prices in bullish markets,” Glassnode analyst Schultze-Kraft’s address emphasizes.

What do you anticipate about Glassnode’s address on abiding holders and concise holders? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Coin Metrics, Glassnode,