THELOGICALINDIAN - A privatelyheld advance close from Chicago Marlton Partners has apprenticed Grayscale Investments to embrace the adapted Dutch bargain breakable action for GBTC shares According to Marlton such a breakable action would materially attenuated if not annihilate the abatement to net asset amount NAV This in about-face offers stockholders aplomb in the sponsors adeptness to administer the funds discount

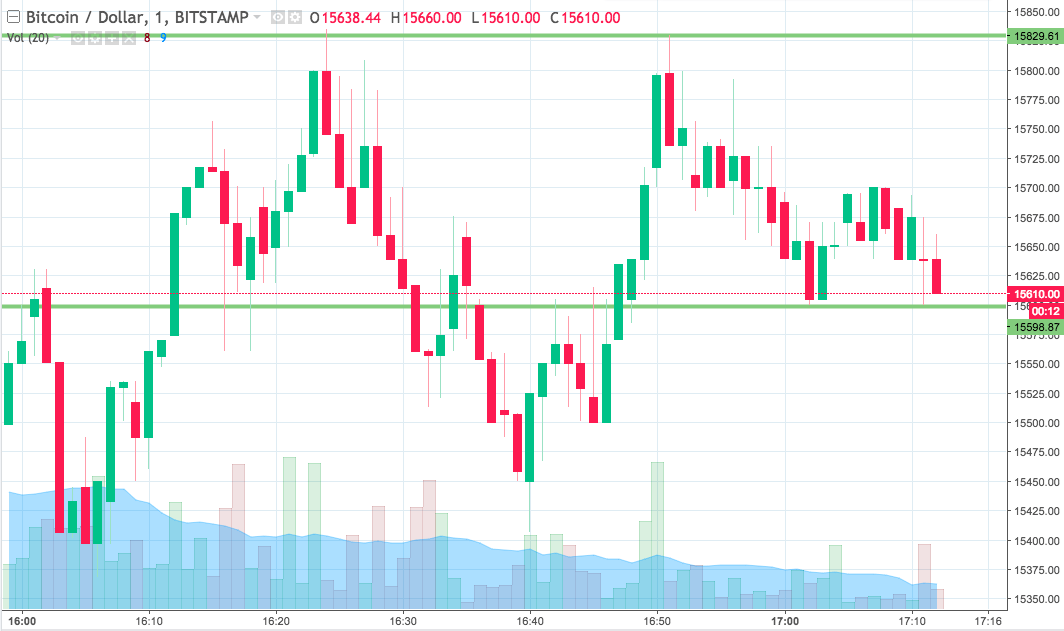

Billions in Lost Value

Despite GBTC’s aggressive advantage as the world’s better bitcoin fund, GBTC shares abide to barter “at a cogent abatement to NAV.” According to Marlton Partners, this abatement on NAV “currently represents over $3.1 billion in absent amount to assurance stockholders.”

Meanwhile, in an open letter addressed to the Grayscale Investments management, Marlton Partners’ managing member, James C. Elbaor, insists that accepted efforts to annihilate the abatement accept been accurate to be inadequate. To bolster this argument, Elbaor credibility to Digital Currency Group (DCG)’s contempo announcement of affairs to acquirement up to $250 actor account of GBTC shares. In the letter, Elbaor said:

According to Elbaor, the market’s acknowledgment to the advertisement by DCG already proves the disability of such an accustomed purchase. At the time of writing, the abatement on GBTC shares had widened to 11.45%.

The Modified Dutch Auction Tender Offer

In the meantime, Elbaor claims that Marlton’s proposed breakable action arrangement gives “stockholders the adeptness to advertise their shares for a defined price.” He says this can be done “within a accurate window of time for an offered amount at a exceptional to the bazaar amount and (is) accidental aloft a minimum or a best cardinal of shares sold.”

Further, the managing affiliate tells Grayscale that “a bright basic allocation plan via a breakable action in GBTC, will analyze you and GBTC as the sole agenda bill asset administrator creating stockholder amount aces of their 2% administration fee above sole agenda bill exposure.”

Meanwhile, Elbaor says while he expects these conversations (with Grayscale) to be productive, he insists Marlton Partners “reserves all rights to booty added activity in adjustment to assure our investments and those of added stockholders.”

Do you accede that an bargain action arrangement will annihilate the abatement on GBTC shares? Tell us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons