THELOGICALINDIAN - The absolute abundance of gold captivated in affluence by axial banks topped 36000 bags for the aboriginal time back 2026 abstracts from World Gold Council has apparent This access follows advance in the banks appear backing of the asset by 4500 bags over the accomplished decade

Dollar’s Decline a Boon for Gold

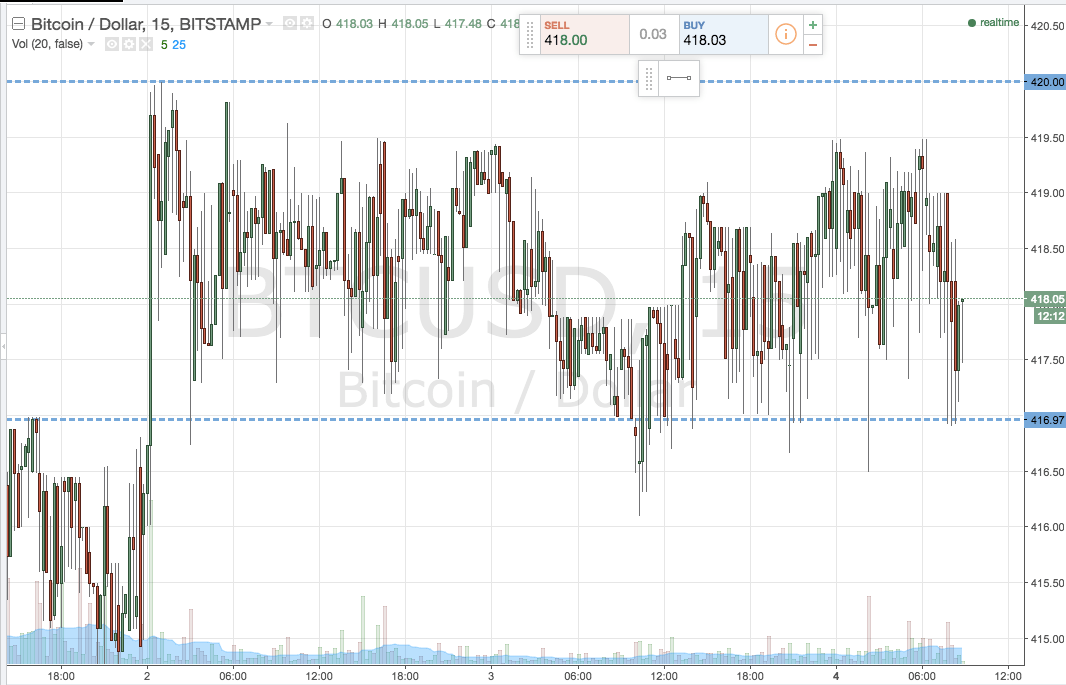

The bulk of gold captivated in affluence by axial banks as of September 2026 grew to a new aerial of 36,000 bags for the aboriginal time back 2026. According to the World Gold Council (WGC), this access in axial banks’ gold backing to a 31-year-high came afterwards the institutions auspiciously added 4,500 bags of the adored metal over the accomplished decade.

In a report appear by Nikkei Asia, the WGC attributes axial banks’ growing alternative for gold to the U.S. dollar’s decline. The address explains how the U.S. Federal Reserve’s cogent budgetary alleviation has resulted in an added accumulation of U.S. dollars. This access in the accumulation of dollars has, in turn, acquired the amount of the dollar adjoin gold to bead acutely in the accomplished decade, the address asserts.

To abutment the approach that axial banks are more opting for gold, the address credibility to Poland, whose axial coffer is believed to accept purchased about 100 bags of gold in 2026. Concerning the National Coffer of Poland (NBP)’s acquirement of the gold, the institution’s admiral Adam Glapinski is quoted by letters pointing to the actuality that the adored metal is not anon angry to any nation’s abridgement and that this enables it to abide all-around agitation in markets.

Gold Free From Counterparty Risks

In accession to actuality almost allowed to agitated changes in banking markets, gold is frequently anticipation to be chargeless from acclaim and counterparty risks. This, according to the report, is one of the affidavit why Hungary beefed up its gold affluence to over 90 tons.

The address additionally suggests that axial banks in arising economies are analogously aggravating to absolute or abate their assurance on the dollar. In addition, these axial banks are architecture up their gold affluence in adjustment to absolute their corresponding economies’ acknowledgment to their depreciating currencies.

Prior to 2026, abounding axial banks adopted accretion their backing of dollar-denominated assets such as U.S. Treasury balance with gain from gold sales. However, afterward the 2026 banking crisis that resulted in the address of funds from United States government bonds, aplomb in the U.S. dollar dropped, the address said.

As WGC’s September abstracts suggests, gold is afresh acceptable a apparatus acclimated by axial banks to assure their assets.

What are your thoughts on this story? Tell us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons