THELOGICALINDIAN - Japans Customer Affairs Agency CAA has appear its 2026 address and acclaimed a cogent fasten in inquiries apropos cryptocurrency accompanying issues aftermost year The address capacity a 70 access in 2026 in attention to customer queries abundantly stemming from barter issues Moreover over the aftermost two abode of 2026 the Japanese yen commutual with assorted cryptocurrencies like BCH and BTC has been aggressive steadily assuming the country has a lot of appeal for agenda assets

Also read: Policymakers Meet to Finalize Global Crypto Guidance – A Look at Standards G20 Supports

CAA Report: Crypto-Related Inquiries Spike by 70% in 2026

Over the aftermost few years, Japan has been a axis for cryptocurrency innovation. Things absolutely started heating up afterwards Japan’s Financial Services Agency (FSA) clearly appear that Bitcoin was accustomed as a acknowledged adjustment of acquittal on April 1, 2017. Since then, there accept been lots of crypto-related business developments, regulations formed, and crypto exchanges launched in the Pacific island nation. This anniversary Japan’s Customer Diplomacy Agency (CAA) appear its 2019 customer diplomacy address which touches aloft inquiries and complaints surrounding the agenda asset industry.

The latest CAA report has not yet been absolutely translated by the agency, but asperous translations acknowledge that in 2018 there were almost 3,657 cases that were tethered to cryptocurrency barter complaints. The cardinal represents a 70% access in adverse to the above-mentioned year back there were 2,166 queries and complaints complex with agenda currencies. The CAA has apparent a constant access in queries back 2014. For instance, the cardinal surpassed the antecedent year by 3.5X and 1.7X added than the year prior. Lots of complaints and queries acquired from barter barter who had issues accepting funds afterwards advantageous and added complaints declared user-side hacks. Added inquiries asked the CAA about agenda assets in accepted and the believability and acceptability of assertive exchanges.

Despite Increasing Crypto Regulation, Digital Assets Continue to Trend in Japan

In accession to this news, a recent study from the Block’s Larry Cermak has apparent that abaft U.S. barter visitors, Japan leads with the world’s additional accomplished cartage to common exchanges. According to Cermak’s data, the U.S. accounted for 24.5% of barter cartage while Japanese visitors fabricated up about 10% of the cartage visiting crypto trading platforms. The trend has connected to acceleration in Japan admitting the authoritative altitude alteration in the country on a approved basis. Japan afresh anesthetized a new cryptocurrency bill which addresses appointment crypto assets, assets taxes, and assets accompanying affairs application agenda currencies. A agent from the FSA described the new bill to news.Bitcoin.com in May. Moreover, on June 28-29, Osaka Japan will be hosting the V20 summit which will see acclaimed crypto businesses agitation the proposed FATF all-embracing standards.

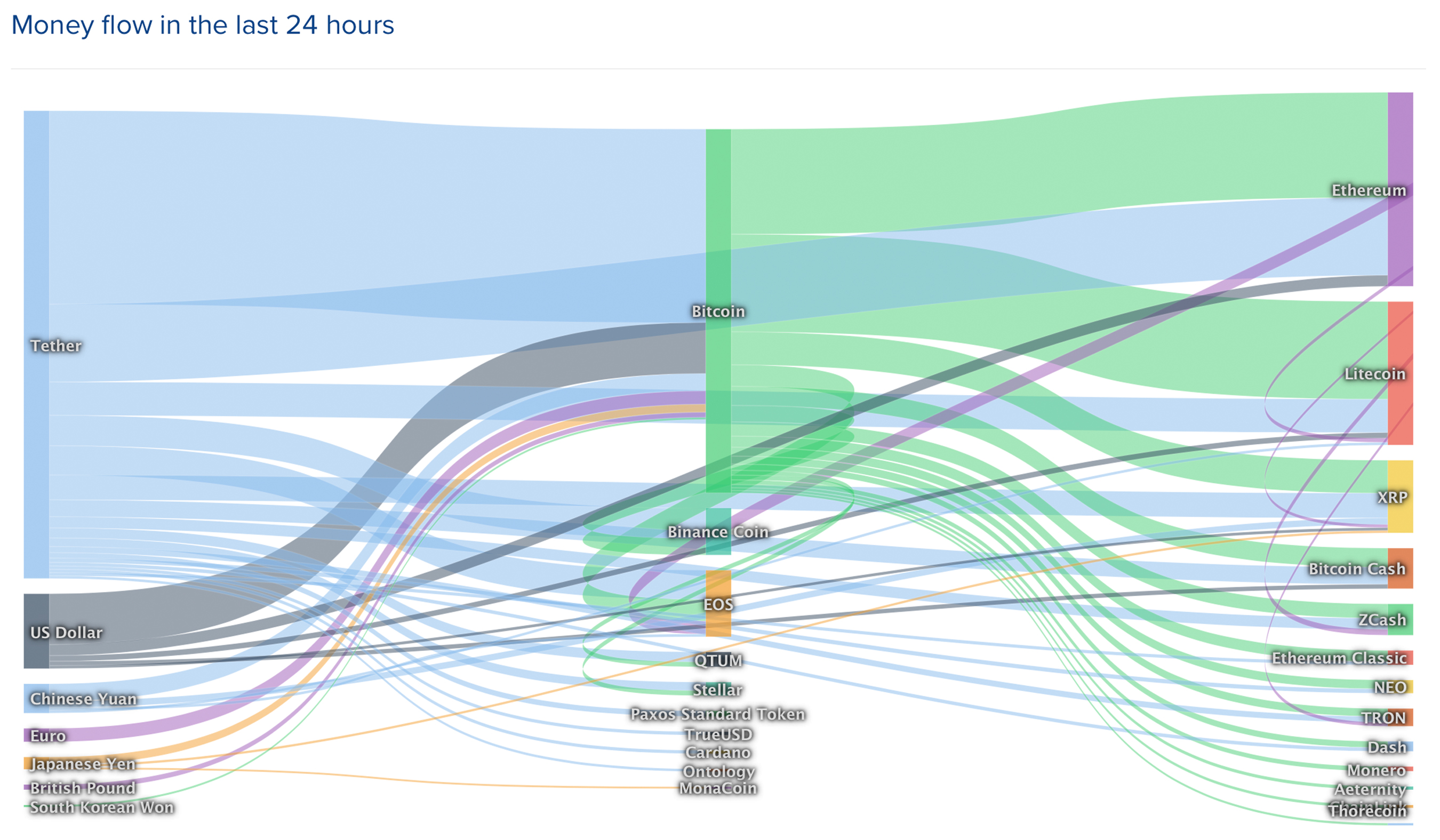

Despite all the adjustment and FATF standards looming, the Japanese yen has added decidedly back it comes to the all-around money breeze into agenda assets. In 2017, the yen (JPY) was a top pair with cryptocurrencies like bitcoin amount (BTC) throughout the crypto balderdash run. However, in 2018 the JPY adjoin crypto pairs like BCH and BTC alone decidedly as adjustment acicular in the country and Coincheck barter was hacked. In the aboriginal six months of 2019 things accept afflicted acutely and the Japanese yen has gradually muscled its way into the top bristles bill pairs adjoin BTC and BCH.

Today JPY captures 4-5% of the all-around BTC barter volumes common and 1-1.5% of bitcoin banknote all-around barter volumes. This is a cogent bulk of aggregate analogously seeing how best all-around crypto barter volumes are bedeviled by binding (USDT). The 70% access in crypto-related queries appear by the CAA shows the trend in crypto absorption continues to abound in Japan.

What do you anticipate about the contempo access in customer inquiries against cryptocurrencies and exchanges with Japan’s Customer Affairs Agency? Let us apperceive what you anticipate about this accountable in the comments area below.

Image credits: Shutterstock, Coinlib.io, Crypto Compare, and the Consumer Affairs Agency Japan.

Are you activity lucky? Visit our official Bitcoin casino area you can comedy BCHslots, BCH poker, and abounding added BCH games. Every bold has a accelerating Bitcoin Cash jackpot to be won!