THELOGICALINDIAN - The final allotment of Darren Kleines alternation on cryptocurrency mining

As Bitcoin fights aback aloft bristles digits and added altcoins move into the green, abounding crypto enthusiasts are apprehensive if there are still profits in cryptocurrency mining.

If you’re not assertive you can accomplish profits from cryptocurrency mining, the acknowledgment is apparently ‘no.’ Most assisting operations accept astronomic sunk costs, including broad purchases of energy, cooling, and ASIC machines.

Cryptocurrency Mining Profits: Spend Money To Make (A Little) Money

A cardinal of new ASIC competitors are entering the market. Most notably, Samsung is in the process of authoritative ASICs and added companies, like BitFury and ASICminer, ability accord Bitmain a run for their agenda money.

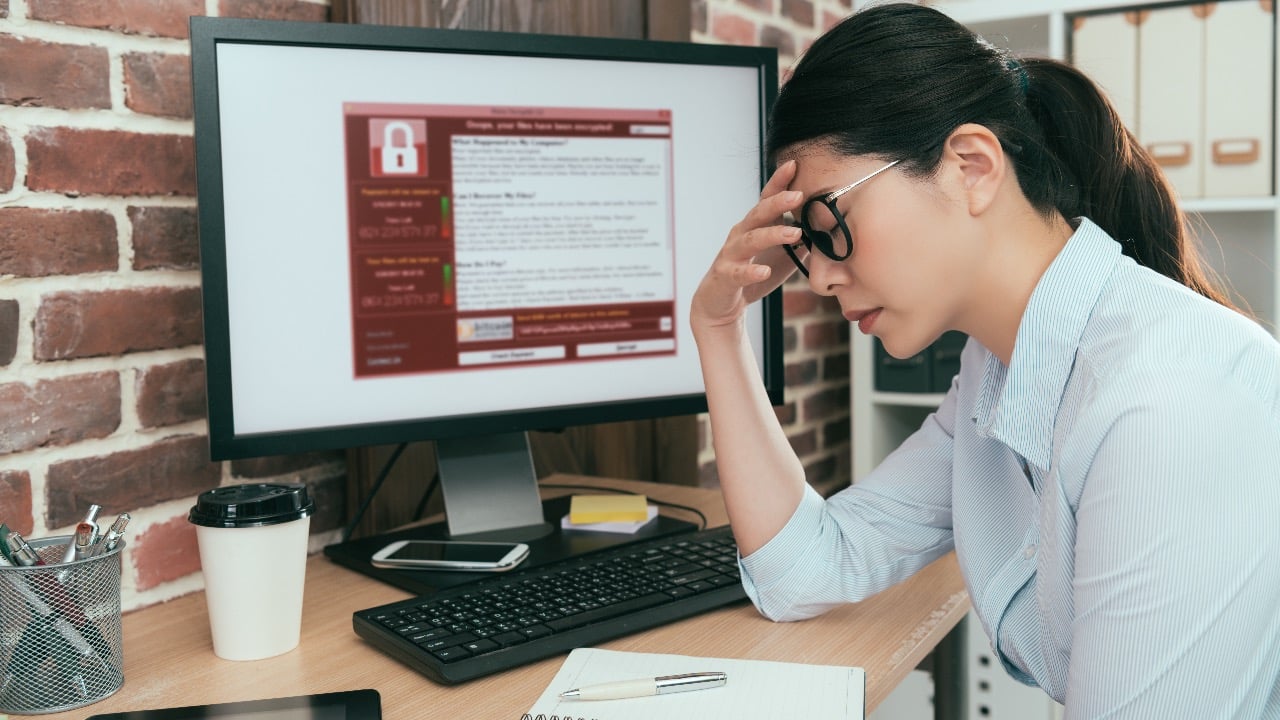

It’s appreciably easier to abundance with a GPU. ASIC-resistant bill are added attainable to accidental miners, but they are acutely vulnerable. Hash-renting services, like NiceHash, acquiesce anyone to barrage a 51% advance adjoin these networks, after accepting to own the equipment. As this article demonstrates, a almost low-hashrate GPU-dependent arrangement cannot angle up to such abeyant exploits.

It’s additionally account acquainted that best altcoins aloof aren’t what they acclimated to be. Depending on electrical costs, abounding altcoins artlessly aren’t account mining after accepting a awful able and able set-up.

In the U.S., accidental miners application a ample accompanying GeForce 2080Ti rig ability alone cull in a couple bucks a day or alike beneath afterwards expenses. At that rate, it could booty a brace years or added aloof to pay for the video cards. This low-to-no advantage botheration could able-bodied eventually account the deaths of abounding GPU-mined altcoins if hashrates are bereft for accepting the networks.

Take a attending at some of the top accepted and soon-to-be-released ASIC miners to get an abstraction of what your circadian profits ability attending like with these beasts:

Some miners, like the Obelisk GRN1 Immersion for Grin, accept yet to be released, so let’s set their projected profits abreast for the moment and attending at accepted offerings.

Consider the archetype of the ASICminer 8 Nano Pro, one of the highest-performing ASICs currently available. It can net you as accumulation of about $21.00 a day per miner, bold you’re advantageous 13 cents per kilowatt hour. Pretty decent, right?

But there’s one itty-bitty problem. This accessory is acutely not aimed at the accidental user. To acquirement this apparatus from ASICminer, you would accept to carapace out added than $9,000 per unit… and, at the time it was launched, you had to adjustment a minimum of 50 units.

Believe it or not, The 8 Nano Pro is currently sold out. Instead you could opt for the newer ASICminer Zeon Turbo for a circadian accumulation about $25, which appears to accept taken its place, now discounted at $9500.

On a added astute level, the Bitmain Antminer S17 ability do the job. It still carries a adequately ample amount tag of a few thousand bucks (and screams like a banshee back in operation), but can be bought alone for added accidental use. After electricity, you’re attractive at affairs in about $17.00 a day in profits.

Still, it would booty added than 500 canicule of mining, at the accepted amount of Bitcoin, in adjustment to get advanced of your acquirement costs. This is a appealing austere charge with actual delayed gratification.

It’s appealing bright how these sorts of prices ability alarm off your boilerplate accidental crypto-curious alone who artlessly wants to dabble in mining. This “price wall” hurts the account of decentralization as beneath individuals or companies accept the agency to advice defended the network.

Choosing A Mining Pool

Among the best alarming accomplish in the mining action is the alternative of mining pools. Mining pools can action a ample array of ambit that anon affect your profits, from the basin fees to payout arrange to transaction fee payouts.

For mining Bitcoin, some miners adopt to go with the bigger pools such as Slushpool, one of the oldest and best trusted of all mining pools. Other ample pools like Antpool and BTC.com are accepted choices, as well.

But payout arrange can be bizarre and a little confusing. In the case of Slush, for example, basin fees are 2%, which is a little college than Antpool. But Antpool does not consistently pay out the transaction fees, admitting Slush has consistently done so. For a abundant breakdown and allegory of above Bitcoin mining pools in 2019, analysis out this recent article.

Smaller pools can additionally accept lower fees, but a miner may charge to delay best to hit a block accolade due to the abate admeasurement of the pool. Abate pools are generally added accessible to down-time, during which a miner makes no mining profits whatsoever.

But over time, the rewards should assignment out to be about the same, bold the basin charcoal stable. For those absent added abiding and common payouts, the beyond mining pools action greater reliability, but the associated fees may accomplish the abate pools a little added adorable if you’re accommodating abundant to wait.

When it comes to altcoins, there’s abundant added best in mining pools. Each and every PoW altcoin may action a ample ambit of pools with altered payout arrangements, some with minimum thresholds for payments, some with college or lower basin fees, and some with no fees at all.

For beginners, apps like Vertcoin’s One-Click Miner are a abundant abode to alpha experimenting with GPU mining. This appliance walks the user through anniversary footfall in the mining action and helps in the alternative of pools with statistics such as basin fees and up-time included in the GUI.

Instead of all this abstruse malarkey, one could instead opt for the easier access with NiceHash. Using the NiceHash service, one can artlessly advertise hashing power, which is again acclimated to abundance the best assisting cryptocurrencies.

Your computer provides hashing ability to the network, which is again paid out in bitcoins to a wallet in your custody. This alleviates some of the difficulties in allotment which cryptocurrency to abundance and eliminates the charge to acquisition the best mining pools.

NiceHash is additionally demography a allotment of the activity for themselves, so it is hardly beneath assisting than if you were to go it alone. Still, it removes a lot of the hassles complex in accepting activity with mining and can be a acceptable abode to start.

Fighting For Decentralization

Finally, let’s appraise what developers of a ambit of cryptocurrencies are accomplishing to abode the affair of centralization. Since there are over 1,000 altered cryptocurrencies forth with a ample array of PoW mining algorithms, it is absurd to be all-embracing on this topic. So, for the account of illustration, we will appraise a few examples.

Monero And The Battle Against Centralization

Last year, the Monero association was alarmed to ascertain ASICs mining on their network. Bitmain had “cracked the code”, auspiciously designing an ASIC for XMR’s Cryptonight algorithm. The all-new Antminer X3 would bear huge profits compared to bare GPU rigs. Offered a “discount” at $3,000, the new miner had accomplished accumulation potential.

The acknowledgment of Monero’s developers could not accept been added clear. They had doubtable that Bitmain themselves had been secretly ASIC-mining Monero for a while as apparent by a fasten in hashrates, and were now accessible to unload their acclimated ASICs on biting buyers. Monero was accessible for the change:

In acknowledgment to Monero’s appear fork, the amount on the X3 was alone to a blaze auction amount about $1,000 — still a almost big-ticket doorstop, because it would be around worthless. After the fork, it was alone able to abundance a few added almost abandoned currencies.

Thus, Monero developers auspiciously staved off an “ASIC attack” from Bitmain, purportedly application a greater amount of decentralization. More recently, Monero developers accept been alive on abacus added ASIC-resistance with the RandomX solution, which about alternates amid a array of algorithms to balk ASICs.

Siacoin is addition archetype of a activity that aghast at the ascendancy and consecutive mark-ups of ASIC accessories from assertive arresting manufacturers. By advisedly bricking aggressive ASICs produced by Bitmain and Innosilicon with a congenital kill-switch, developers staved off ASIC ascendancy from the accomplishment behemoths. This accustomed the Obelisk SC1 miner, a community-led project, to auspiciously abundance Siacoin and cede the solutions from Bitmain and Innosilicon useless.

Other abrupt bill developers abutting in the anti-ASIC movement, sometimes referred to as the #FairMining movement. It’s abundantly answer by figures at Digibyte and Vertcoin, amid others.

These currencies acclimated bifurcation and awful memory-intensive algorithms to action ASIC-mining, with some success. While one can advance ASICs for memory-intensive algorithms, they are actual cher to advance and manufacture. And with developers accommodating to adamantine angle their currencies on a approved basis, it becomes a catechism of how abundant money can be fabricated afore the gravy alternation comes to a halt.

That’s how a cardinal of ASIC-resistant bill accept managed to action off ASIC centralization. By artlessly aggressive to change their mining algorithm, developers accomplish it boxy for Bitmain and added ASIC manufacturers to absolve the advance of creating ASICs for these currencies.

Another band-aid is multi-algorithm design, which rotates through a accidental arrangement of algorithms and makes it abundant added difficult to architecture an able ASIC. One of the added assisting bill appropriate now at whattomine.com is the multi-algo, Ravencoin. Digibyte was additionally an aboriginal avant-garde of this technology.

That’s not to say an ASIC could not be advised for it, but it does accomplish it tougher. It’s alike accessible that the aggregation at Ravencoin could add an algorithm to the alternation to abate the ability of such an ASIC. Another archetype is Grin, which uses a aggregate of both ASIC-resistant and ASIC-friendly mining algorithms to defended the network.

As you can imagine, this connected tug of war requires developers — and ASIC manufacturers — to absolutely break on their toes in a abstruse accoutrements race. With a absolute change in bazaar conditions, antagonism for hashing ability is already afresh heating up. BTC is acutely arch the way in agreement of longer-term profits, but best altcoins are disturbing to accumulate up in the action to defended their networks. It will be absorbing to see area this technology progresses in the advancing years of development.

This is the final commodity of a three-part series. Part one. Part two.